Overview

Swaps Fundamentals Course Overview

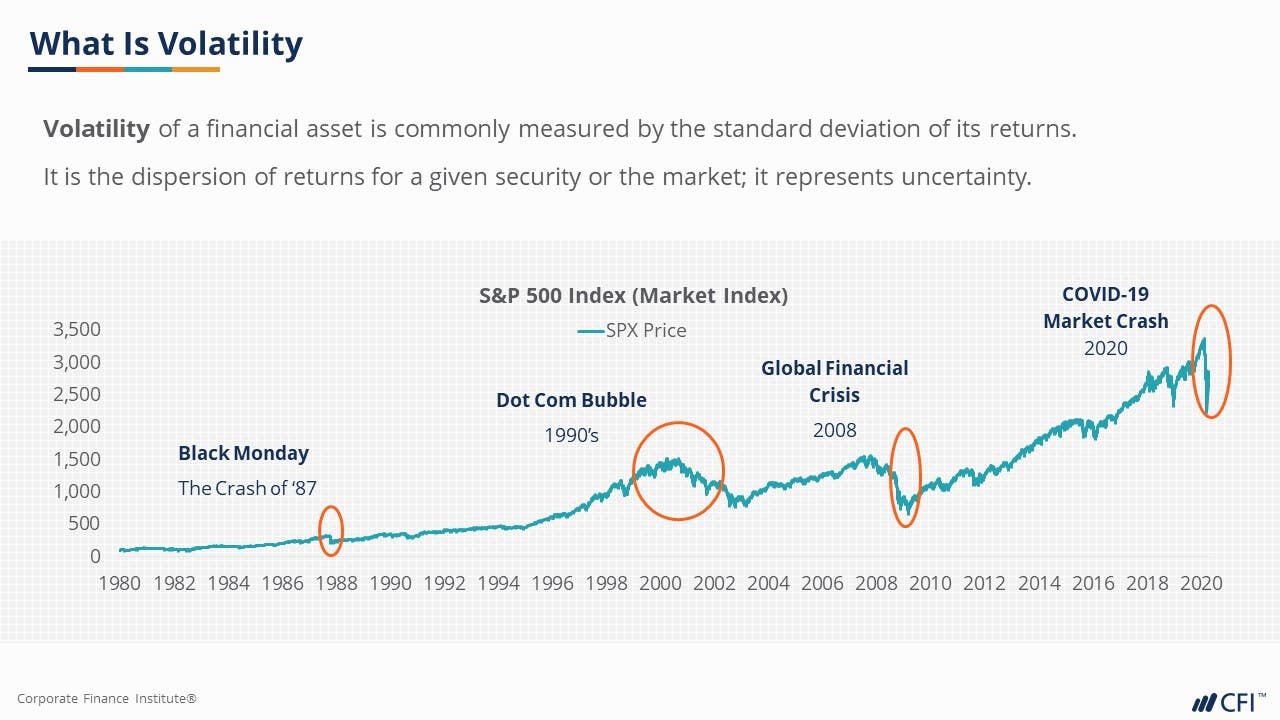

This course walks you through the overview of swaps and the different types of swaps traded by investors and institutions for various purposes. We will compare the structure and uses of the different swaps, as well as demonstrate the calculations of cash flows, pricing, and swap values using examples. We will define some of the most important terminology used in swap contracts, such as swap rate, swap spread, and swap curve. We will also show you how swap contracts would look using Refinitiv Workspace and the key information one could find.

Swaps Fundamentals Learning Objectives

Upon completing this course, you will be able to:- Understand the overall mechanics and structure of swaps, who and why use different types of swaps, as well as pricing, payments, and valuation of swaps

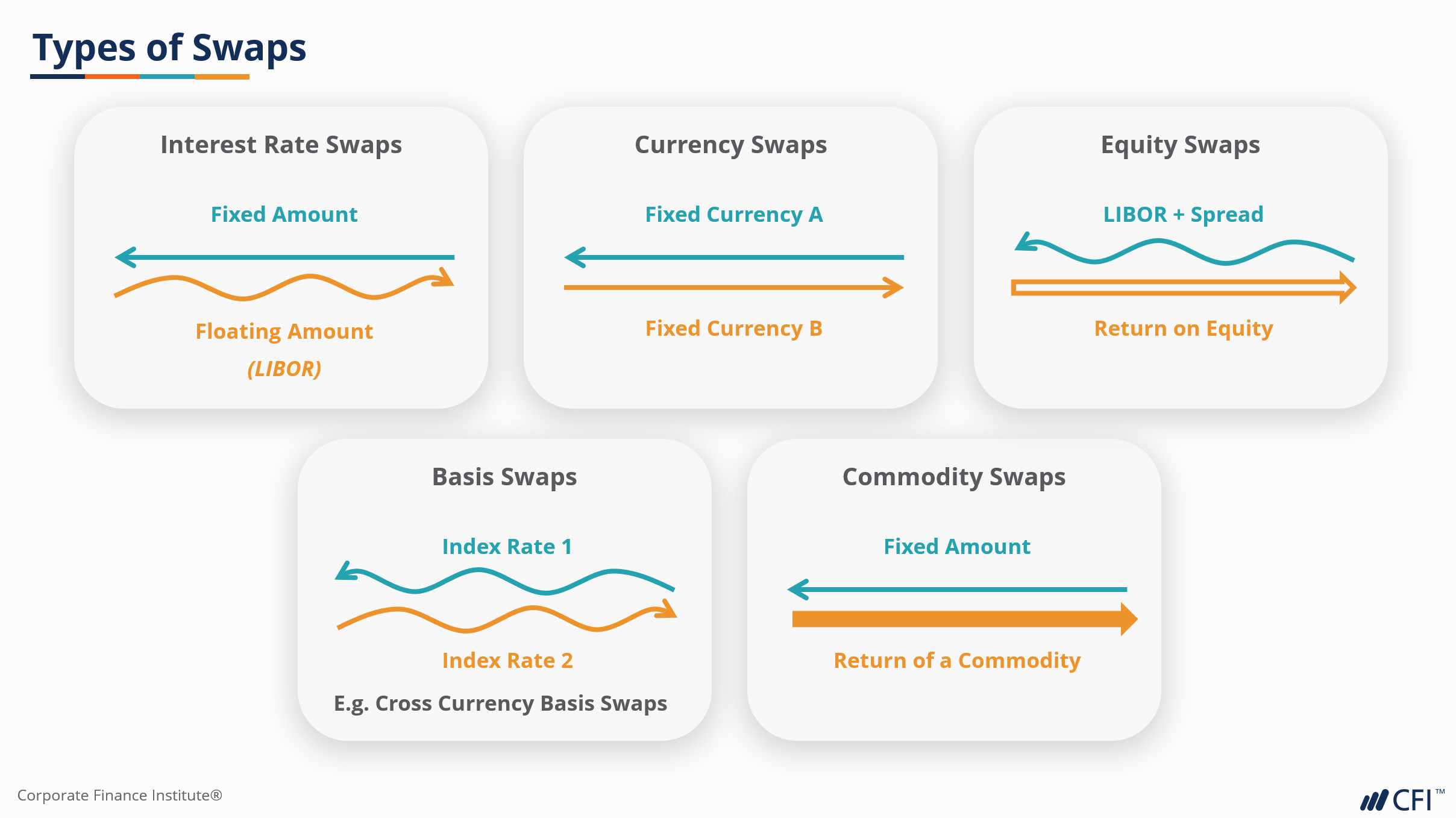

- Compare and contrast the various types of swaps, including:

- Interest rate swaps

- Currency swaps

- Equity swaps

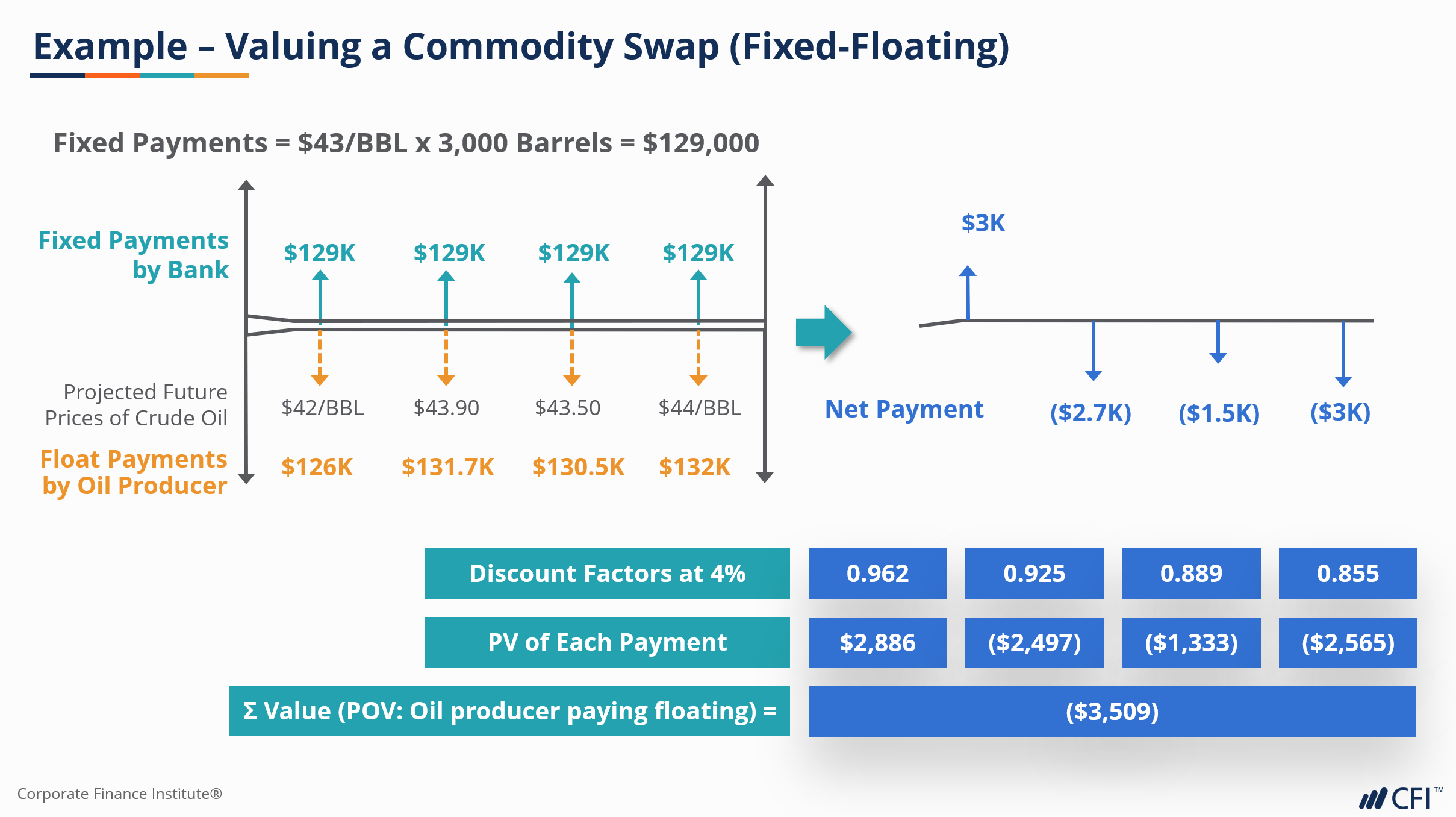

- Commodity swaps

- Basis swaps

- Swaptions

- Variance swaps

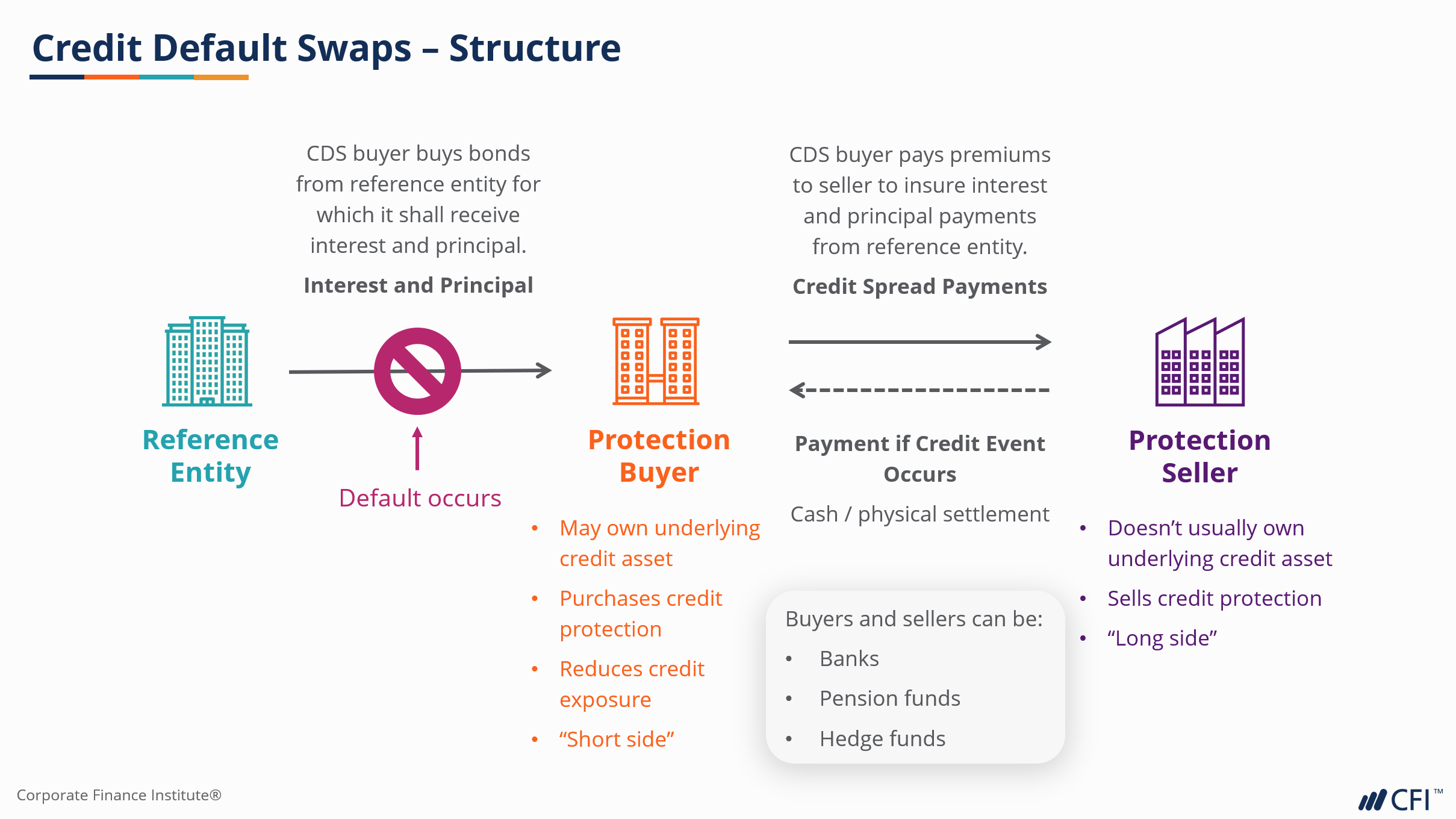

- Credit default swaps (CDS)

- Explain the structure and key features of each type of swaps

- Identify the benefits and risks associated with each type of swaps

- Calculate the price and values of each type of swaps

Who Should Take This Course?

This Swaps Fundamentals course is perfect for anyone who would like to build up their understanding of capital markets. This course is designed to equip anyone who desires to begin a career in fixed income, equity, sales and trading, or other areas of finance.

Prerequisite Courses

Recommended courses to complete before taking this course.

Level 3

2h 51min

100% online and self-paced

Field of Study: Finance

Start LearningWhat You'll Learn

Interest Rate Swaps

Currency Swaps

Equity Swaps

Basis Swaps

Variance Swaps

Credit Default Swaps

Course Summary

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Capital Markets & Securities Analyst (CMSA®) Certification

- Skills Learned Trading strategies used in the finance and capital markets

- Career Prep Work in capital markets, whether on the buy-side or the sell-side