Overview

Evaluating a Business Plan Overview

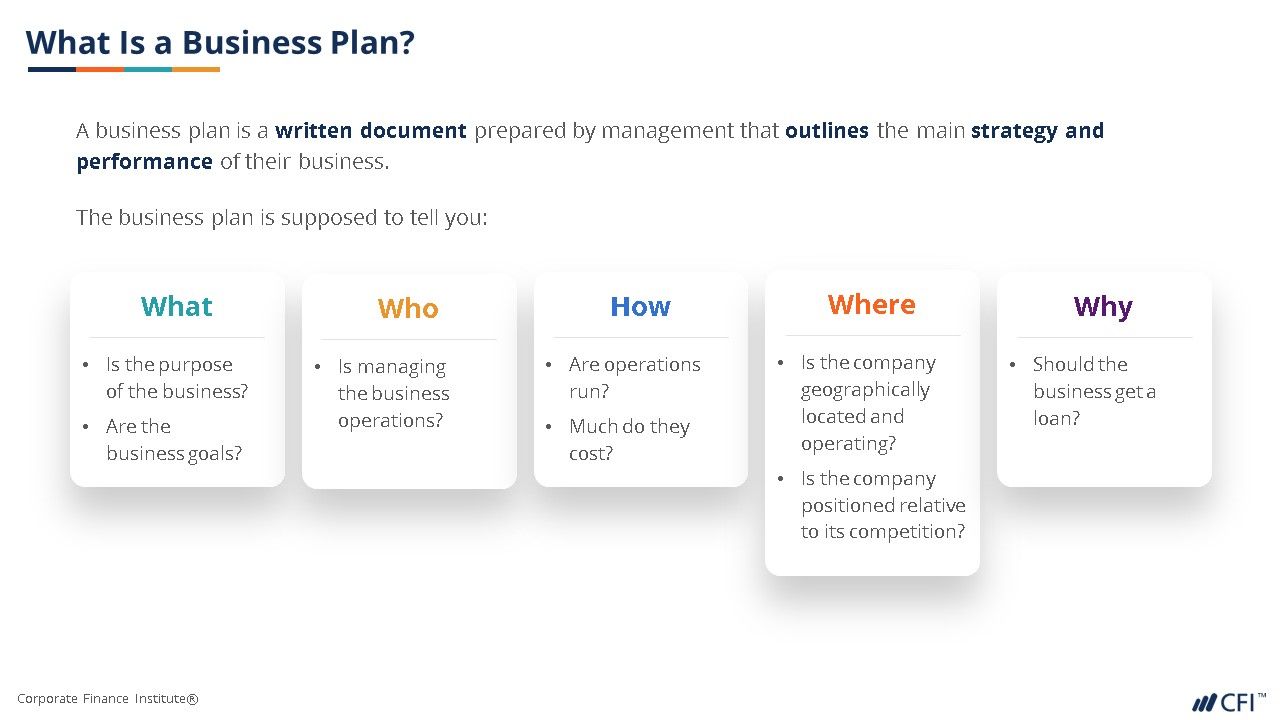

In the Evaluating a Business Plan course, we will provide key insights into the business plan development process and let students practice by working through a practical case study. The course will start by sharing an overview of the components which make up a business plan prior to delving into each element. At the end of each module, students can work through the relevant section of the case to further hone their knowledge of the topic. The various modules look at the development of business plan cover pages, executive summaries, company descriptions, management and operations (including management profiles and organizational charts), services or product lines, market analyses (including the competitive landscape and SWOT/PESTEL analyses), marketing and sales, financial management and projections (including key financial ratios), and appendices.

The various modules look at the development of business plan cover pages, executive summaries, company descriptions, management and operations (including management profiles and organizational charts), services or product lines, market analyses (including the competitive landscape and SWOT/PESTEL analyses), marketing and sales, financial management and projections (including key financial ratios), and appendices.

Evaluating a Business Plan Learning Objectives

Upon completing this course, you will be able to:- Understand how to develop a business plan

- Perform qualitative and quantitative analysis

- Explain crucial business plan concepts

- Learn how to evaluate the business plan of a company (case study)

Who should take this course?

The Evaluating a Business Plan course is perfect for any aspiring credit analyst working in insurance, underwriting, rating agencies, commercial lending, corporate credit analysis, and other areas of credit evaluation.Prerequisite Skills

Recommended skills to have before taking this course.

- Critical thinking

- Basic computer skills

- Excel

Evaluating a Business Plan

Level 2

1h 15min

100% online and self-paced

Field of Study: Finance

Start LearningWhat you'll learn

Course Introduction

Executive Summary & Funding Request

Appendices

Qualified Assessments

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Commercial Banking & Credit Analyst (CBCA®) Certification

- Skills Learned Financial Analysis, Credit Structuring, Risk Management

- Career Prep Commercial Banking, Credit Analyst, Private Lending