Overview

Commodities Fundamentals Overview

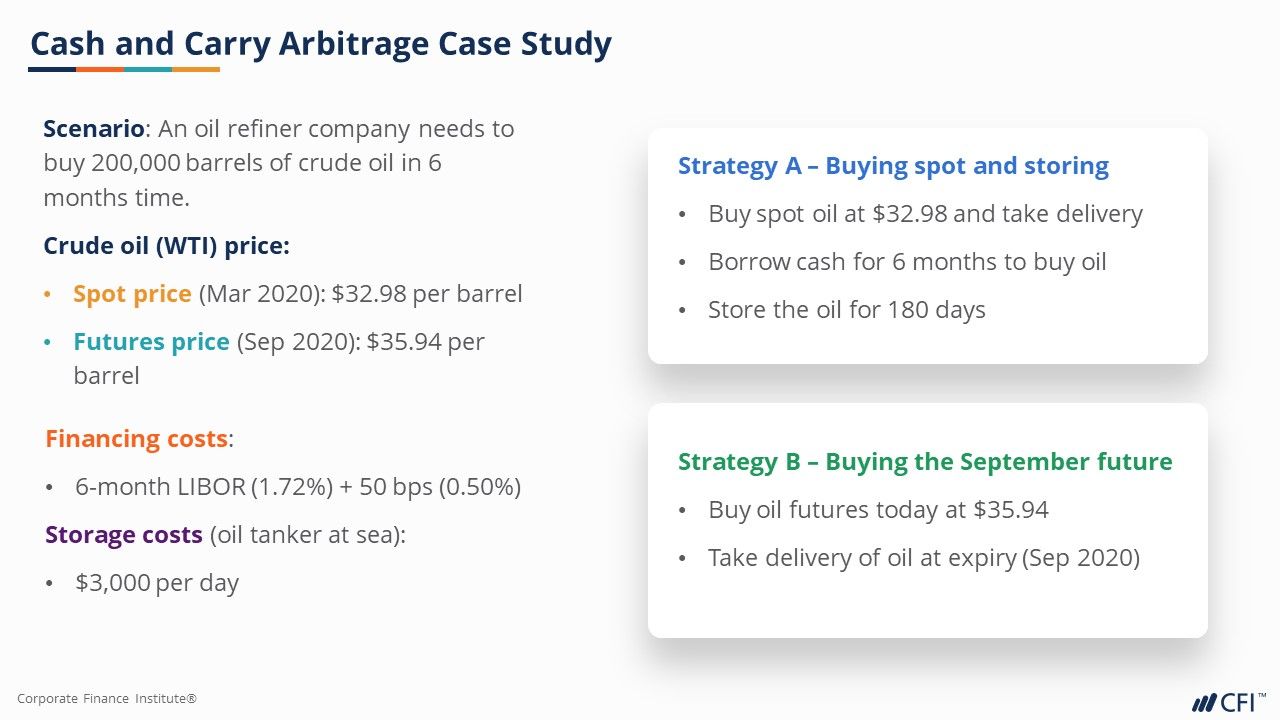

This course provides an in-depth overview of commodities trading in capital markets. We will introduce the key features of commodities and go over the major commodity categories with their key drivers. Then we will explore how commodities are traded in the derivatives markets using futures and options. We will demonstrate common commodity trading strategies such as hedging, cash and carry arbitrage trading, and monthly rollover. Finally, we will discuss commodity spread trading strategies such as intramarket spreads, intermarket spreads, and strips.

Commodities Fundamentals Learning Objectives

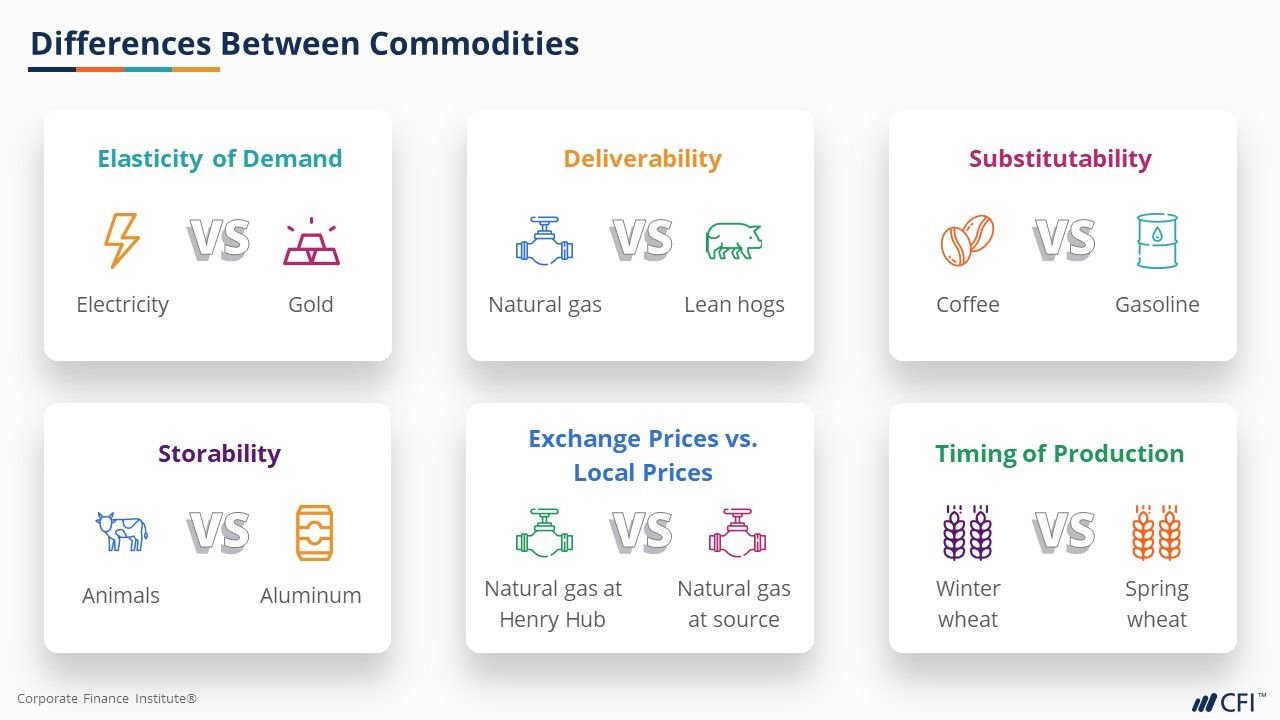

By the end of this course, you will be able to:- Define commodities and their key features

- Identify the major commodity categories

- Discuss the drivers of the commodities in different categories

- Undertake commodity trading strategies using futures and options

- Explain commodity spreads and common spread trading strategies

Who should take this course?

This introductory commodities course is perfect for students interested in commodities derivatives and trading strategies. This course provides a comprehensive overview of commodities. It is designed to equip anyone who desires to begin a career in investment banking, sales, trading, treasury, or other areas of finance that require an understanding of commodities.

Prerequisite Skills

Recommended skills to have before taking this course.

- Logical thinking

- Basic Math

Commodities Fundamentals

Level 3

1h 24min

100% online and self-paced

Field of Study: Finance

Start LearningWhat you'll learn

Commodities Overview

Major Commodity Categories

Commodity Trading Strategies

Course Summary

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Capital Markets & Securities Analyst (CMSA®) Certification

- Skills Learned Trading strategies used in the finance and capital markets

- Career Prep Work in capital markets, whether on the buy-side or the sell-side

Financial Planning & Wealth Management Professional (FPWMP®) Certification

- Skills Learned Financial Learning, Business Development, Investment Management, Practice Management, Relationship Management

- Career Prep Financial Planner, Investment Advisor, Portfolio Manager