Overview

Derivatives Fundamentals Course Overview

This introductory course on the topic of derivatives covers the fundamental knowledge you need to know about derivatives. You will learn to differentiate between forward, futures, options, and swaps contracts. You will also work on practical examples in Excel to calculate the profits/losses for each type of contract. By the end of this course, you will have the essential knowledge about derivative contracts required to proceed to more advanced topics, such as derivatives pricing and trading.

Why take this derivatives fundamentals course?

This course covers the definition, purpose, and components of each of the four main types of derivatives. You’ll look at real-world examples of derivatives on Refinitiv Workspace. Additionally, you’ll work on example calculations in Excel to determine the profits/ losses generated from various derivatives. Upon completing this course, you should be comfortable explaining the differences between the types of derivatives and how they can be used for hedging and speculating purposes. Major topics covered in this course include:- Characteristics of derivative contracts

- Over-the-counter vs. exchange-traded

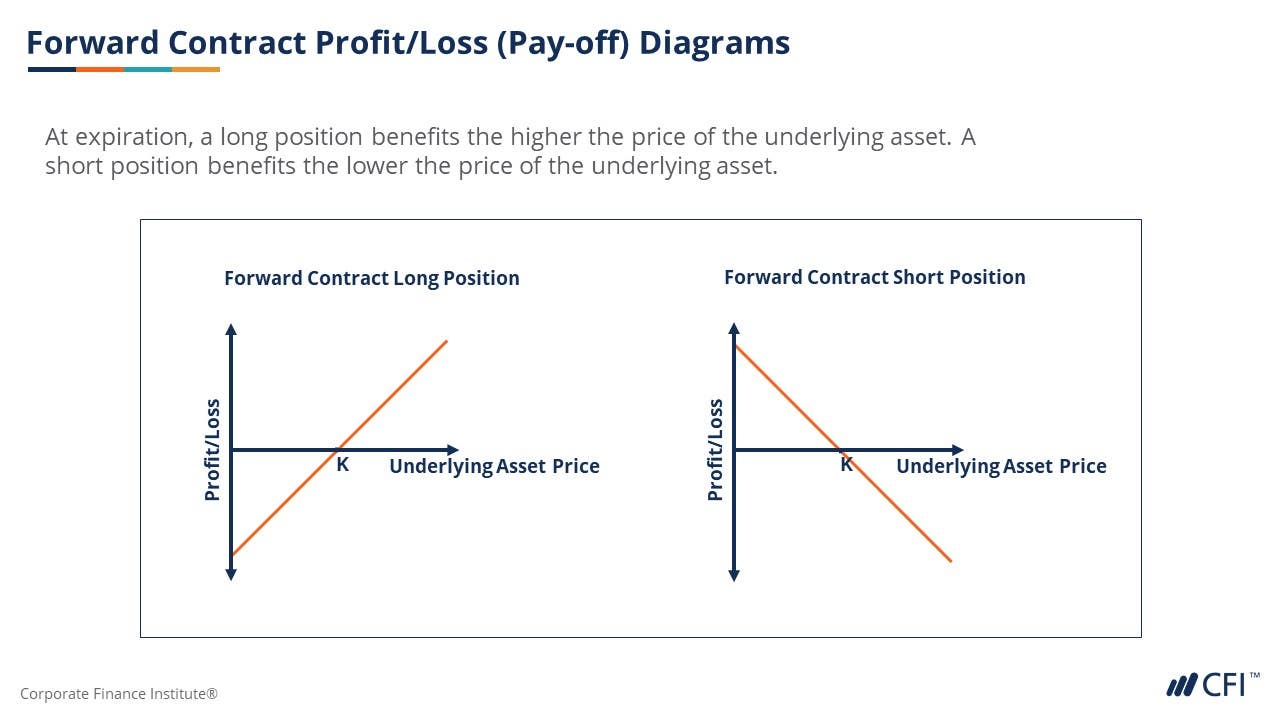

- Forward contracts

- Futures contracts

- Initial and maintenance margins

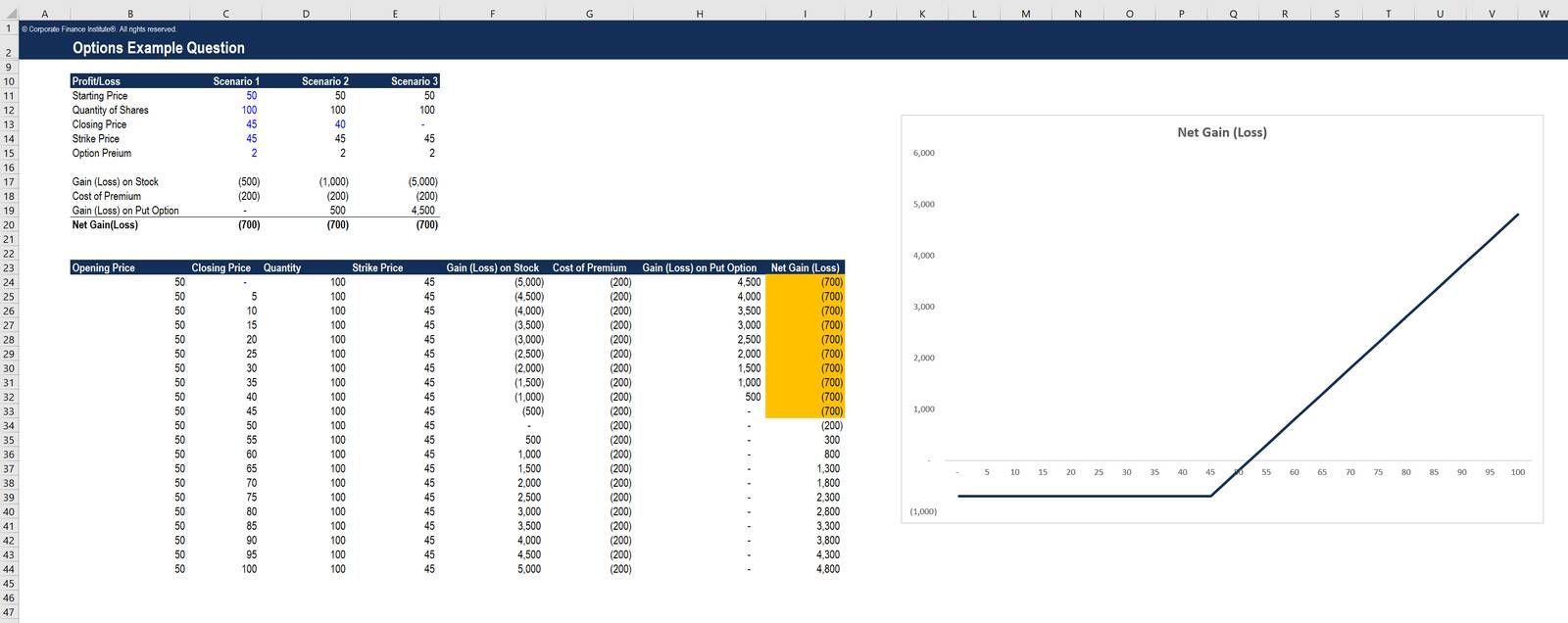

- Call and put options

- Moneyness (in-the-money, at-the-money, out-of-the-money)

- Swap contracts

Who should take this course?

This Introductory derivatives course is perfect for anyone who wants to build up their understanding of capital markets. This course is designed to equip anyone who desires to begin a career in fixed income, equity, sales, trading, or other areas of finance with the fundamental knowledge of derivatives.

Prerequisite Skills

Recommended skills to have before taking this course.

- Excel

- Basic Math

Derivatives Fundamentals

Level 3

1h 13min

100% online and self-paced

Field of Study: Finance

Start LearningWhat you'll learn

Options Contracts

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Capital Markets & Securities Analyst (CMSA®) Certification

- Skills Learned Trading strategies used in the finance and capital markets

- Career Prep Work in capital markets, whether on the buy-side or the sell-side

Financial Planning & Wealth Management Professional (FPWMP®) Certification

- Skills Learned Financial Learning, Business Development, Investment Management, Practice Management, Relationship Management

- Career Prep Financial Planner, Investment Advisor, Portfolio Manager

Risk Management Specialization

- Skills You’ll Gain Risk Identification, Regulatory Analysis, Risk Measurement, Risk Mitigation

- Great For: Market Risk Analyst, Credit Risk Analyst, Compliance Officer, consulting, Enterprise Risk Manager, Audit