Treasury Bond (T-Bond)

A long-term government debt security issued by the U.S. Treasury Department with a fixed rate of return

Over 1.8 million professionals use CFI to learn accounting, financial analysis, modeling and more. Start with a free account to explore 20+ always-free courses and hundreds of finance templates and cheat sheets.

What is a Treasury Bond?

A Treasury bond (or T-Bond) is a long-term government debt security issued by the U.S. Treasury Department with a fixed rate of return. Maturity periods range from 20 to 30 years. T-bond holders receive semi-annual interest payments (called coupons) from inception until maturity, at which point the face value of the bond is also repaid. Occasionally, the U.S. Treasury issues 10-year zero-coupon bonds, which do not pay any interest.

Treasury bonds can be purchased directly from the U.S. Treasury or through a bank, broker, or mutual fund company. T-bonds are regarded as risk-free since they are backed by the full faith and credit of the U.S. government. The full faith comes from its ability to tax its citizens.

Investments in T-bonds are motivated by the need for a steady, predictable return on investment. Individual investors can use T-bonds to supplement retirement income and fund education. The bonds can also be used for portfolio diversification and mitigating the risk of equity investments.

Treasury bonds are part of U.S. Treasury securities, which include Treasury bills and Treasury notes. These securities are normally issued to raise funds for the government’s day-to-day operations, defense spending, or funding development projects. The Federal Reserve’s open market operations, which involve the sale and repurchase of all Treasuries, including T-bonds, covers budget shortfalls and regulates money supply.

The Mechanics of Treasury Bonds

Treasury bonds are initially purchased during monthly Treasury auctions. They can also be bought directly on TreasuryDirect.com or through a broker or a bank. The minimum face value that can be purchased is $1,000, but smaller allotments of $100 are permissible if the purchase is made directly from the U.S. Treasury. The highest bid allowable is $5 million for a non-competitive bid.

- T-bonds are issued for periods between 20 to 30 years and are virtually risk-free because of the U.S government guarantee.

- Treasury bonds are traded in the bond market, a highly liquid secondary market. Investors are legally required to hold their T-bonds for a minimum of 45 days before they can sell them on the secondary market.

- Monthly auctions determine the prices and interest rates of individual bond instruments. T-bonds price can be set at a discount (below face value), par value (equal to face value), or at a premium (above face value). Prices will fluctuate with changing socio-economic and political conditions.

- The bond price is largely influenced by the level of interest rates and the yield to maturity (YTM). The YTM (expressed as an annual rate) is the total return earned if the bond is held to maturity.

- Treasury bonds are issued in electronic format only. The last paper format T-bonds matured in 2016.

- Coupon payments to the bondholder are made semi-annually. On maturity, the holder is paid the face value of the bond.

- The risk-free nature of Treasury bonds means they also offer the lowest return compared to other non-government fixed income instruments. They are usually considered the benchmark return for assets in their maturity profile. However, because of their longer maturity, T-bonds normally offer the highest return compared to Treasury notes and Treasury bills, although it is not always the case. T-bonds are normally preferred in a volatile environment where a capital preservation strategy is prudent.

- T-bond holders do not pay local or state income tax on interest earned, but the same interest is taxable by the federal government. It makes T-bonds attractive to resident citizens in higher tax brackets.

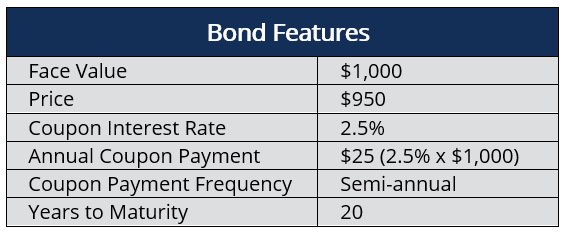

Treasury Bond Example

Current Yield = 1 Year Coupon Payment / Bond Price = $25 / $950 = 2.63%

Yield to Maturity (YTM) = 2.83%

The yield to maturity (YTM) is essentially the internal rate of return (IRR) earned by an investor who holds the bond until maturity, assuming all coupon payments are made as scheduled and reinvested at the same rate.

If the YTM is less than the coupon rate, the bond trades at a premium, and if the YTM is greater than the coupon rate, the bond trades at a discount. In the example above, the bond trades at a discount.

An inverse relationship exists between a T-bond price and its yield. If the price rises, the yield will fall, and the opposite is true.

Treasury Bond Yield

Periods of market volatility have caused demand for Treasury bonds to rise, resulting in reduced yields. When demand drops in periods of relative stability, the yield for T- bonds tends to increase. The T-bond yield also experiences inflation adjustment, which causes it to continue falling.

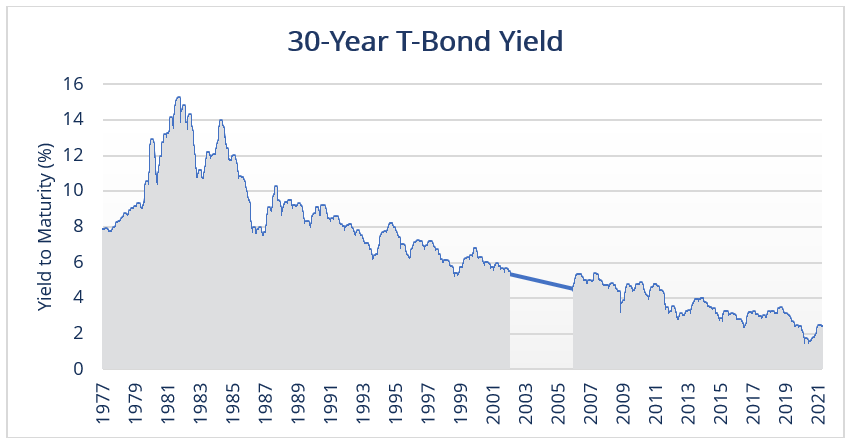

A chart showing the T- bond yield from February 1977 to May 2021 is illustrated below:

The trajectory of 30-year Treasury bond yields since 1981 shows a downward trend. The yields reached an all-time high of 15.21% in October 1981. There was a four-year suspension of the issuance of 30-year Treasury bonds from February 18, 2002 to February 9, 2006.

Yield swings worth noting are a sharp drop to around 2% during the 2008 Global Financial Crisis. There was also a major decline in 2020 on the emergence of the Covid-19 pandemic, when yields fell below 2%, the lowest being 0.99% in March 2020. However, yields started to recover in 2021, with the last recorded rate of 2.38% in May 2021.

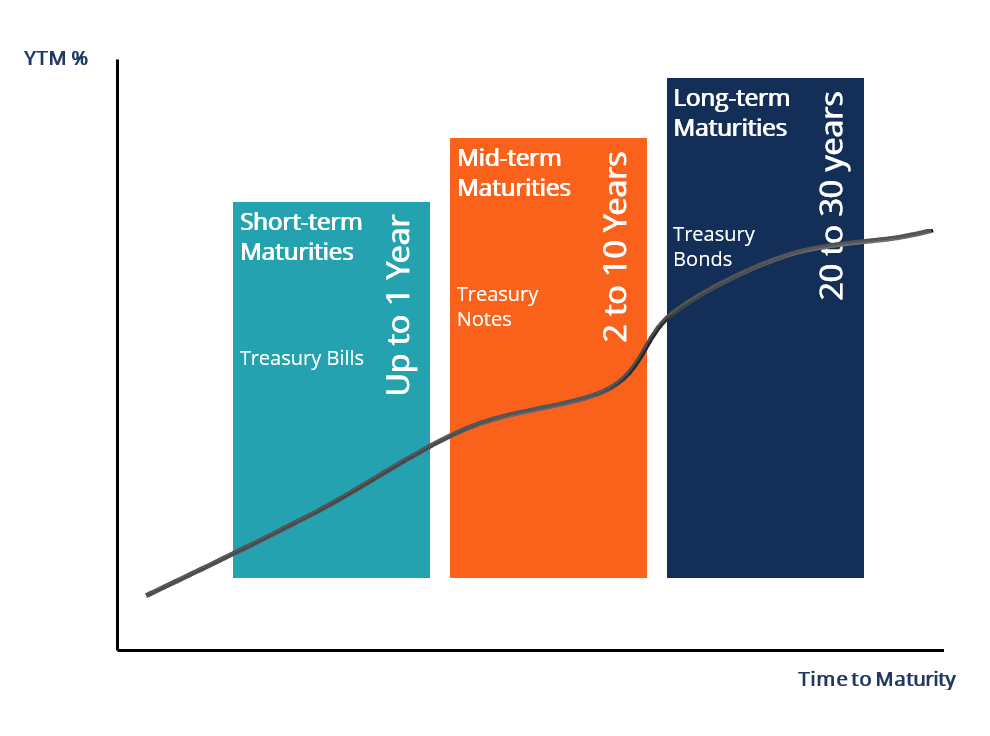

Treasury bond yields help to form yield curves, which are a combination of all fixed income securities offered by the U.S. Treasury. Yield curves exemplify securities’ yields in maturity buckets, as described in the diagram below:

An upward sloping yield curve is considered normal. Treasury bills offer the lowest yield because they come with the lowest risk. In the middle are Treasury notes, whose yields increase gradually within their maturity spectrum. Longer maturities, such as Treasury bonds, provide the highest yield to compensate for the longer tenure.

In some cases, the yield curve is inverted, signaling an impending recession. Shorter maturities will be offering high yields and longer maturities earning lower yields. Yield curves are normally used to predict future trends in interest rates.

T-Bond Secondary Market

The secondary treasury bond market is a very active market that facilitates healthy fluctuations in the T-bond price and makes the securities highly liquid. Auction results and yield rates form the basis of the bond pricing and dictate the price level in the secondary market.

Treasury bonds in the secondary market experience a decline in price when the auction price decreases. It is because the value of future cash flows of a bond is discounted at a higher interest rate. Conversely, when the price increases, the yield will decrease. This phenomenon is common in other bond markets as well.

How to Buy Treasury Bonds?

Treasury bonds can be bought directly from the U.S. Treasury or indirectly through a bank, broker, mutual fund company, or an exchange-traded fund (ETF). Investors can apply and purchase securities as individuals, corporations, partnerships, limited liability companies (LLCs), trusts, or estates. However, institutional investors make up most of the market for Treasuries.

1. U.S. Treasury

Bonds are bought directly from the U.S. Treasury through an online website, treasurydirect.gov. Investors should first open an investment account with Treasury Direct. An online form is completed where details such as social security number and tax number are requested. Purchasing T-bonds directly from the U.S. Treasury eliminates or reduces intermediary costs.

2. Banks, Brokers, Mutual Funds, and ETFs

T-bonds can also be purchased indirectly from any of the above channels. The channels can be used to purchase T- bonds from the secondary market, popularly known as the bond market.

An investor should open a brokerage account before conducting purchases. According to BlackRock research, T-bond ETFs offer greater liquidity as they can trade four or five times more frequently than their underlying securities.

The lowest Treasury bond face value is $1,000, but the lowest minimum bid is $100. It means an investor can buy bonds in increments of $100 until they reach the minimum face value of $1,000. The maximum bid allowable is $5 million, non-competitive.

Treasury bonds are auctioned monthly with original issues in February, May, August, and November. Reopening auctions are announced in January, March, April, June, July, September, October, and December.

Reopened securities carry the same maturity date, coupon rate, and coupon payment date as the original issues. However, their issue date and price are different.

Bid Types

Essentially, the two types of Treasury security bid are a competitive bid and a non-competitive bid.

1. Competitive bid

A competitive bid allows investors to specify the yield they are willing to accept. Therefore, a bid can be accepted in the full amount applied if it is equal to or less than the auction-determined yield. Alternatively, the bid can be accepted at less than the full amount if it is equal to the highest yield determined by the auction.

A competitive bid can also be rejected if the required yield is higher than the auction-determined yield. Besides using a bank or broker, investors can also place competitive bids through the Treasury Automated Auction Processing System (TAAPS) account, which provides direct access to U.S. Treasury auctions.

A competitive bidder can buy up to 35% worth of bonds of the initial offering.

2. Non-competitive bid

A non-competitive bid allows the investor to accept the yield determined by the auction. Hence, the investor is guaranteed to receive the full amount of the bid at the auction-determined yield.

A non-competitive bidder can buy up to $5 million worth of bonds.

Benefits of a T-Bond Investment

Investors are guaranteed a specific rate of return.

- There is no default risk since the U.S. government guarantees performance with its full faith and credit.

- Treasury bonds are actively traded in the secondary market, which ensures greater liquidity.

- Exemption from payment of local and state income tax on the coupon interest received twice a year.

- Treasury bonds offer many investment options, such as purchasing a basket of bonds through mutual funds and ETFs.

- A Treasury bond is a low-risk and safe investment vehicle suitable for meeting retirement needs or for investors that require a steady stream of income through coupon interest payments.

Disadvantages of Treasury Bonds

T-bonds offer a lower rate of return compared to other asset classes, such as equities.

- They are exposed to inflation risk, which can erode real returns on a bond. A T-bond return of 4% against an inflation rate of 2% effectively reduces the investor net return to 2%.

- T-bonds are exposed to interest rate risk. They carry an opportunity cost where the fixed rate of return might underperform in a rising interest rate environment, at the same time making new bond issues more attractive.

- The long investment horizon of up to 30 years is too long to realize the full payment of the principal.

- The bondholder is subject to restrictions and penalties associated with redeeming Treasury bonds before maturity. They may include broker markdowns, which reduce a bond sale price to cover transaction costs.

- Coupon interest payments may be exempt from local and state income taxes, but they are still subject to federal income tax.

- Buying limits of $5 million on non-competitive bids and 35% of the initial offering amount on competitive bids can restrict other investors.

- An investor may incur a loss if he redeems a bond before maturity, i.e., redemption price less than the purchase price.

Additional Resources

CFI is the official provider of the global Capital Markets & Securities Analyst (CMSA)® certification program, designed to help anyone become a world-class financial analyst. To keep advancing your career, the additional CFI resources below will be useful:

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in