Overview

Equity, FX, and Rate Futures Course Overview

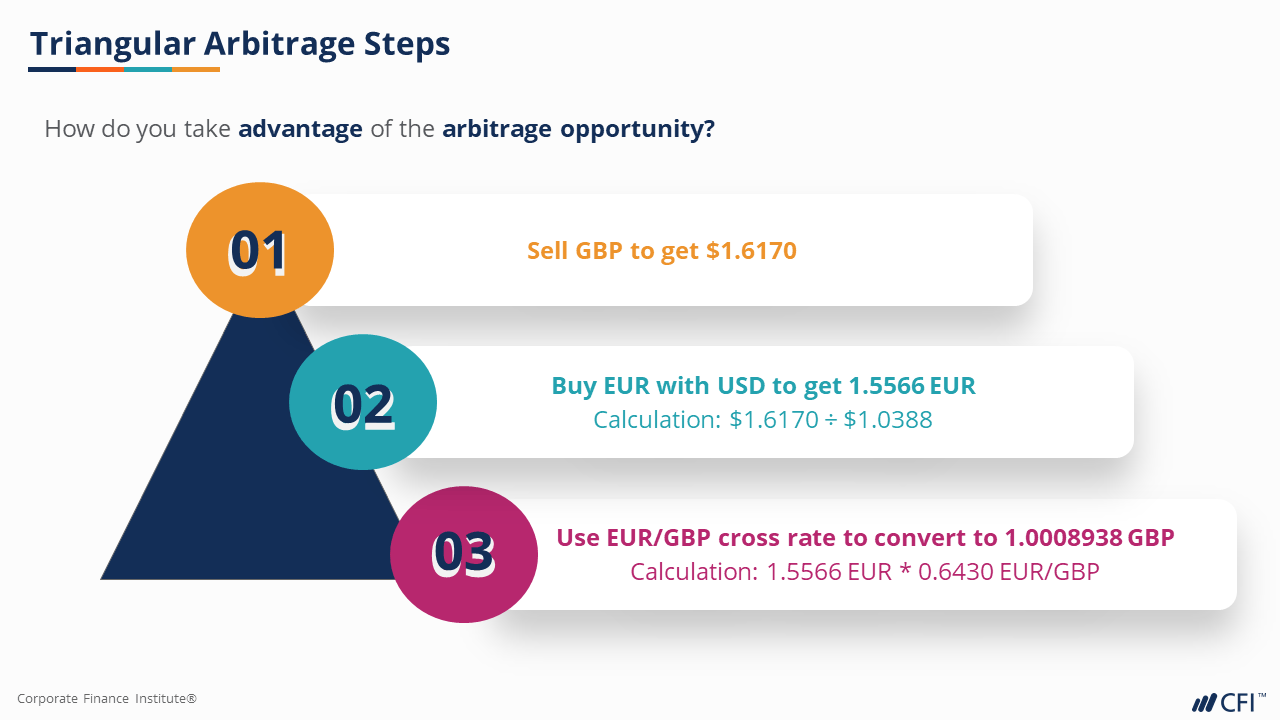

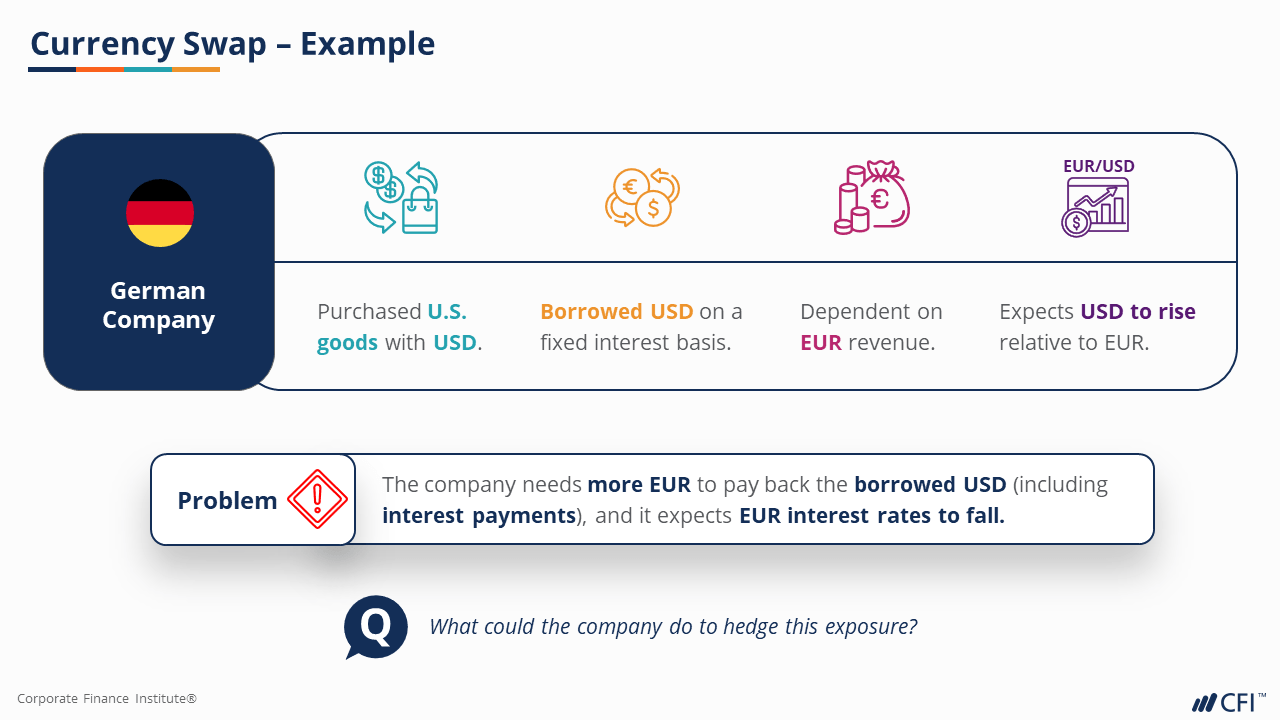

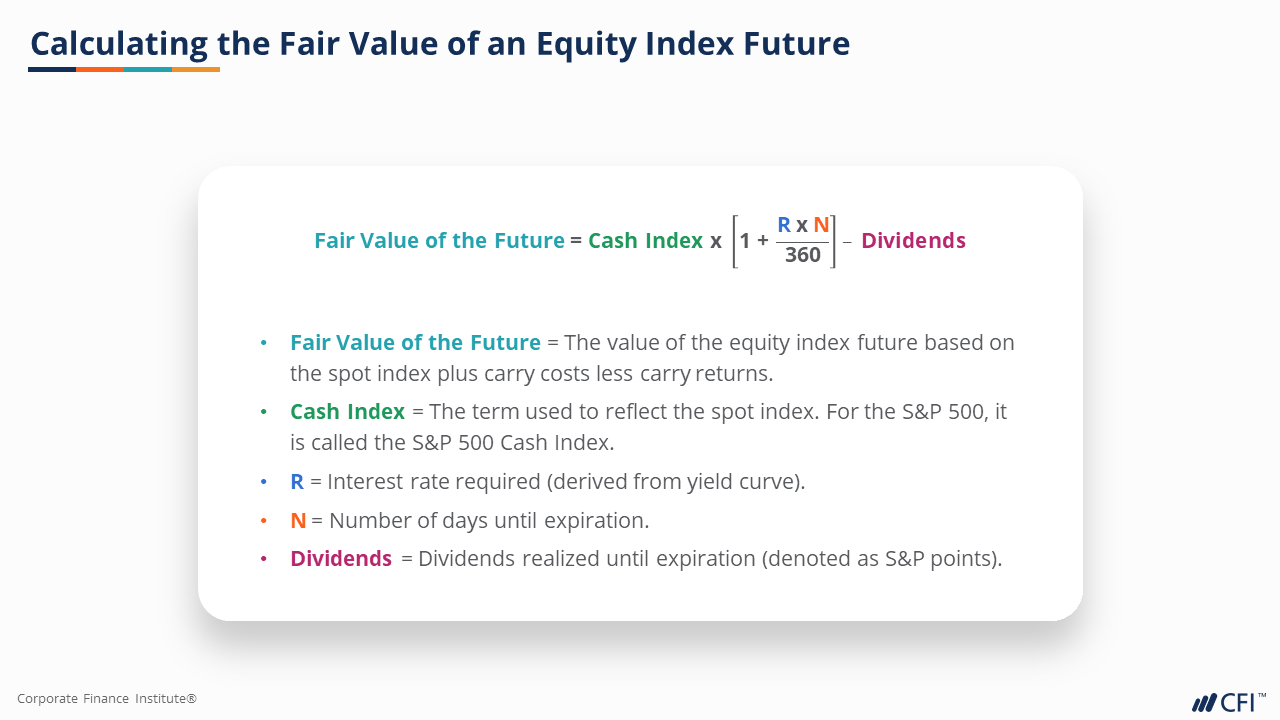

This course focuses on currency futures, equity index futures, and interest rate futures and forwards. The course provides insight into key concepts such as cross rates, triangular arbitrage, and currency swaps. You will also learn how to calculate the fair value of equity index futures and use these instruments to hedge a position. By the end of the course, you will also have an understanding of forward rate agreements (FRAs), short-term interest rate futures (STIRs), interest rate swaps (IRS), and the relationship between spot rates and forward rates. Equity, FX, and Rate Futures Learning Objectives

Equity, FX, and Rate Futures Learning Objectives

- Identify triangular arbitrage opportunities by calculating cross rates

- Understand how to use equity index futures to hedge a position

- Describe the relationship between spot rates and forward rates

- Explain FRAs, STIRs, and IRS

- Understand currency futures, equity index futures, and interest rate futures

Who Should Take This Course?

This Equity, FX, and Rate Futures course is ideal for anyone looking to enhance their understanding of futures and forwards. It is designed to benefit students and professionals looking to begin a career in derivatives trading or for anyone interested in learning more about the space.

Equity, FX, and Rate Futures

Level 3

1h 8min

100% online and self-paced

Field of Study: Finance

Start LearningWhat you'll learn

Currency Futures Contracts

Equity Index Futures Contracts

Interest Rate Futures and Forward Contracts

Course Outro

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Capital Markets & Securities Analyst (CMSA®) Certification

- Skills Learned Trading strategies used in the finance and capital markets

- Career Prep Work in capital markets, whether on the buy-side or the sell-side