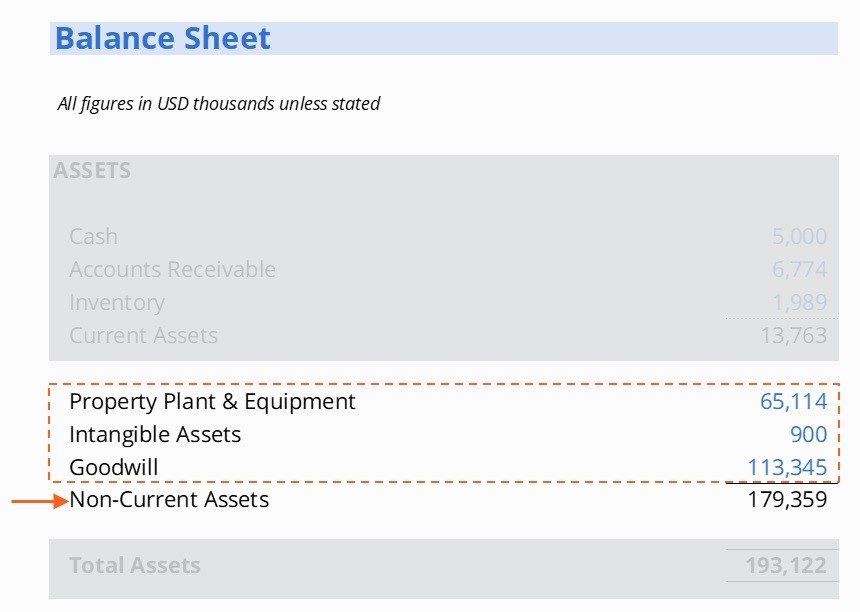

Non-Current Assets

Assets that will not be converted to cash within 1 year and that will generate economic benefit into future periods

Over 1.8 million professionals use CFI to learn accounting, financial analysis, modeling and more. Start with a free account to explore 20+ always-free courses and hundreds of finance templates and cheat sheets.

What are Non-Current Assets?

Assets that are cash – or that will be converted to cash within the current fiscal period (like accounts receivable and inventory) – are classified as current assets. Non-current assets, on the other hand, will not be converted to cash in the current period.

Non-current assets may also be characterized as assets that will generate economic value for one or more fiscal periods into the future. For example, consider a business that owns manufacturing equipment; an effective management team will use that equipment to manufacture products for as long as it is safe and practical to do so. The economic benefit materializes in the future when those products are sold to generate revenue.

Other examples of non-current assets include tangible assets like land, buildings, and vehicles, as well as intangible assets like intellectual property and goodwill.

Non-current assets are sometimes referred to as long term assets.

Key Highlights

- Non-current assets are assets that are expected to generate economic benefit into future fiscal periods.

- Non-current assets may be tangible (like physical property) or intangible (like intellectual property).

- Key categories of non-current assets include property, plant & equipment (PP&E); investments; goodwill; and “other” intangible assets.

- Non-current assets are typically funded using longer-term financing like term debt, subordinated debt, or even equity funding structures.

Tangible vs. Intangible Assets

Non-current assets generally fall into one of two categories. These are:

Tangible Assets

These are real physical assets. Creditors (including commercial banks and other private, non-bank lenders) tend to like tangible assets as security because they can “grab, seize, and sell” them if enforcement action is required against the borrower’s collateral.

A vehicle is an example of a tangible, non-current asset.

Intangible Assets

Sometimes abbreviated to just intangibles, these are assets that have economic value within the context of the business. A common example of an intangible, non-current asset is “intellectual property.”

These tend to be less popular with creditors because there is no physical “thing” that can be repossessed and liquidated.

Types of Non-Current Assets

There are a number of types of non-current assets. The most common categories that appear on corporate financial statements tend to be:

Property, Plant & Equipment

Typically abbreviated to PP&E, this category includes tangible physical assets like land, buildings, machinery and other equipment, as well as vehicles (from passenger vans to forklifts and construction vehicles).

PP&E is the most common type of capital expenditure (CAPEX) for many commercial enterprises. PP&E is capitalized, not expensed. PP&E is generally considered strong collateral security from the perspective of creditors.

Investments

When a company has surplus cash, management may choose to deploy that cash into a variety of assets or projects that are expected to generate future cash flows or capital gains.

Investments tend to fall into two categories: external or internal.

External investments are often equity or debt instruments (like stocks and bonds); they may also include derivatives like forward contracts or call options (on currencies and/or commodities, for example). Internal investments include investments in subsidiaries, associate companies, or joint ventures.

Under most accounting frameworks, including both US GAAP and IFRS, Investments are generally held at purchase price (known as book value) on a company’s balance sheet. Changes in book value are recorded as gains or losses at the time of disposition.

Goodwill

Goodwill is created on a company’s balance sheet when it purchases another business for more than the fair market value of its net assets (meaning assets minus liabilities).

Assume that company A purchases company B because company B represents some “value” to company A. This value could come in the form of customer lists, brand recognition, intellectual property, or even projected cost savings (often referred to as “synergies”). If company A is willing to pay a premium above company B’s net asset value at the time of acquisition, then (post acquisition) company A’s balance sheet will show a non-current asset called goodwill (which is equal to the amount of that premium).

However, goodwill is tested annually for what’s called impairment. If goodwill is believed to be less valuable than it was at the time of the acquisition, it will be written down to its current fair value. Goodwill impairment is a non-cash expense and is often added back to normalized earnings and/or EBITDA when analyzing a company.

(Other) Intangible Assets

Intangible assets are items that represent value to a company within the context of its business operations. These non-current assets generate revenue or benefits for the business into future fiscal periods, but they do not have any physical substance (like PP&E would, for example).

Intangible assets include trademarks, copyrights, and patents. An intangible non-current asset is typically amortized (based on its projected useful life) in the same way that PP&E is depreciated.

Capitalizing Non-Current Assets

Most major accounting standards, including US GAAP and IFRS, adhere to the matching principle.

The matching principle dictates that the costs of doing business should be recorded in the same period as the economic benefits they generate (regardless of when they are actually paid). Let’s use an example to illustrate:

Suppose that a business purchases a $500,000 piece of equipment that is expected to have a useful life of five years. That business does not expense $500,000 in the year of acquisition; instead they use depreciation to “expense” the equipment over its anticipated useful life (even if management paid cash up front).

The non-current asset is first recorded at its purchase price but then presented net of depreciation or amortization (book value) at each subsequent period, until the asset is either fully depreciated (as shown in year 5 of the diagram) or disposed of.

Financing Non-Current Assets

Because non-current assets are expected to generate economic benefit into future periods, it’s common to use longer-term funding options to finance them. These include both term debt and equity funding structures.

- Example #1: PP&E is often funded using reducing term loans, capital (finance) leases, or commercial mortgages. It’s standard practice for lenders to align cash repayments approximately with the useful life of the underlying asset.

- Example #2: speculative investments in new company divisions or the acquisition of other businesses and/or technologies are sometimes funded using equity. Equity is a form of patient capital that is well-suited to higher-risk projects and initiatives.

The inverse is current assets, which typically use shorter-term funding sources like revolvers, operating lines of credit, and factoring, among others.

The opposite is true for current assets. If an asset will be converted to cash within a year, it’s usually funded with short term or revolving liabilities; if an asset is not expected to be converted to cash within a year, it’s typically financed using a longer term funding source.

Related Resources

CFI offers the Commercial Banking & Credit Analyst (CBCA)™ certification program for those looking to take their careers in banking to the next level. To keep learning and advancing your career, the following resources will be helpful:

Accounting Fundamentals

Uncover how accounting gives us insight into profitability, operations, growth, and the underlying drivers of the business.

• Understand the role and importance of the financial statements and define various financial statement terms

• Record transactions and learn how they move through the financial statements

• Explore the format of the income statement, balance sheet, and cash flow statement and prepare simple financial statements

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in