Overview

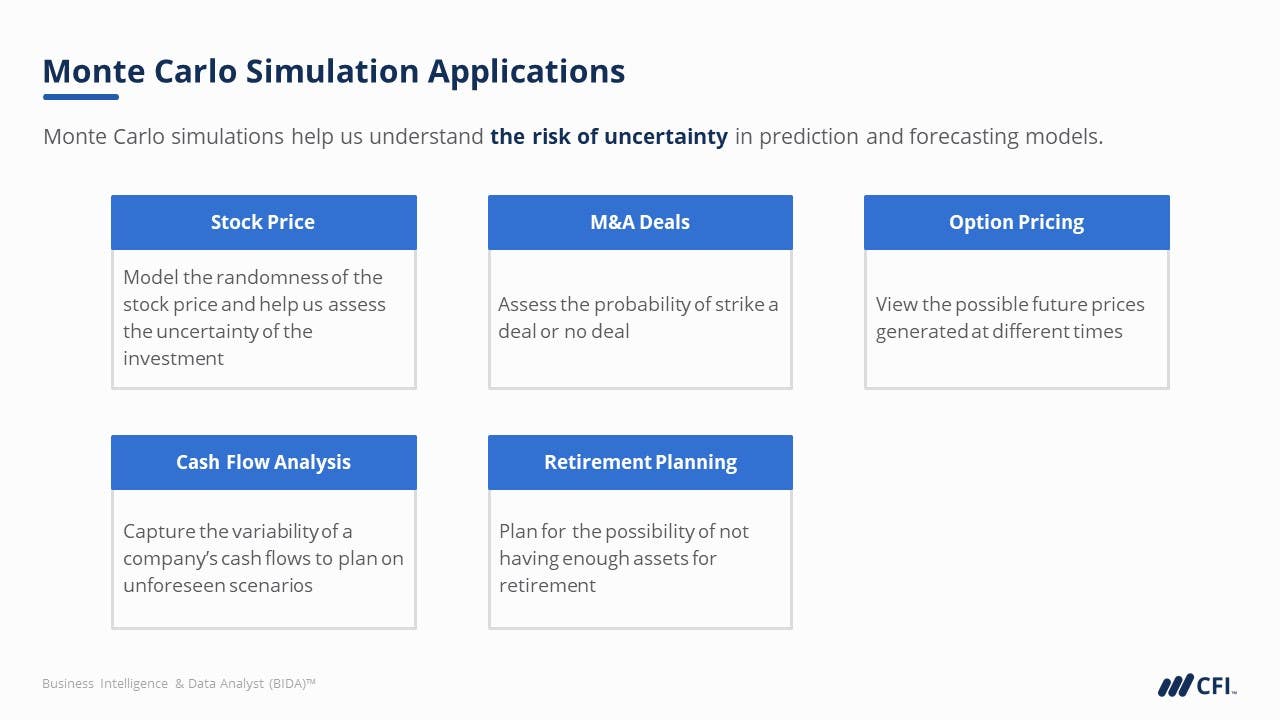

In this course, you’ll learn how to quantify and model uncertainty by using Monte Carlo simulation.

Traditional scenario analysis relies on 2 or 3 “best case” or “worst case” situations that are rarely scientific in nature. Businesses can benefit greatly from improved modeling of risk and uncertainty, by using even basic Monte Carlo simulation.

Using this technique, we can quantify and simulate scenarios that include multiple uncertainties at the same time.

This course will start from the basics, and work through five scenarios that will help you master the basics of Monte Carlo Simulation.

Using these scenarios, you’ll learn how to quantify uncertain scenarios in a more meaningful way to help make business decisions.

Who should take this course?

Business Intelligence derives value from descriptive, backward-looking metrics. To provide the next level of value we must start to consider future scenarios. Modeling uncertainty and scenarios is a key part of this forward-looking skillset, and this Monte Carlo course is a perfect introduction to that world.

Modeling Risk with Monte Carlo Simulation Learning Objectives

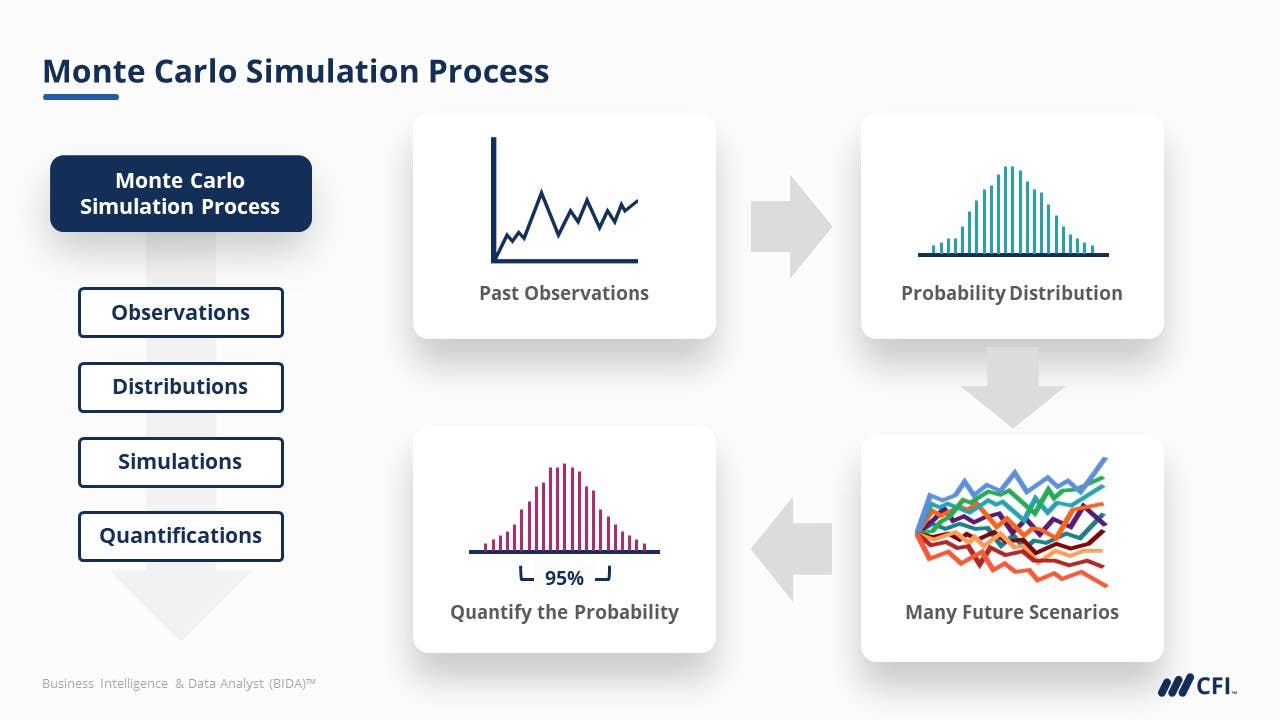

- Explain the main concepts of Monte Carlo simulation

- Use historical observations to estimate the probability distributions of data

- Simulate many possible outcomes of uncertain variables using Python

- Summarize the distribution of scenarios using confidence intervals

- Interpret the output of Monte Carlo simulation results and use it to guide business decisions

Level 4

2h 5min

100% online and self-paced

Field of Study: Finance

Start LearningWhat You'll Learn

Monte Carlo Simulation Introduction

Stock Price Prediction

Capital Investment (NPV) Forecasting

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Capital Markets & Securities Analyst (CMSA®) Certification

- Skills Learned Trading strategies used in the finance and capital markets

- Career Prep Work in capital markets, whether on the buy-side or the sell-side