Overview

Prime Services and Securities Lending Course Overview

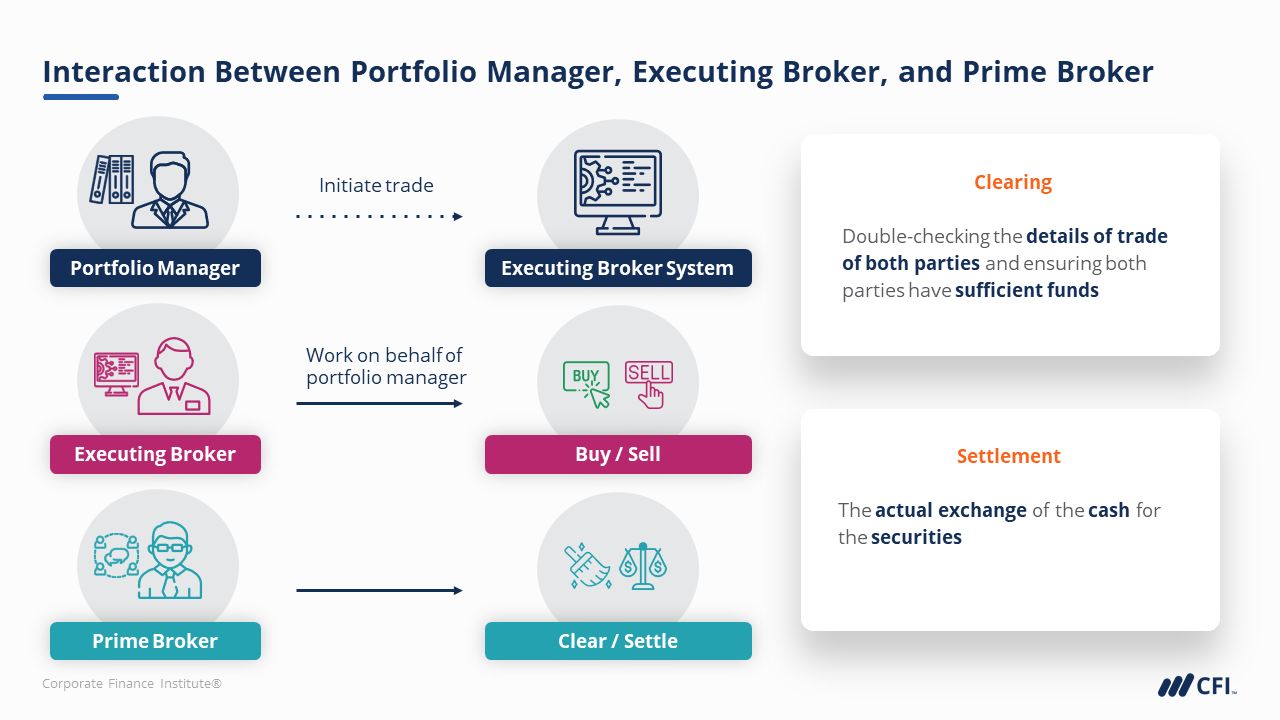

The Prime Services and Securities Lending course aims to guide you to understand how the prime services team provides specialized services to help hedge funds make money and how securities lenders facilitate the shorting of stocks. Once you get started, you will comprehend how prime services (i.e., prime brokers) attracts investors, provides leverage, maintains margin requirements, performs clearing and settlement functions, offers custodial services, and produces real-time reporting for their hedge fund clients. Next, you will cover the securities lending function, where you will understand what securities lending is and identify key differences between short-sellers, stock lenders, and long-sellers. You will recognize how and why market participants may ‘short’ stocks. As short-selling is crucial to the stock market, we will analyze short-selling activity using multiple short equity metrics such as short interest and short interest ratio on Refinitiv Workspace screen.

Who Should Take This Course?

This Prime Services and Securities Lending course is perfect for anyone looking to build a complete understanding of capital markets. This course is designed to help those interested in careers in prime services, securities lending, hedge funds, portfolio management, and other sell-side trading careers. This course explores concepts useful for beginner and intermediate level capital markets professionals or business and finance students seeking to better understand securities lending transactions.Prime Services and Securities Lending Learning Objectives

- Understand what prime services is and how it fits within a bank

- Describe the range of prime services activities

- Recognize how and why market participants may ‘short’ stocks

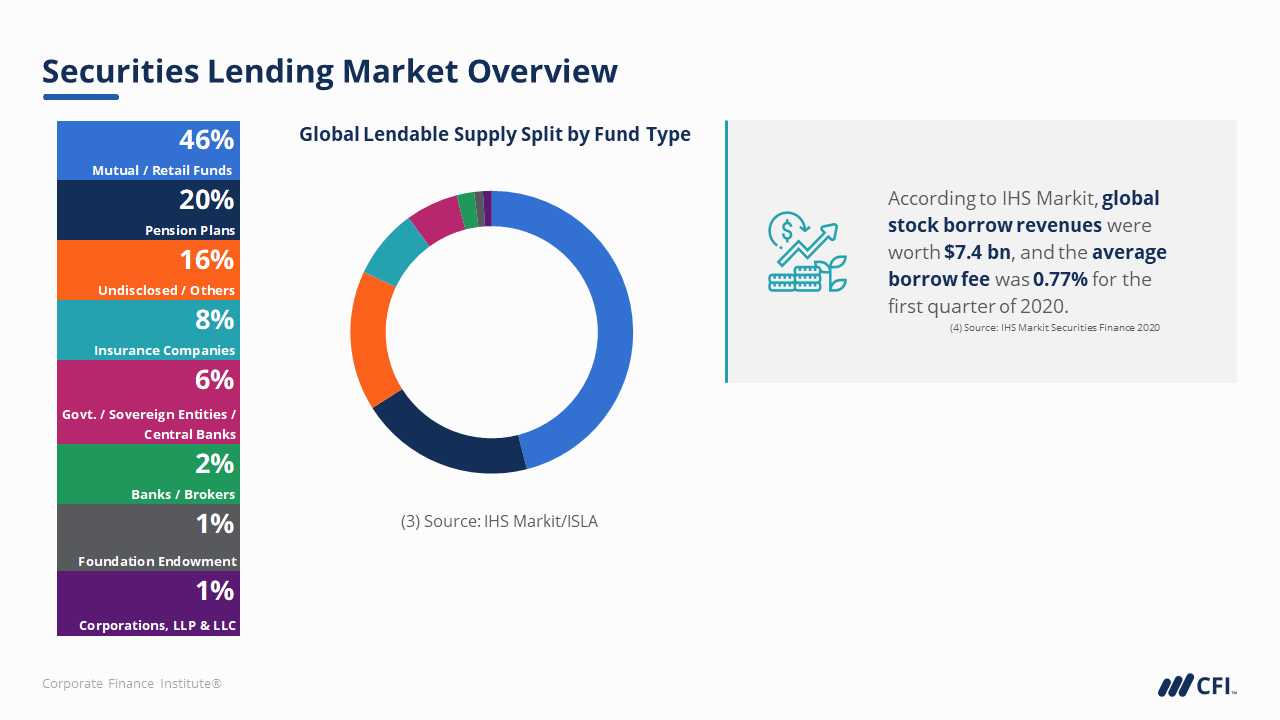

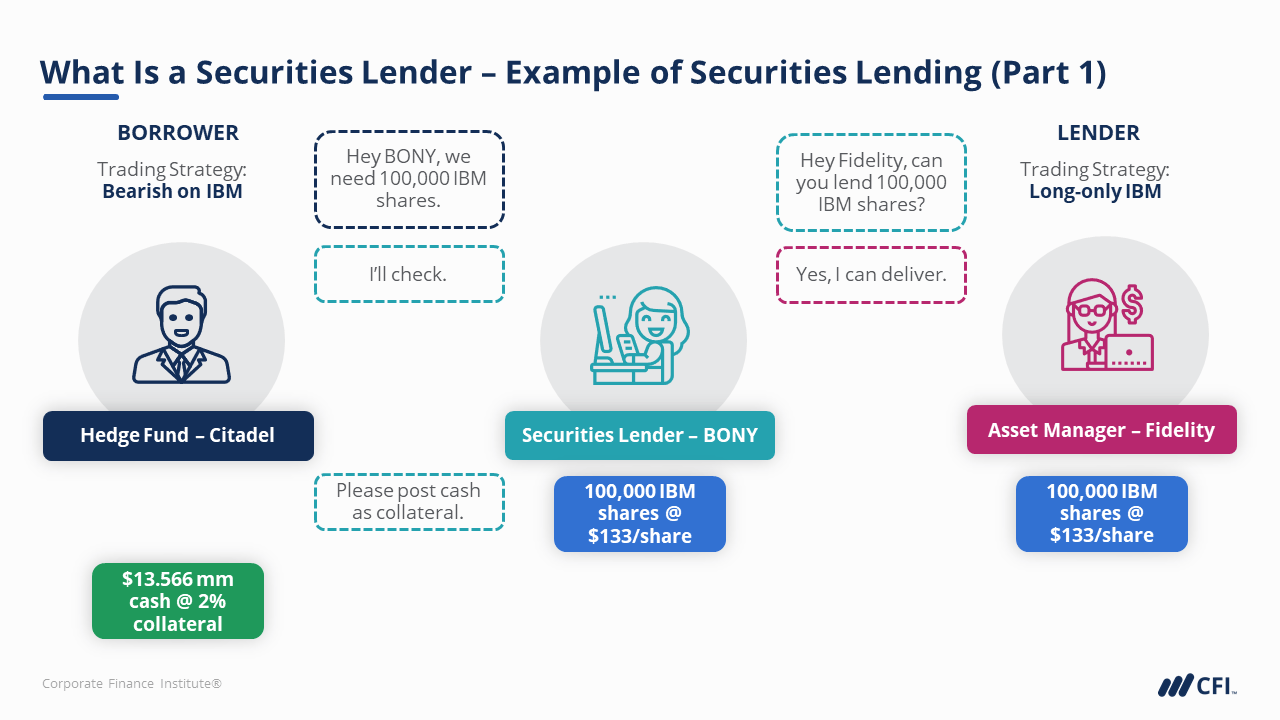

- Comprehend how securities lending works and who are the market participants

- Calculate the cash flows involved in securities lending

Prerequisite Courses

Recommended courses to complete before taking this course.

Level 2

49min

100% online and self-paced

Field of Study: Finance

Start LearningWhat You'll Learn

Introduction

Prime Services

Midway Check-In

Securities Lending

Course Summary

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Capital Markets & Securities Analyst (CMSA®) Certification

- Skills Learned Trading strategies used in the finance and capital markets

- Career Prep Work in capital markets, whether on the buy-side or the sell-side