Overview

Financial Analysis for Credit Course Overview

This Financial Analysis for Credit course looks at the methods and techniques used by credit analysts and commercial bankers within the industry. This course will teach students how to conduct both horizontal and vertical analysis using ratio analysis to develop an understanding of a company’s financial standing. Additionally, students will learn how to perform industry benchmarking using information derived from the three financial statements to evaluate a company’s performance and what those numbers mean in the context of a lending scenario. This course provides a real-world perspective and takes a hands-on approach to outlining how a credit analyst or commercial banker should evaluate the liquidity, leverage, and coverage of a company. The practical exercises and methods explored in this course will be useful for any credit professional or financial analyst that wishes to work in commercial banking, business banking, lending, risk management, or underwriting.

Financial Analysis for Credit Learning Objectives

Upon completing this course, you will be able to:- Understand the components that go into financial analysis

- Calculate the key performance ratios that credit professionals use to assess a company’s profitability and efficiency

- Calculate the key financial ratios that credit professionals use to assess a company’s liquidity, leverage, and coverage

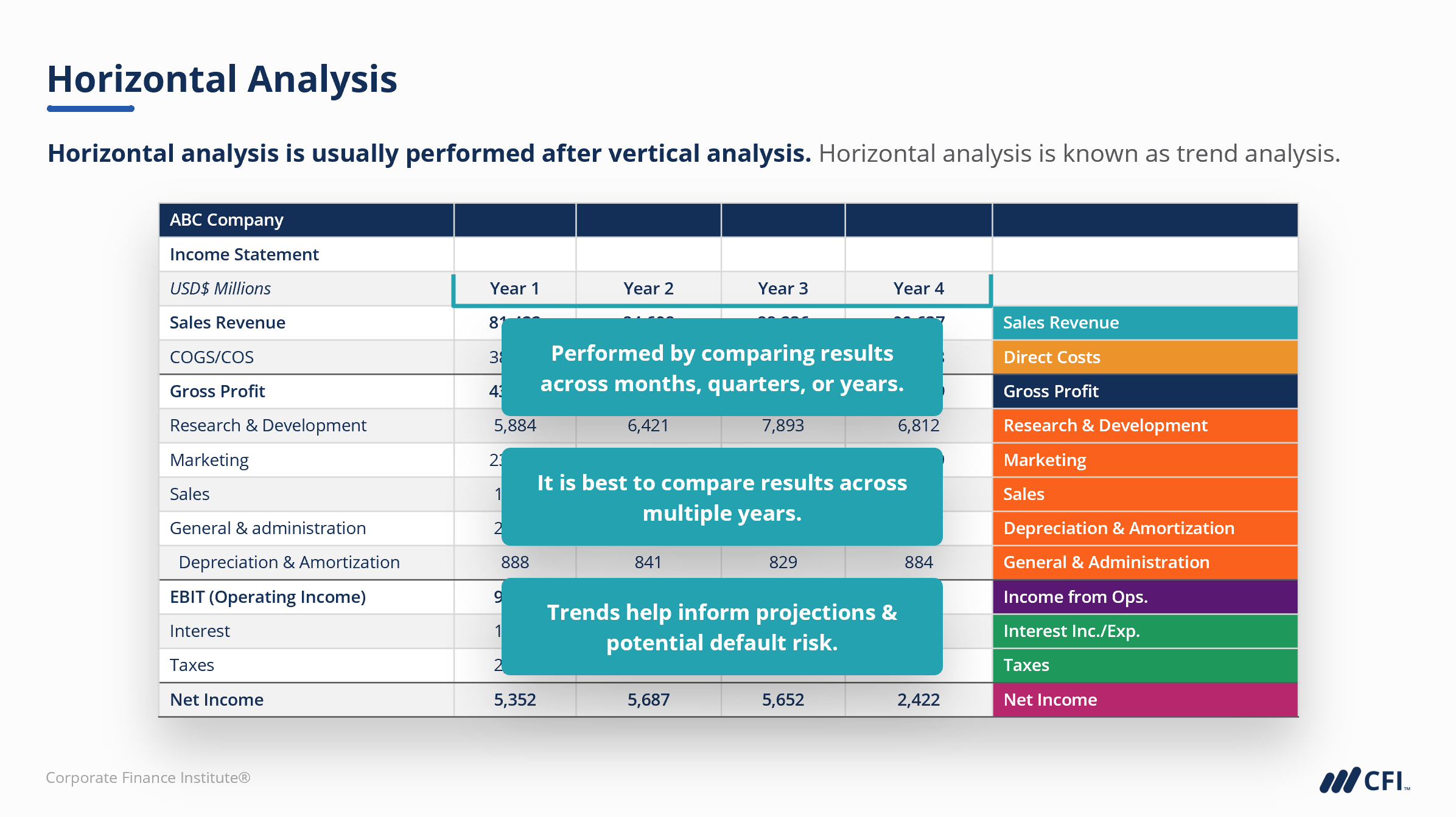

- Undertake a vertical analysis to determine profitability from the income statement and proportionality from the balance sheet

- Undertake horizontal analysis to spot trends and analyze their meaning

- Perform industry benchmarking

- Assess an organization, its competitive advantage, and its management team.

Who should take this course?

This Financial Analysis for Credit course is designed for current and aspiring credit analysts, lending professionals, risk management professionals, and commercial bankers seeking a more comprehensive understanding of financial analysis and its applications in the credit industry. This course provides an in-depth look at the different analysis techniques used by credit professionals within the industry. By providing students with the relevant methodologies used within the financial sector, this course aims to empower the skillsets of current and future banking professionals.

Prerequisite Skills

Recommended skills to have before taking this course.

- Critical thinking

- Basic Math

Financial Analysis for Credit

Level 3

2h 50min

100% online and self-paced

Field of Study: Finance

Start LearningWhat you'll learn

Vertical & Horizontal Analysis

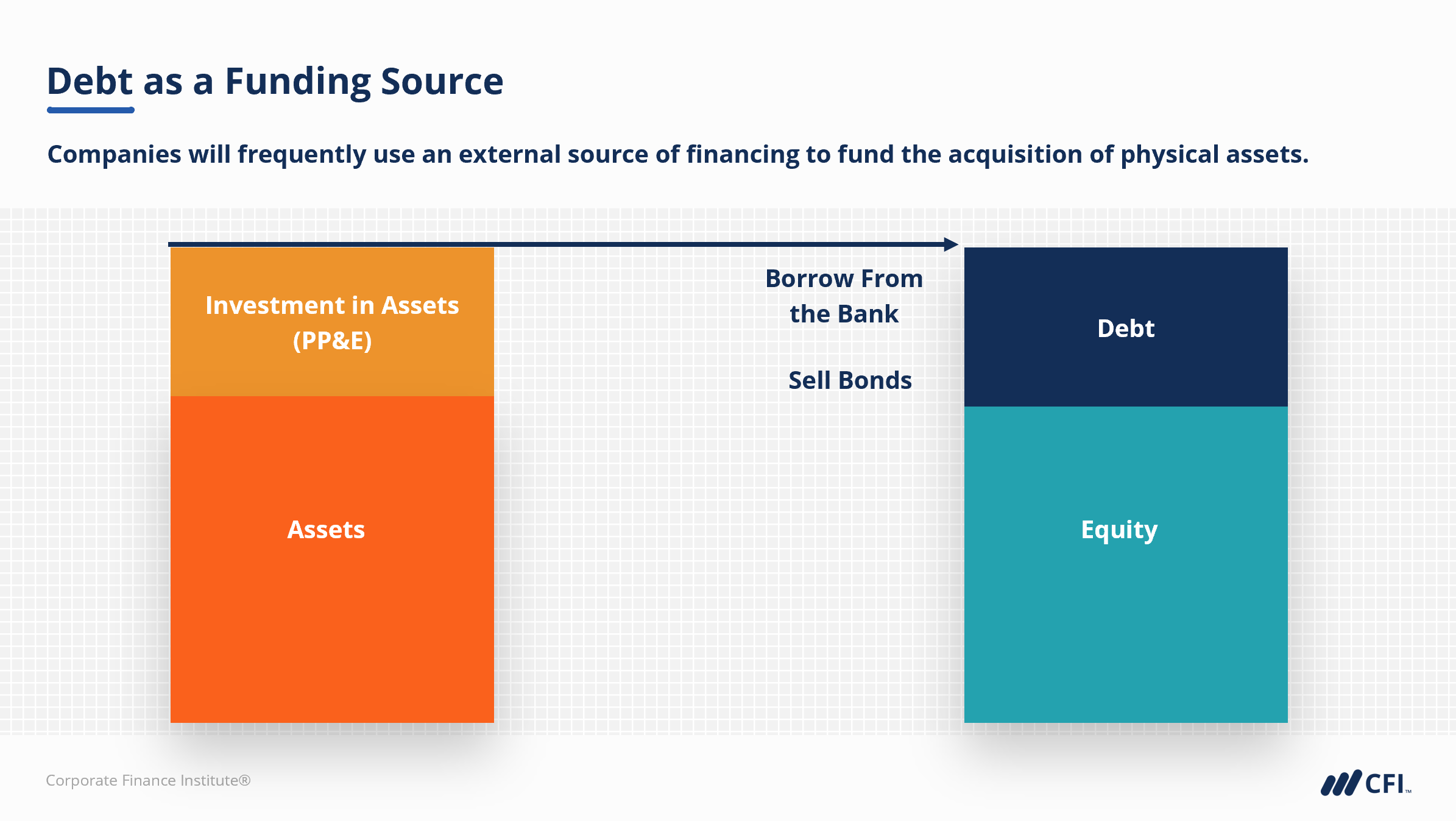

Leverage

Additional Credit Analysis Topics

Conclusion

Qualified Assessments

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Commercial Banking & Credit Analyst (CBCA®) Certification

- Skills Learned Financial Analysis, Credit Structuring, Risk Management

- Career Prep Commercial Banking, Credit Analyst, Private Lending