Overview

Credit Administration and Documentation Overview

Credit administration and documentation are two of the critical components in managing credit and supporting the credit process. Following proper credit administrative and documentation process allow credit analysts to monitor accounts and identify ways to reduce default risk. This course will explain the main components of credit administration and documentation. We will go through examples of credit documents to understand the basic format and layout. We will also explore the considerations that should be considered when assessing risk ratings.

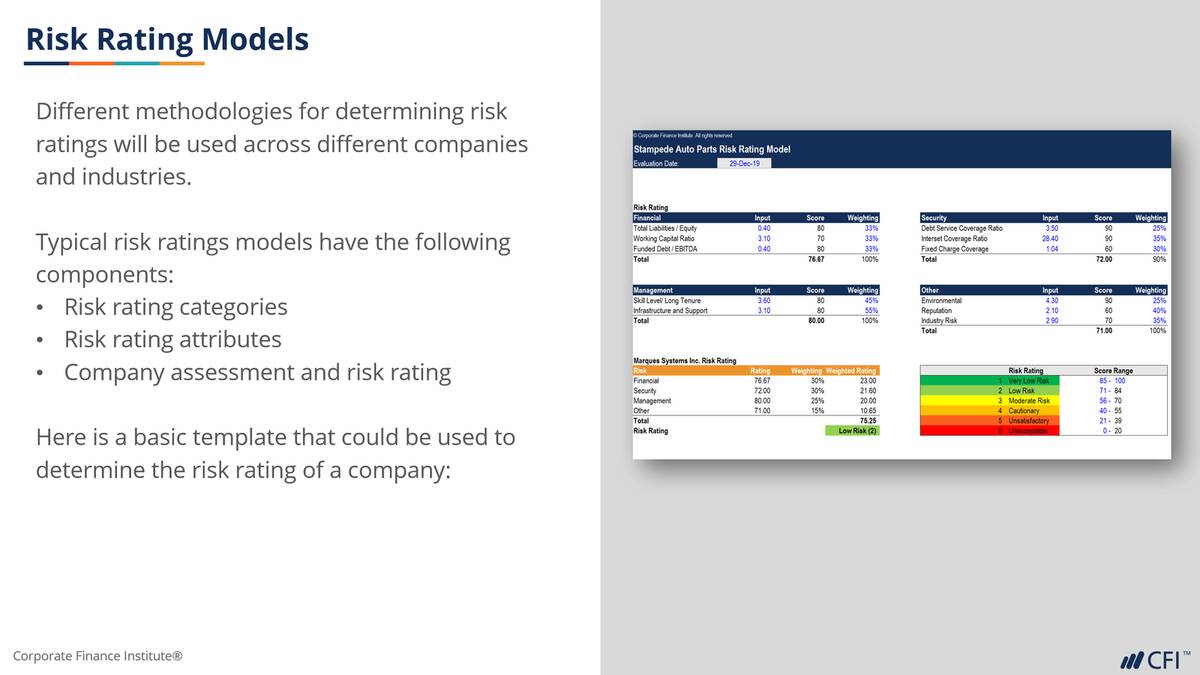

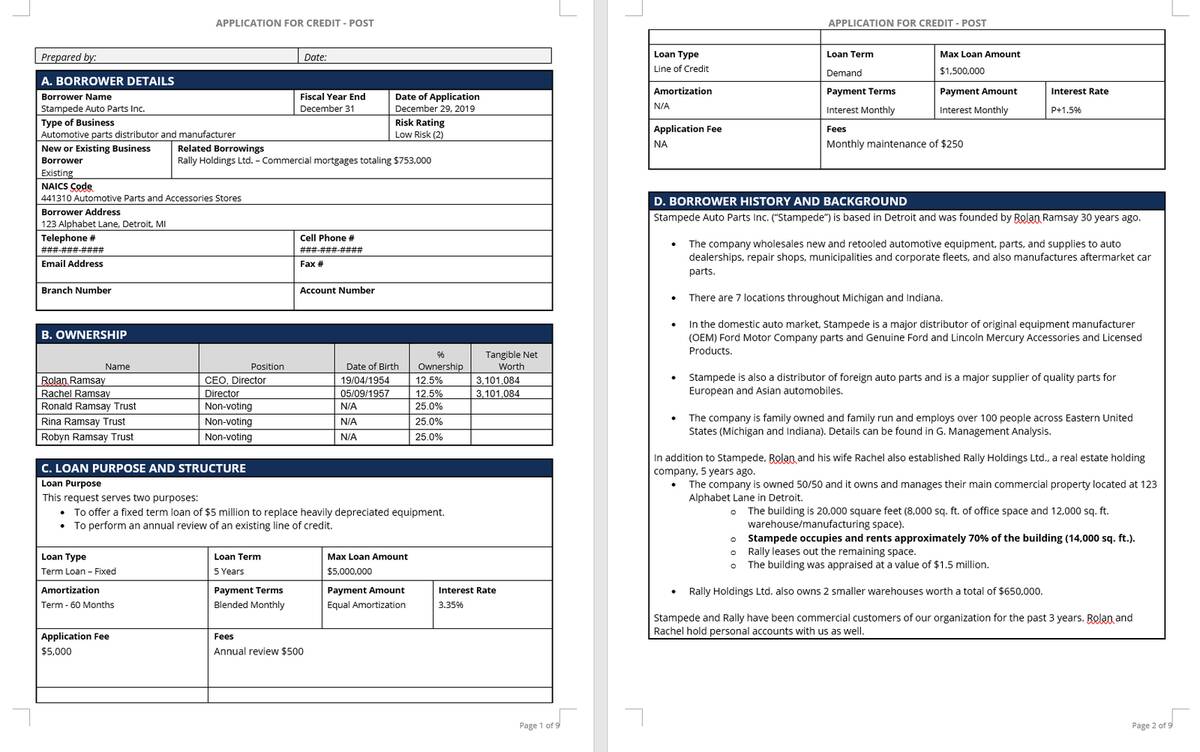

This course will explain the main components of credit administration and documentation. We will go through examples of credit documents to understand the basic format and layout. We will also explore the considerations that should be considered when assessing risk ratings.

Credit Administration and Documentation Learning Objectives

Upon completing this course, you will be able to:- Explain the importance of credit administration

- Describe credit risk considerations and recognize warning signs

- Identify the steps taken when monitoring credit accounts

- Recognize the different types of documentation used to support the administrative process

- List the key steps in the annual review process

Who should take this course?

This Credit Administration and Documentation course is perfect for any aspiring credit analysts working in insurance, underwriting, rating agencies, commercial lending, corporate credit analysis, and other areas of credit evaluation.

Prerequisite Skills

Recommended skills to have before taking this course.

- Critical thinking

- Basic Math

Credit Administration and Documentation

Level 3

32min

100% online and self-paced

Field of Study: Finance

Start LearningWhat you'll learn

Introduction

Loan Monitoring Documentation and Annual Reviews

Summary

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Commercial Banking & Credit Analyst (CBCA®) Certification

- Skills Learned Financial Analysis, Credit Structuring, Risk Management

- Career Prep Commercial Banking, Credit Analyst, Private Lending