Business Valuation Glossary

The most important concepts to know in business valuation modeling

Business Valuation Glossary

This business valuation glossary covers the most important concepts to know in valuing a company. This guide is part of CFI’s Business Valuation Modeling Course.

Alpha

See firm-specific risk for the definition of Alpha.

Beta

The Beta (β) of a stock or portfolio is a number describing the correlated volatility of an asset in relation to the volatility of the benchmark that the asset is being compared to. This benchmark is generally the overall financial market and is often estimated via the use of representative indices, such as the S&P 500.

Capital Asset Pricing Model (CAPM)

The Capital Asset Pricing (CAPM) Model is the most widely used risk/return model used to calculate the equity cost of capital.

Comparable Company Analysis

Comps or Comparable Company Analysis involves identifying valuation multiples from comparable listed companies and applying these to the financials of the company to be valued.

Compounding

The ability of an asset to generate earnings, which are then reinvested in order to generate their own earnings. In other words, compounding refers to generating earnings from previous earnings.

Comps

See Comparable Company Analysis.

Constant Perpetuity

A constant stream of identical cash flows without end.

Covariance

A statistical measure of the variance of two random variables that are observed or measured in the same mean time period.

Covenants

The promises made by the borrowing company in a loan agreement to adhere to certain limits in its operations.

Debt Financing

Raising money for a business through loans or by issuing bonds.

Discount Rate

The discount rate is the percentage rate required to calculate the present value of a future cash flow.

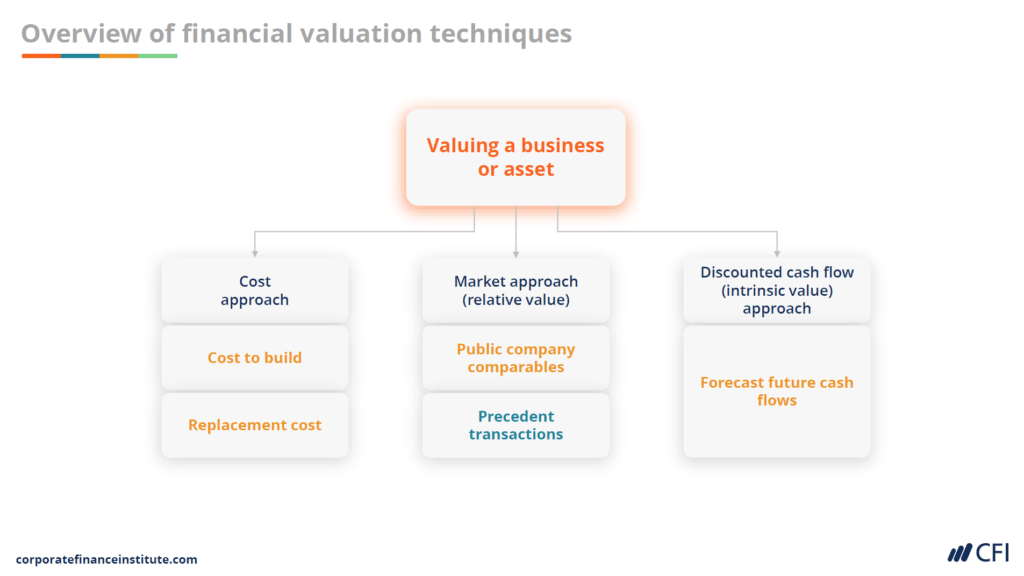

Discounted Cash Flow (DCF) Valuation Approach

Discounted Cash Flow (DCF) valuation is a method of valuing a company using the concept of the time value of money. All future cash flows are estimated and discounted to give their present values. The sum of all future cash flows, both incoming and outgoing, is the net present value (NPV), which is taken as the value or price of the cash flows in question.

Discounting

The process of determining the present value of a payment or a stream of payments that is to be received.

Diversifiable Risk

See firm-specific risk.

Dividends

A share of a company’s net profits distributed by the company to a class of its shareholders.

EBIT

Earnings Before Interest and Tax. Sometimes referred to as operating profit.

EBITDA

Earnings Before Interest, Taxation, Depreciation, and Amortization.

Enterprise Value

Enterprise Value (EV), also known as Total Enterprise Value (TEV), Entity Value, or Firm Value (FV) is a measure reflecting the market value of a whole business. It is the sum of claims of all the security-holders: debt holders, preferred shareholders, minority interest, common equity holders, and others.

Enterprise Value Multiples

A ratio used to determine the value of a company. The enterprise value multiple looks at a company as a potential acquirer would because it takes debt into account – an item which other multiples like the P/E ratio do not include. An example of an enterprise value multiple is EV/EBITDA.

Entity Value

See Enterprise Value.

Equity

Total assets less total liabilities. Also called total shareholders’ equity or net worth.

Equity Financing

The money acquired from the business owners themselves or from other investors.

Equity Multiples

A ratio used to determine the value of a company’s equity. An example of an equity multiple is price to earnings.

Equity Risk Premium

See risk premium for the definition of Equity Risk Premium.

Equity Value

Equity Value is the value of a company available to shareholders. It is the enterprise value plus all cash and cash equivalents, short and long-term investments, and less all short-term debt, long-term debt, and minority interests.

EV/Capital Employed

The EV to capital employed multiple is defined as the enterprise value divided by capital employed, where capital employed is the book value of all funding (e.g. debt and equity).

EV/EBIT

The EV to EBIT multiple is defined as the enterprise value divided by earnings before interest and tax.

EV/EBITDA

The EV to EBITDA multiple is defined as the enterprise value divided by earnings before interest, tax, depreciation, and amortization.

EV/Free Cash Flows

The EV to free cash flows multiple is defined as the enterprise value divided by free cash flows to the firm.

EV/Sales

The EV to sales multiple is defined as the enterprise value divided by sales (also called revenue or turnover).

Firm Value

See Enterprise Value.

Firm-specific Risk

Firm-specific risk is sometimes called unsystematic risk, specific risk, diversifiable risk, or alpha. The category includes risks associated with a firm’s management team, operations, projects, products, profits, and so on.

Free Cash Flows to Equity

Free Cash Flows to Equity is the cash flow available for distribution to equity holders. If net borrowings remain unchanged, the formula is free cash flows to the firm – Interest Expense x (1 – Tax Rate).

Free Cash Flows to the Firm

This is the cash flow available for distribution among all the securities holders of an organization (i.e. debt holders, equity holders, etc.). The standard definition is EBIT x (1 – Tax Rate) + Depreciation & Amortization +/- Changes in Working Capital – Capital Expenditure. This can also be referred to as unlevered free cash flow.

Gross Debt

All interest-bearing debt (both current and long term).

Growing Perpetuity

A constant stream of cash flows without end that is expected to rise indefinitely.

Market Cap

Market Capitalization

Market Capitalization is the share prices times the number of shares outstanding for a publicly-traded company.

Market Risk

Market Risk is often referred to as systematic risk, non-specific risk, non-diversifiable risk, or beta. This category includes risks such as interest rates, the economic cycle, inflation, legislation, and socio-economic developments.

Multiples Valuation Approach

The Multiples Valuation Approach is a valuation theory based on the idea that similar assets sell at similar prices. It assumes that a ratio comparing value to some firm-specific variable (operating margins, cash flow, etc.) is the same across similar firms.

Net Debt

Net debt is all interest-bearing debt (often referred to as gross debt) less cash, cash equivalents, and marketable securities. Net debt assumes that cash and marketable securities are “surplus” or “redundant” and can be used to pay down debt. In practice, It is important to assess whether all cash, cash equivalents, and marketable securities truly are “redundant” or readily disposable.

Net Operating Profit After Tax

Net Operating Profit After Tax (NOPAT) is a company’s after-tax operating profit for all investors, including shareholders and debt holders.

(NOPAT)

NOPAT is typically defined as EBIT x (1 – effective tax rate).

Net Present Value

Net Present Value is the sum of the present values of a time series of future cash flows.

Non-diversifiable Risk

See market risk.

Non-specific Risk

See market risk.

Normalized Earnings

Earnings adjusted for non-recurring items, over/under depreciation, profit/loss on the sale of assets, etc. so that earnings reflect the ongoing performance of the company.

Precedent Transaction Analysis

Precedents or Precedent Transaction Analysis involves identifying recent acquisitions in the same sector and applying the multiples from these transactions to the financials of the company to be valued.

Price to Book

The price to book multiple is defined as the market capitalization (or equity value of common shares) divided by the book value of equity which is total common shareholders’ equity excluding preference shares and minority interest.

Price to Cash Flow

The price to cash flow multiple is defined as the market capitalization (or equity value of common shares) divided by free cash flows to equity. Free cash flows to equity is typically defined as cash flows from operations less capital expenditures.

Price to Earnings

The Price to Earnings Multiple is defined as the market capitalization (or equity value of common shares) divided by the earnings belonging to common shareholders.

Risk-free Rate

Most analysts use the yield on government bonds to determine the risk-free rate even though they are not entirely risk free. This is because it is virtually impossible to get a truly risk-free rate.

Risk Premium

Risk Premium is the excess return that the overall stock market provides over the risk-free rate.

Single-stage DCF Valuation

A DCF valuation technique that solely uses a DCF perpetuity formula to value a company. It should only be used for companies with stable cash flows that are expected to grow in a predictable manner.

Specific Risk

See firm-specific risk.

Standard Deviation

A measure of the dispersion of a set of data from its mean. The more spread apart the data, the higher the deviation. Standard deviation is calculated as the square root of variance.

Systematic Risk

See market risk.

Total Shareholder Return

Total shareholder return (TSR) is the total return of a stock to an investor including both dividends and capital gains.

Two-stage DCF Valuation

A DCF valuation technique that is made up of a finite forecast period and a post-forecast period. The post-forecast period is commonly referred to as the continuing value, terminal value, or TV.

Unsystematic Risk

See firm-specific risk.

Variance

Variance is a measure of the dispersion of a set of data points around their mean value. Variance is a mathematical expectation of the average squared deviations from the mean.

Weighted Average Cost of Capital (WACC)

The Weighted Average Cost of Capital (WACC) incorporates the individual costs of capital for each provider of finance (e.g. debt and equity), weighted by the relative size of their contribution to the overall pool of finance.

Additional business valuation resources

CFI’s business valuation glossary covered key concepts from the Business Valuation Modeling Course. To continue learning and advancing your career these resources will be helpful:

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in