Overview

Introduction to ESG course overview

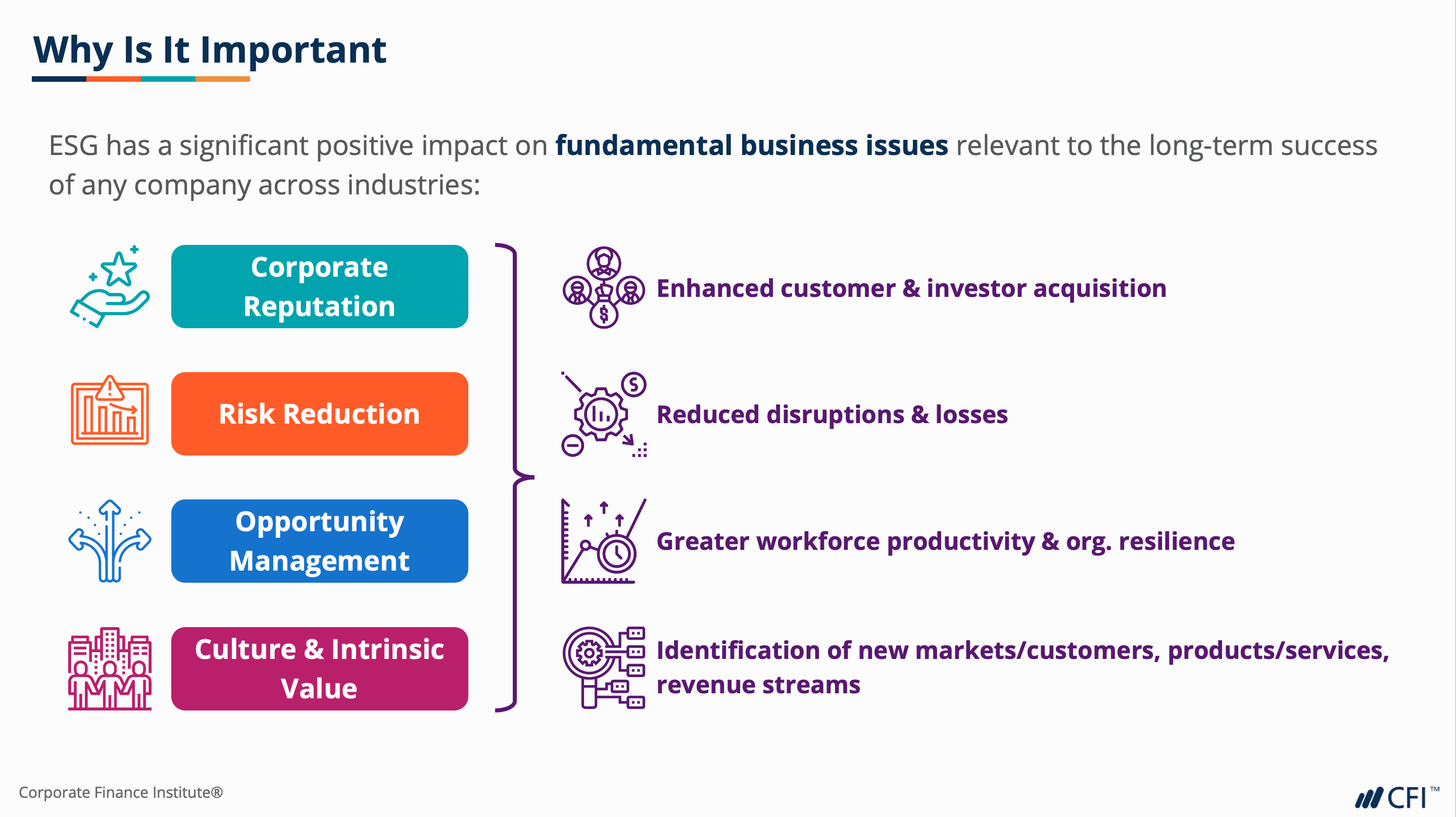

Environmental, Social, and Governance (ESG) has gained increasing attention over the past few years, with many institutional investors investing only in those companies that provide ESG performance reporting. ESG has considerations relevant to analysts and investors, consumers and employees, and it has become a key topic of discussion at the Board table. This course provides an overview of an ESG framework and how it supports a company’s overall risk management. It examines each component in detail and provides insight into how they converge to impact a company and its stakeholders. The course also discusses how to look at corporate pressures & stakeholder expectations and their impact on risk identification and business success. Lastly, we look at critical considerations from both the company and investor perspectives before applying theory to practice in a final case study.

Introduction to ESG learning objectives

Upon completing this course, you will be able to:-

Explain what ESG is and its relevance to making financial decisions;

-

Describe key environmental, social, and governance issues;

-

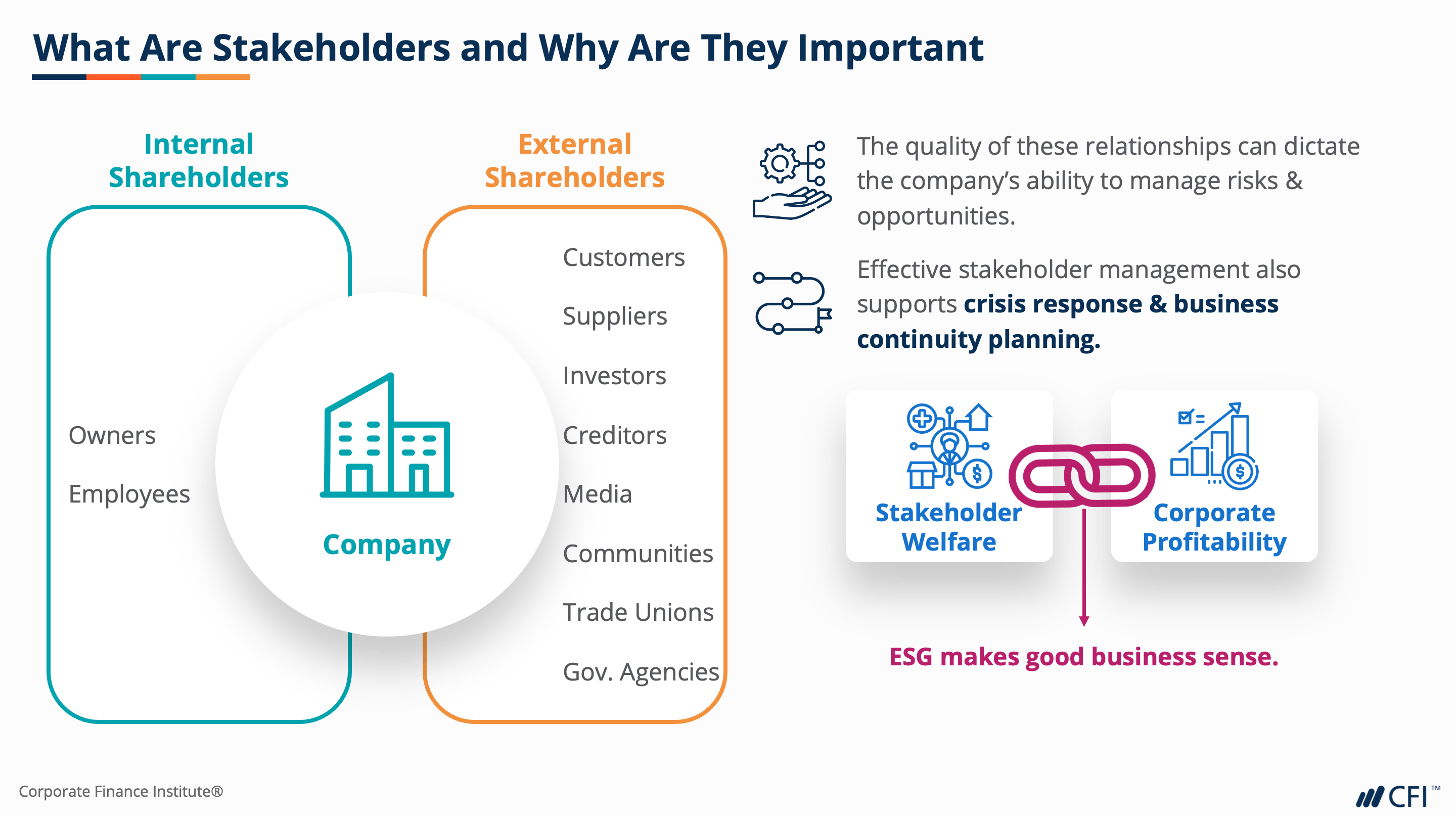

Explain how stakeholders influence corporate ESG performance;

-

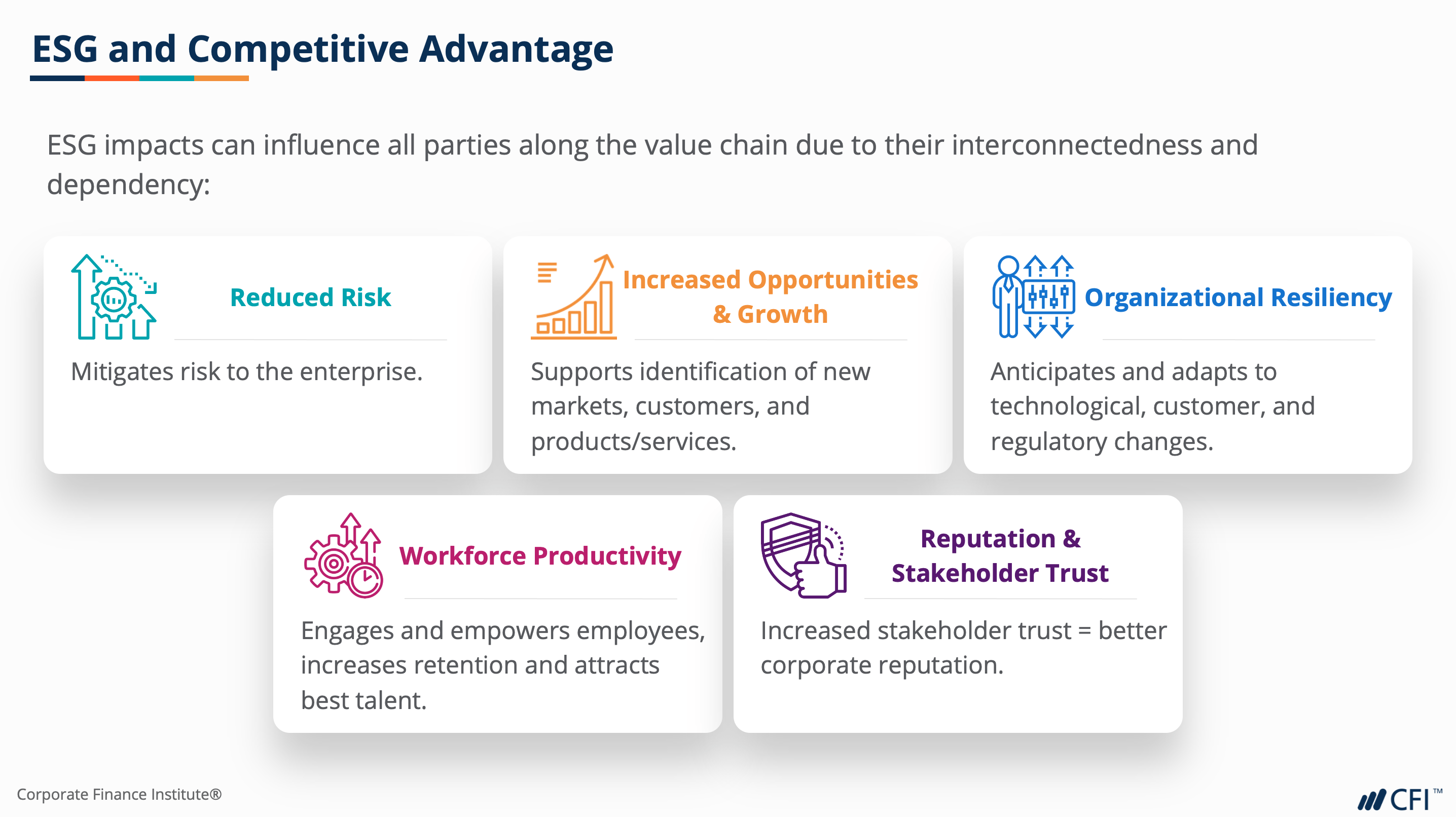

Analyze ESG risks and opportunities;

-

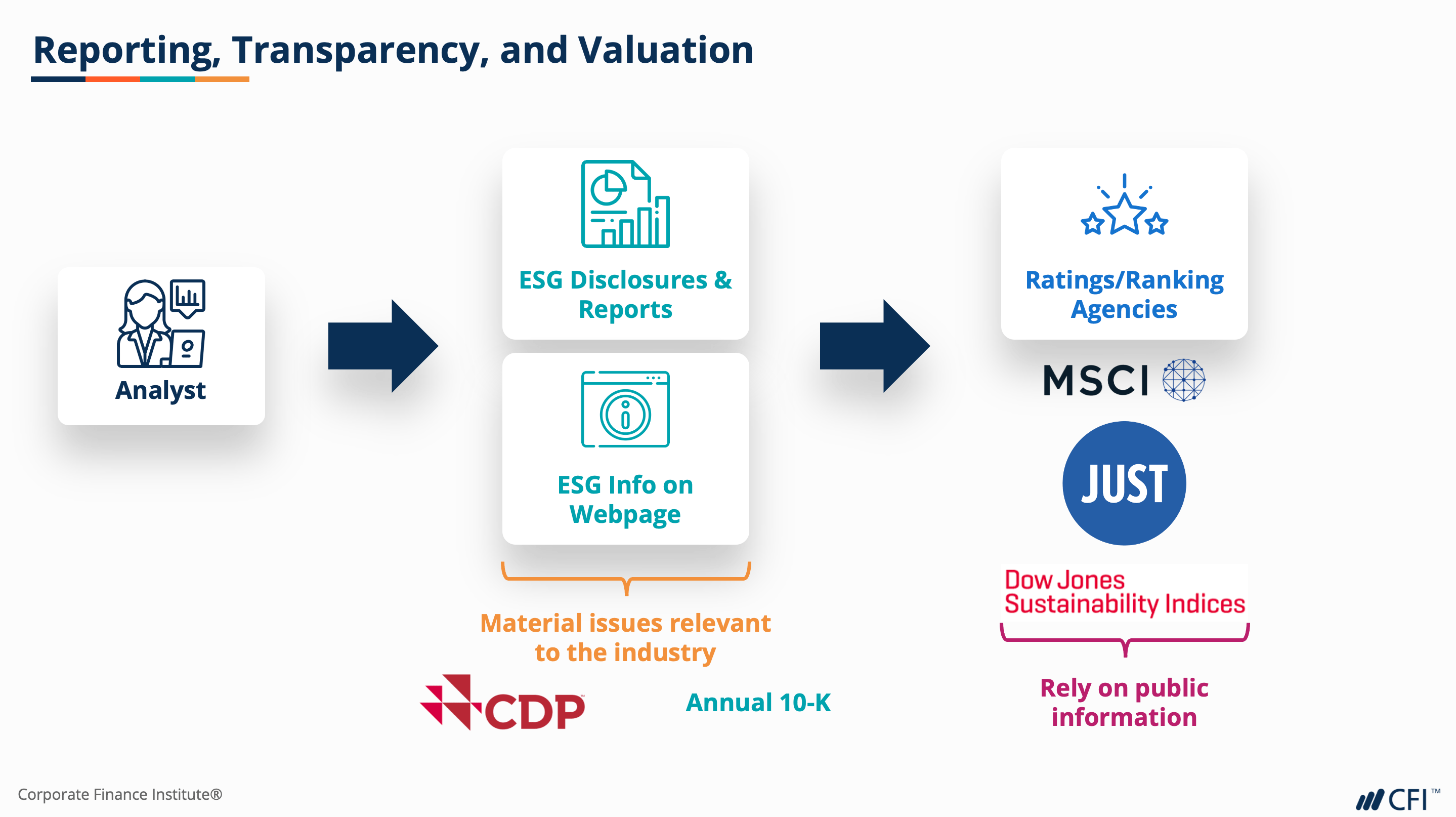

Assess ESG company performance using publicly available information;

-

Translate ESG information to business intelligence.

Who should take this course?

Who should take this course?

This Environmental Social Governance (ESG) course is perfect for any analyst who would like to better understand how a company manages risks and opportunities that shifting market & non-market conditions create in today’s world.

This course explores concepts that will be useful for beginner and intermediate-level research analysts, banking and investment professionals, or business and finance students seeking to gain further insight into ESG.

The exercises and tools explored in this course will also be useful for any business analyst that wishes to advise public market clients on ESG strategies and improved disclosures.

Prerequisite Skills

Recommended skills to have before taking this course.

- Critical thinking

Introduction to ESG

Level 1

50min

100% online and self-paced

Field of Study: Specialized Knowledge

Start LearningWhat you'll learn

Corporate Pressures & Stakeholder Expectations

Key Considerations for Companies & Investors

Case Study & Course Summary

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Environmental Social, and Governance Specialization

- Skills Learned ESG Analysis, ESG Integration, ESG Investing, ESG & Business Intelligence

- Career Prep Asset Management, Management Consulting, Business Analyst, Credit Analyst, Corporate Development, Senior Leadership