- What is Investment Value?

- Importance of Investment Value

- How to Determine Investment Value

- 1. Comparable Sales

- 2. Gross Rent Multiplier

- 3. Cash on Cash Return

- 4. Direct Capitalization

- 5. Discounted Cash Flow (DCF)

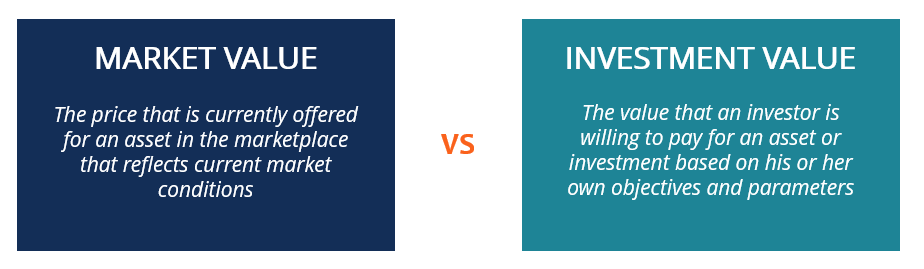

- Investment Value vs. Market Value

- What is Market Value?

- Investment Value Revisited

- Investment Value and Market Value May Be Different

Investment Value

The amount of money an investor would pay for a property

What is Investment Value?

Investment value is the amount of money an investor would pay for a piece of property. It refers to an asset’s specific value based on certain parameters. Investment value represents an individual’s measurement of the asset’s property value.

Potential investors often adopt an investment value metric when they decide to invest in property (like real estate) with certain personal investment goals in mind. This metric can include a certain return on investment rate that they are looking for in an investment. The value metric is motivated by the beliefs of a certain investment strategy.

Key Highlights

- Investment value is the amount of money an investor would pay for a piece of property. This can differ from the market value of the property due to differences in uses and investment objectives.

- The reason investment value is important to potential buyers of a property is that they want to compare the price of the real estate to the anticipated rate of return. If the investor’s return thresholds are met, then it makes sense to invest in the property.

- There are several different methodologies to estimating investment value, including looking at comparable sales and discounted cash flow valuation.

Importance of Investment Value

The reason investment value is important to potential buyers of a property is that they want to compare the price of the real estate to the anticipated rate of return.

When they find the specific rate of return, they can measure the investment’s final results with the projected price they will pay for the property. It allows the investor to make intelligent purchasing decisions that are in line with the investor’s investment objectives.

How to Determine Investment Value

Since investment value depends on the investor’s objectives, the investment value of an asset is unique to each investor. Different investors can use the same valuation methods and come up with different investment values.

Investors can choose among several valuation methods when determining the investment value of an asset. Below are the most commonly used investment measures:

1. Comparable Sales

Under this methodology, an investor will compare similar properties on a per square foot or per unit basis to help determine a property’s investment value. The sales comparison approach is used by independent appraisers as well.

The reason why properties are calculated on a per square foot basis is that larger properties will have more square feet and, therefore, normally, a higher price. By dividing price by square feet, you obtain a multiple, which can then be used to value the investment asset.

The logic follows that if property X is worth $250 per square foot, then assuming the properties are similar in other regards, the potential investment property may be worth $250 per square foot.

2. Gross Rent Multiplier

This metric measures an investment’s value by multiplying the gross rent a property produces in a year by the gross rent multiplier (GRM). The GRM figure is derived from similar properties in the same market.

This makes it different from the comparable sales comparison approach since a financial metric (gross rent) is used instead of a capacity metric (square feet).

This approach is similar to using the enterprise value to sales multiple when performing a company valuation.

3. Cash on Cash Return

The cash on cash return figure is calculated by dividing the first year’s pro forma cash flow by the total initial investment. This is a less generalized version of the return on investment calculation.

4. Direct Capitalization

Direct capitalization is another metric used by appraisers and investors. It involves capitalizing the income stream of a property and is a common method used to determine the market and investment value of commercial property.

5. Discounted Cash Flow (DCF)

The DCF model is used to calculate the net present value and/or the internal rate of return on the investment property. The said model solves some of the limitations in the ratios listed above (for example, finding truly comparable properties is difficult). Of course, the discounted cash flow method requires making a lot of assumptions about the future operations and cash flows of the property.

Investment Value vs. Market Value

What is Market Value?

Market value is the price that is currently offered for an asset in the marketplace, which reflects current market conditions and supply and demand. Essentially, market value is an objective estimate of the asset’s value in the given market conditions.

The calculation of market value may vary among different assets. For example, the market value for liquid assets such as equities or futures can be easily found using the quotes on the exchanges where the securities are traded.

Conversely, illiquid assets such as real estate do not have the same kind of obvious price point. Thus, the true market value of such assets is usually determined by appraisal professionals. They conduct research on an asset, as well as consider current market conditions, to identify a reasonable market value.

Investment Value Revisited

Investment value is the value that an investor is willing to pay to obtain an asset or investment. It is based on the individual’s subjective goals, criteria, and opinion about the asset, which may not always reflect the asset’s true value.

Investment value is a metric that investors use to make investment decisions. In identifying investment value, investors generally consider several criteria, including, but not limited to, return on investment, investment strategy, and risk levels. In addition, investors also may make forecasts of market conditions that can have a significant impact on the property’s value.

The calculation of investment value is a challenging process that usually combines both art and science. Each investor must carefully assess his or her own objectives, market conditions, and factors attributable to the investment to come up with a quantified investment value.

As discussed previously, there are a number of different methodologies for calculating the investment value, and they don’t always yield the same numbers.

Investment Value and Market Value May Be Different

The investment value can be lower or higher than the market value. It depends on the property’s specific situation at the time. The investment value can be greater than the market value if a buyer places a higher value on the property than a different purchaser.

In the real world, such a situation can occur if a company expands its premises to a larger building that’s been put on sale right across its current office. The company is willing to agree to a price higher than the building’s market value to ensure that competitors stay out of the area.

In such a case, the extra investment value is derived from the strategic advantage the company will gain by buying the property. A single investor can also agree to an investment value that is higher than the market value. This could occur if the investor receives a special tax status or highly beneficial financing terms.

Alternatively, the investment value to an investor can also be below the market value. This can happen when the investment is not the type of property that an investor would normally concentrate their efforts on. For example, a multi-family housing developer who is considering the idea of developing a hotel may result in the investment value being lower than the market value.

This can be due to the hotel development being outside the developer’s area of expertise. This can result in higher costs involved in learning how to develop the property, or because the developer’s investors are demanding a higher-than-average return from the property due to the lack of previous experience with this type of asset.

Additional Resources

Thank you for reading CFI’s guide to Investment Value. To keep advancing your career, the additional resources below will be useful:

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in