Overview

Capital IQ Fundamentals Course Overview

Capital IQ Fundamentals Learning Objectives

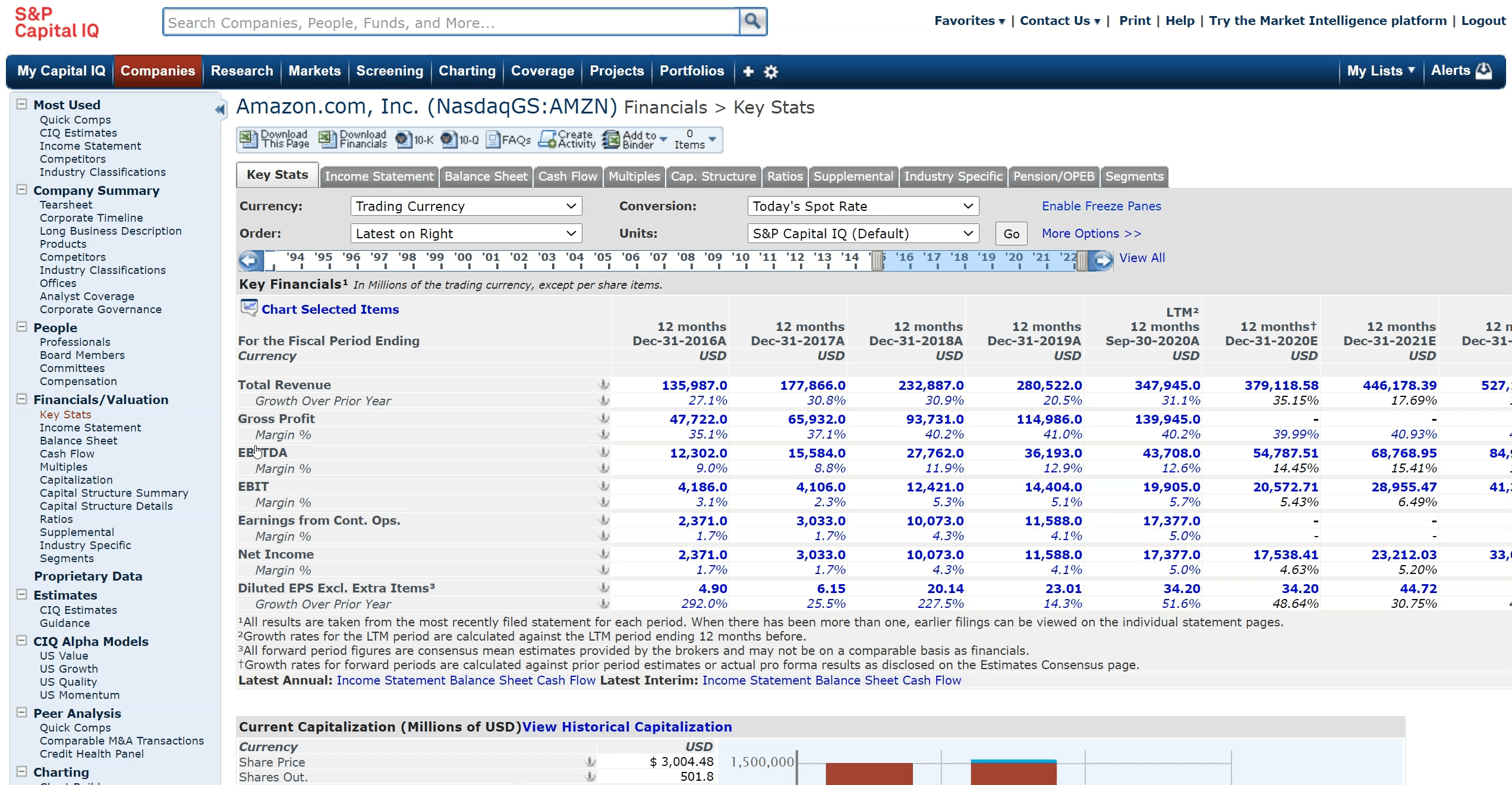

Upon completing this course, you will be able to:- Navigate the Capital IQ platform and customize your dashboard

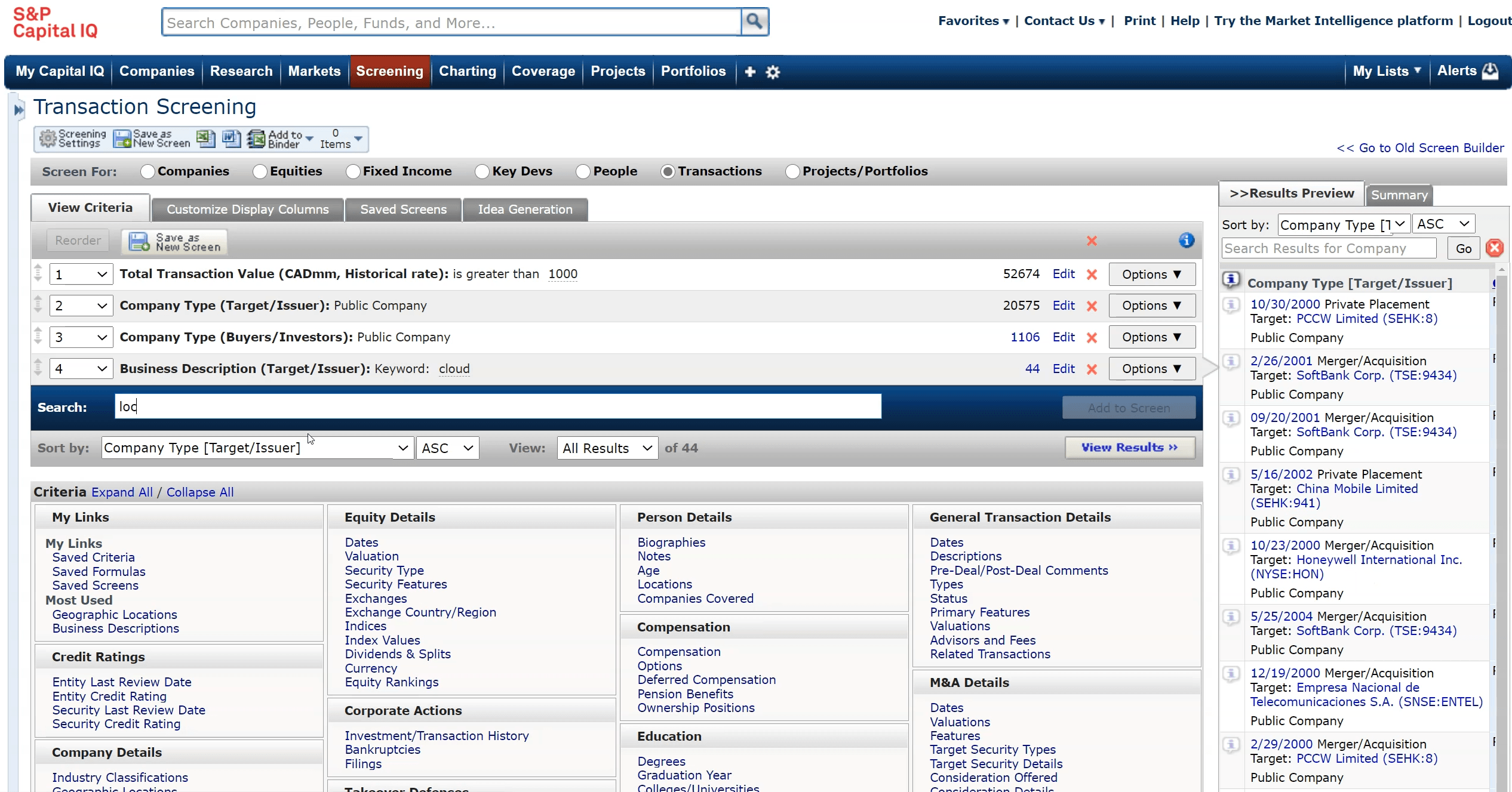

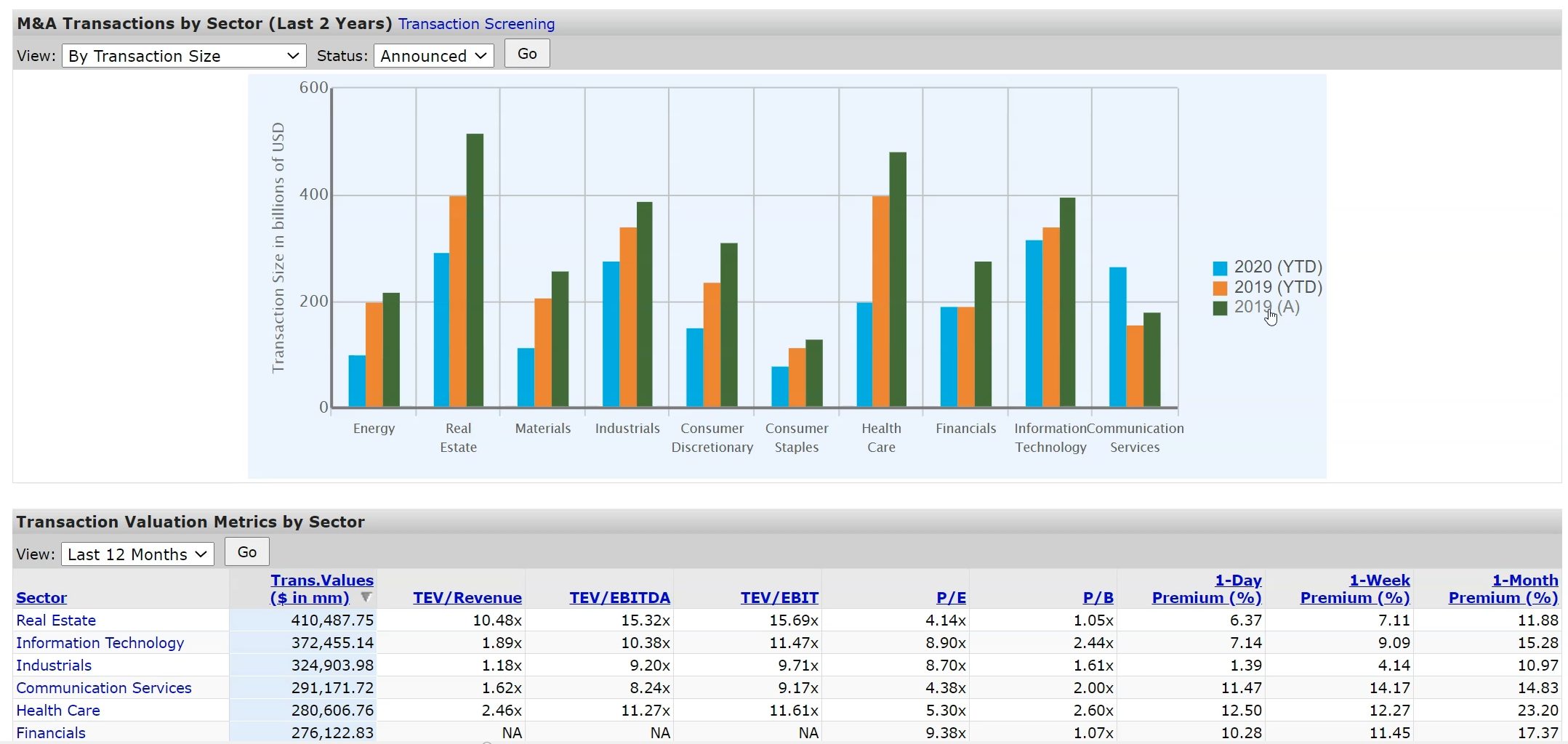

- Explore the commonly used functions, including Companies, Research, Markets, Screening, Charting, Coverage, Projects, and Portfolios

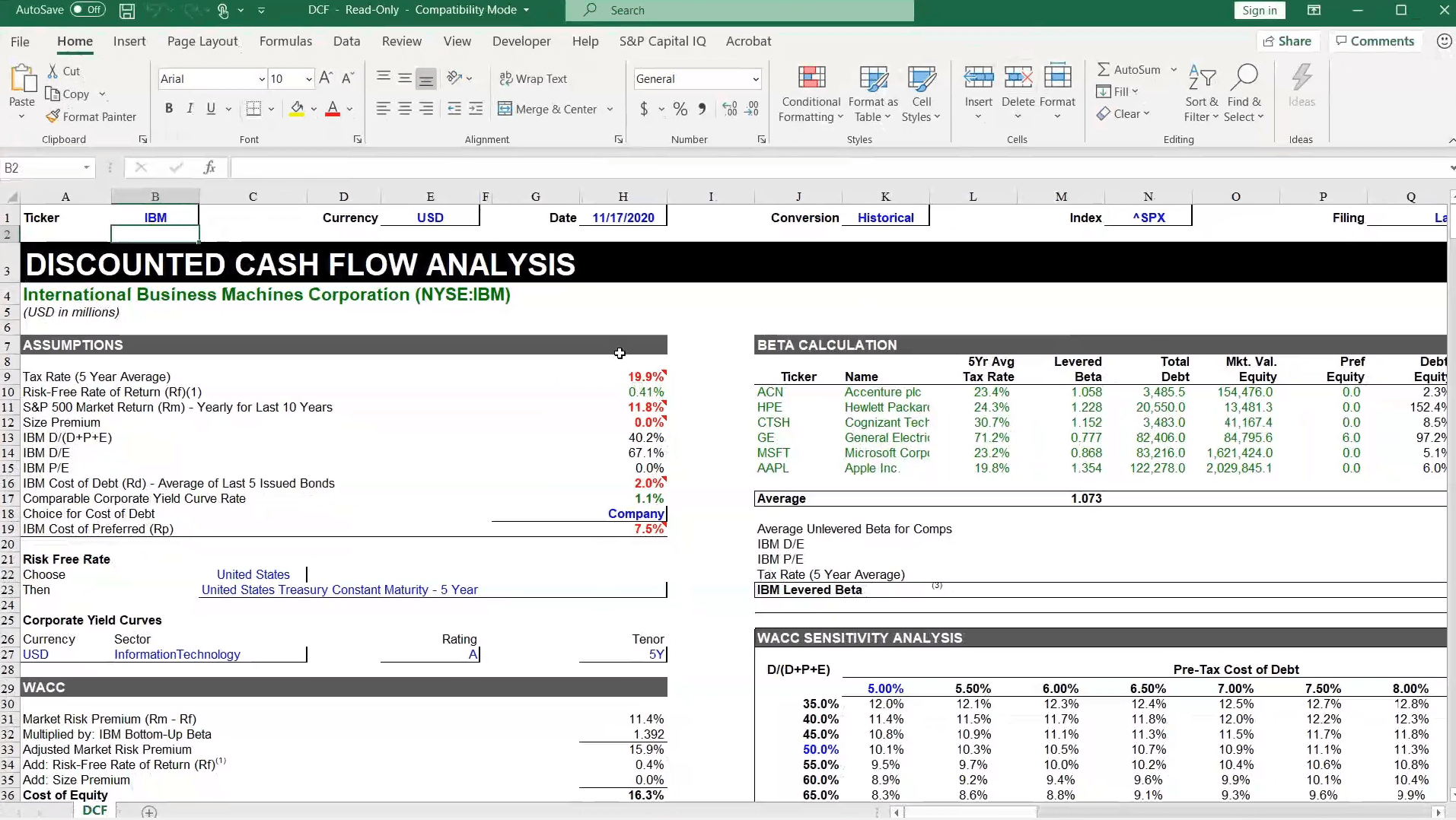

- Learn how to download the Capital IQ Excel plug-in and use the built-in templates and formula builder

Who should take this course?

Prerequisite Courses

Recommended courses to complete before taking this course.

Prerequisite Skills

Recommended skills to have before taking this course.

- Basic Math

- Basic computer skills

- Basic statistics

Capital IQ Fundamentals

Level 2

1h 7min

100% online and self-paced

Field of Study: Specialized Knowledge

Start LearningWhat you'll learn

Charting, Coverage, Projects, Portfolios

Conclusion

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Financial Modeling & Valuation Analyst (FMVA®) Certification

- Skills Learned Financial modeling and valuation, sensitivity analysis, strategy

- Career Prep Investment banking and equity research, FP&A, corporate development