Overview

Completing a Credit Application Course Overview

This completing a credit application course combines all of the concepts you have learned throughout CFI’s Certified Banking and Credit Analyst Program. This course will show you how to combine the 5Cs of credit to fill out a real credit application. We will analyze the different components of the application and connect the courses you have finished to fill out each part. You will evaluate a business case study to determine what is necessary for a credit application.

Completing a Credit Application Learning Objectives

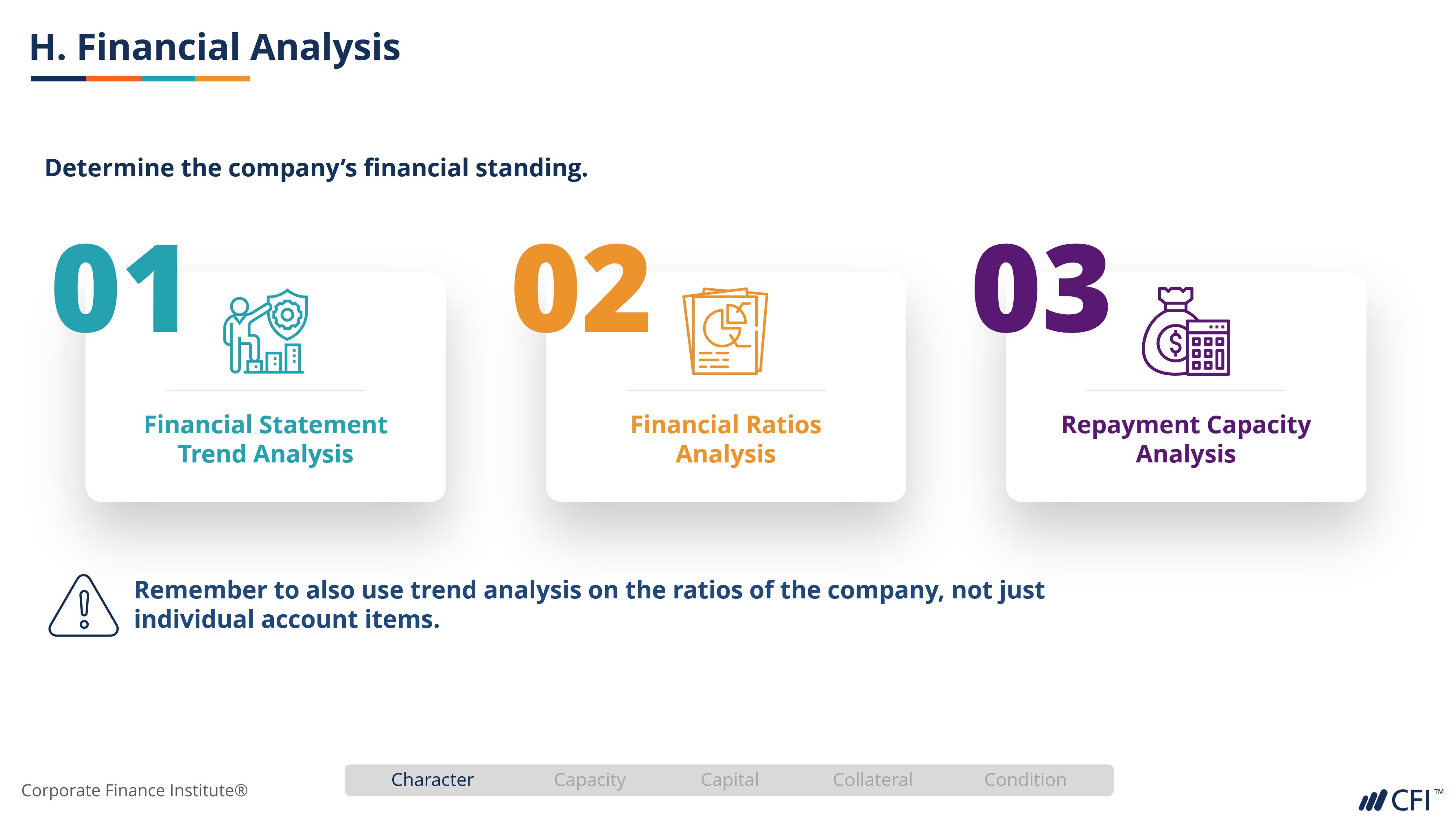

This course examines the framework of a credit application. The first section of this course will evaluate each part of the application in detail and determine what is needed to complete it. The second section of the course will analyze a business case study. This case study will test a credit analyst’s ability to perform analysis on many factors that affect a company’s credit, including management, industry conditions, and financial health. Upon completing this course, you will be able to:- Understand the components of a credit application

- Combine the 5Cs of credit to evaluate a company and give recommendations

- Deliver information efficiently using business writing best practices

- Complete a credit application for a company case study

Who should take this course?

This completing a credit application course is perfect for any aspiring credit analyst working in insurance, underwriting, rating agencies, commercial lending, corporate credit analysis, and other areas of credit evaluation.Prerequisite Courses

Recommended courses to complete before taking this course.

Completing a Credit Application

Level 3

1h 19min

100% online and self-paced

Field of Study: Finance

Start LearningWhat you'll learn

Components of a Credit Application

Completing a Credit Application - Case Study

Summary

Qualified Assessments

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Commercial Banking & Credit Analyst (CBCA®) Certification

- Skills Learned Financial Analysis, Credit Structuring, Risk Management

- Career Prep Commercial Banking, Credit Analyst, Private Lending