Buy Side vs Sell Side

The role of an analyst on the buy side and the sell side

Over 1.8 million professionals use CFI to learn accounting, financial analysis, modeling and more. Start with a free account to explore 20+ always-free courses and hundreds of finance templates and cheat sheets.

What’s the Difference between the Buy Side vs Sell Side?

Buy-Side vs Sell Side. The Buy Side refers to firms that purchase securities and includes investment managers, pension funds, and hedge funds. The Sell-Side refers to firms that issue, sell, or trade securities, and includes investment banks, advisory firms, and corporations. Sell-Side firms have far more opportunities for aspiring analysts than Buy-Side firms usually have, largely due to the sales nature of their business.

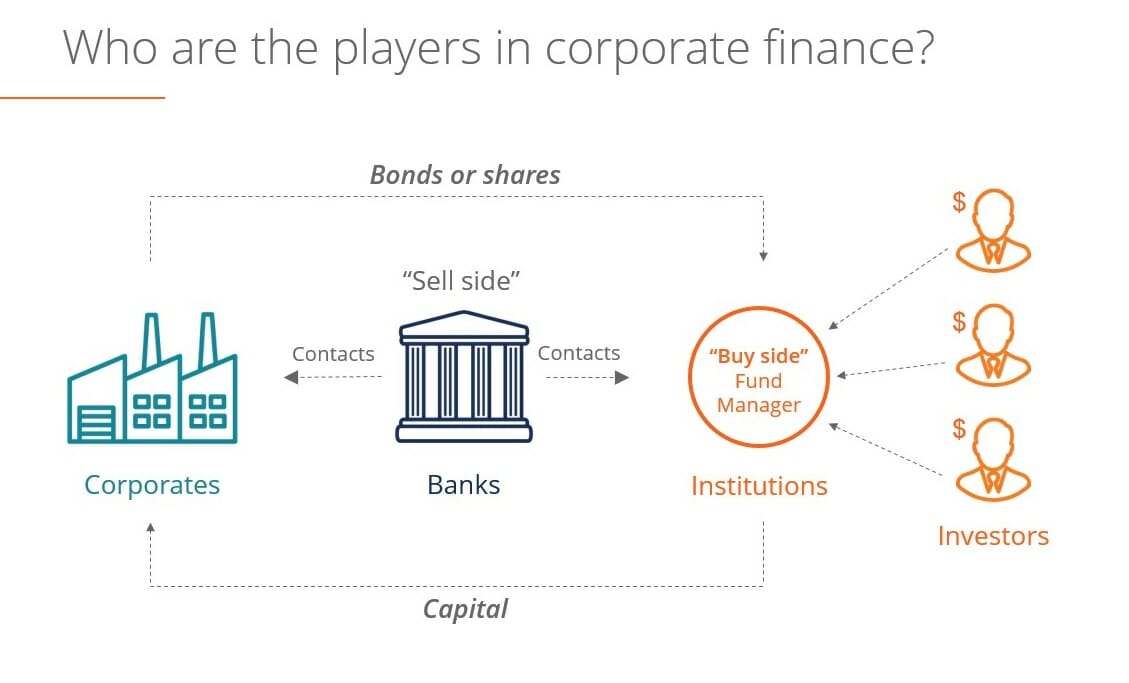

When talking about investment banking, it is important to know the difference between the buy-side and the sell-side. These two sides make up the full picture, the ins and outs of the financial market, and both are indispensable to each other:

- Buy-Side – is the side of the financial market that buys and invests large portions of securities for the purpose of money or fund management.

- Sell-Side – is the other side of the financial market, which deals with the creation, promotion, and selling of traded securities to the public.

Learn all about the Buy Side vs Sell Side in our Free Introduction to Corporate Finance Course.

About the Sell Side

On the Sell Side of the capital markets, we have professionals who represent corporations that need to raise money by SELLING securities (hence the name “Sell Side”). The Sell-Side mostly consists of banks, advisory firms, or other firms that facilitate the selling of securities on behalf of their clients.

For example, a corporation that needs to raise money to build a new factory will call their investment banker and ask them to help issue either debt or equity to finance the factory. See our guide on “What is Investment Banking” to learn more about what bankers do.

The bankers will prepare an analysis, with the aid of extensive financial modeling, to determine what they believe investors will think the company is worth. Next, they prepare a variety of marketing materials to be distributed to potential investors. This is where the Buy Side comes in…

About the Buy Side

On the Buy Side of the capital markets, we have professionals and investors that have money, or capital, to BUY securities. These securities can include common shares, preferred shares, bonds, derivatives, or a variety of other products that are issued by the Sell Side.

For example, an asset management firm runs a fund that invests the high net worth clients’ money in alternative energy companies. The portfolio manager (PM) at the firm looks for opportunities to put that money to work by investing in securities of what he/she believes are the most attractive companies in the industry. One day, the VP of equity sales at a major investment bank calls the portfolio manager and notifies them of an upcoming initial public offering (IPO) of the company in the alternative energy space.

The PM decides to invest and buys the securities, which flows the money from the buy-side to the sell-side.

Explore CFI’s interactive career map to learn more about the buy-side vs sell side.

Role of the Sell Side vs Buy Side

There are some major differences between the sell-side vs buy-side in the capital markets. The main differences come down to the role each side plays for their client and the personality types that do well on each side.

The Role of the Sell Side:

- Advise corporate clients on major transactions

- Facilitate raising capital, including debt and equity

- Advise on mergers and acquisitions (M&A)

- Win new business (build relationships with corporates)

- Market and sell securities

- Create liquidity for listed securities

- Help clients get in and out of positions

- Provide equity research coverage of listed companies

- Perform financial modeling and valuation

The Role of the Buy Side:

- Manage their clients’ money

- Make investment decisions (buy, hold, or sell)

- Earn the best risk-adjusted return on capital

- Perform in-house research on investment opportunities

- Perform financial modeling and valuation

- Find investors and recruit capital to manage

- Grow assets under management (AUM)

To learn more about the differences between the buy-side vs sell-side check out our free introduction to corporate finance course!

Sell-Side Careers

There is a wide range of careers available on the sell side, with more entry-level opportunities than there are typically available on the buy-side. Below is an overview of the main career paths available on the sell-side.

Main sell-side jobs:

Popular sell-side firms are Goldman Sachs, Barclays, Citibank, Deutsche Bank, and JP Morgan. Check out our list of top 100 investment banks, as well as boutique banks and bulge bracket banks.

To learn more about each of these career paths, check out our interactive career map.

Buy-Side Careers

Finance professionals often “graduate” to the buy-side after spending a few years on the sell-side. Banks tend to be great training grounds, with their various analyst and associate programs, which typically last two to four years. At that point, analysts or associates may look at moving to the buy-side. Below is an overview of the main career paths available on the buy-side.

Main buy-side jobs:

- Portfolio management

- Wealth management

- Private equity

- Venture capital

- Hedge funds

Sell-Side Skills

There are unique characteristics to understand the buy side vs sell side. At the most junior positions, roles may be very similar, but at more senior positions the roles start to vary more significantly. As the word “sell” implies, on the sell side there is more salesmanship required than is usually the case on the buy-side.

The main skills required on the sell-side include:

- Industry research

- Financial modeling

- Excel skills

- Research report generation

- Pitchbook presentations

- Client relationship management

- Winning new business

- Selling and closing deals

Buy-Side Skills

As mentioned above, at the analyst or associate level the skill sets are very similar, but ultimately there is less salesmanship required on the buy-side and, therefore, it tends to attract a slightly more cerebral and less gregarious type of individual (although this is just a broad generalization).

The main skills required on the buy-side include:

- Industry research

- Financial modeling

- Excel skills

- Research report generation

- Raising capital

- Achieving targeted rates of risk-adjusted return

All of the skills required for these careers can be easily learned with our online buy-side and sell-side training courses.

Buy-Side vs Sell-Side Compensation

Total compensation (salary and bonus) can vary widely depending on the position, the firm, the city, and all sorts of other factors. For this reason, it’s difficult to make generalizations about the compensation differences of the sell side vs buy side, but here are a few points to know:

Buy-side jobs typically require more experience, and professionals are often thought to “graduate” from the sell-side to the buy-side.

Buy-side jobs have a performance bonus element (a carried interest in private equity or the 2-and-20 structure in hedge funds), which can lead to significant upside potential income if the investments perform well.

Sell-side jobs also have performance bonuses, which can be based on both personal performance, as well as on the performance of the firm.

It’s generally safe to assume that you can make more on the buy side, but don’t underestimate the ability of a rainmaker investment banker on the sell-side to earn massive amounts of money.

How Do The Buy Side and Sell Side Earn a Profit?

Buy-side companies make money by buying low and selling high trade activities. They have to create value by identifying and buying underpriced securities. For instance, a buy-side analyst who is monitoring the price of a technology stock observes a drop in the price, as compared to other stocks, yet the tech company’s performance is still high. The analyst may then make an assumption that the tech stock’s price will increase in the near future. Based on the analyst’s research, the buy-side firm will make a buy recommendation to its clients.

Sell-side firms earn their way through fees and commissions. Therefore, their main goal is to make as many deals as possible. The market makers are a compelling force on the sell side of the financial market. They engage in foreign exchange markets by buying and selling a substantial volume of currencies, underwriting and managing bond issues bought directly from the US Treasury, dominating the stock market via underwriting stock issuance, taking proprietary positions, and selling to both companies and individual investors.

What is a Sell-Side Analyst?

A sell-side analyst is an analyst who works in investment banking, equity research, commercial banking, corporate banking, or sales and trading.

For more information on Sell-Side Analysts, please visit our Career Map and explore the many opportunities related to the Sell Side.

Video Explanation of Buy Side vs Sell Side

Below is a video explanation of the difference between the buy-side and sell-side of the capital markets, as well as the most common career paths one can take on either side of the markets!

Additional Resources

Thank you for reading CFI’s guide on Buy Side vs Sell Side. To continue to prepare for capital markets careers, we’ve got plenty more free resources to help you on your journey:

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in