Overview

Recommended prep course

These preparatory courses are optional, but we recommend you complete the stated prep course(s) or possess the equivalent knowledge prior to enrolling in this course:Monthly cash flow modeling course overview

Monthly Cash Flow Modeling Course Objectives

Key Learning Objectives:- Apply a structured approach to monthly cash flow modeling in Excel

- Build up the assumptions and formulas required to forecast the business month by month

- Understand how to forecast the financial statements based on the business plan

- Caluclate the monthly cash flow

- Analyze the impact of the forecast on the company’s balance sheet and capitalization

- Output relevant graphs to illustrate the cash flow profile to management

Who should take this course?

This course is designed for finance professionals, analysts, and aspiring FP&A specialists seeking to enhance their skills in financial modeling and cash flow forecasting to advance their careers in corporate finance, financial planning, and strategic management.

Prerequisite Courses

Recommended courses to complete before taking this course.

Prerequisite Skills

Recommended skills to have before taking this course.

- Excel

- Financial modelling

- Financial accounting

Monthly Cash Flow Modeling

Level 3

1h 10min

100% online and self-paced

Field of Study: Finance

Start LearningWhat you'll learn

Financial Modeling Best Practices

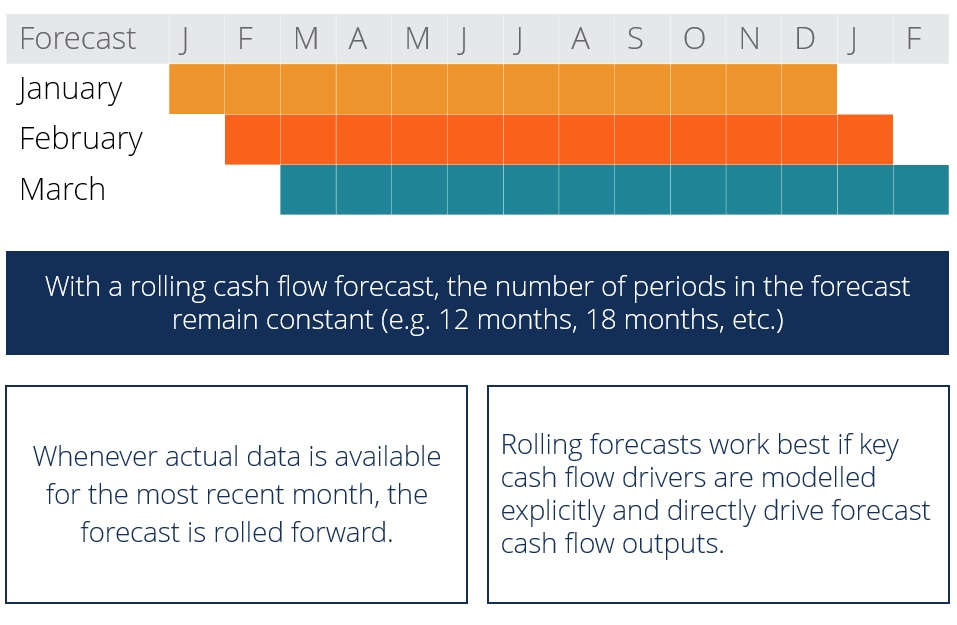

Modeling Cash Flows (Review)

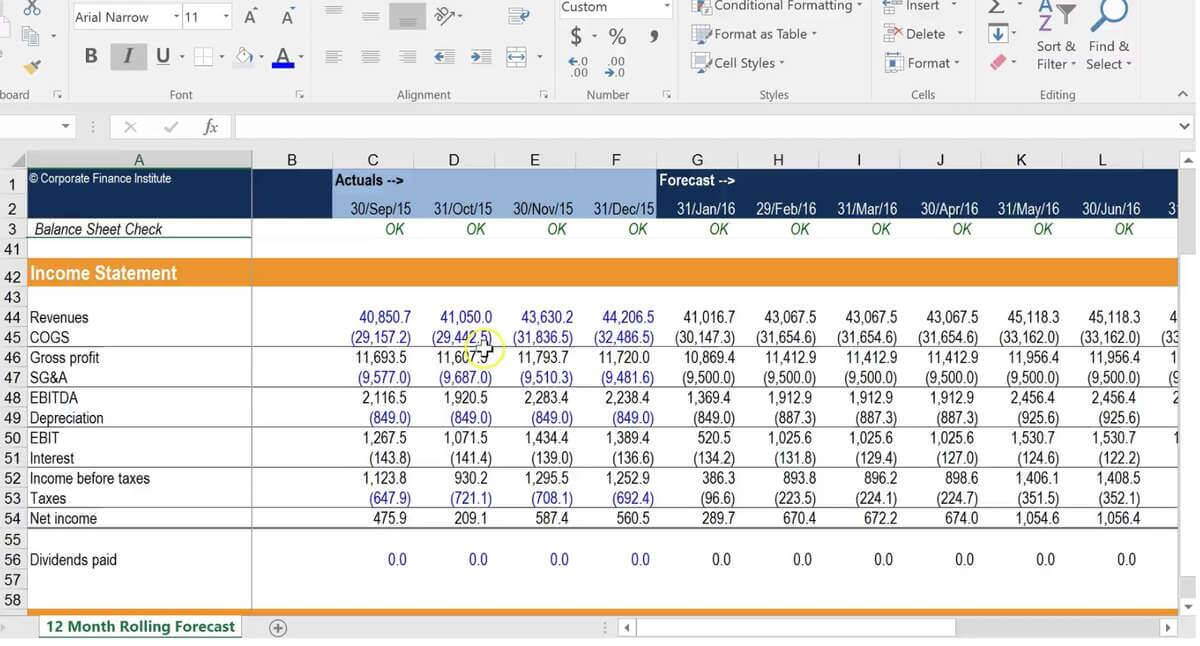

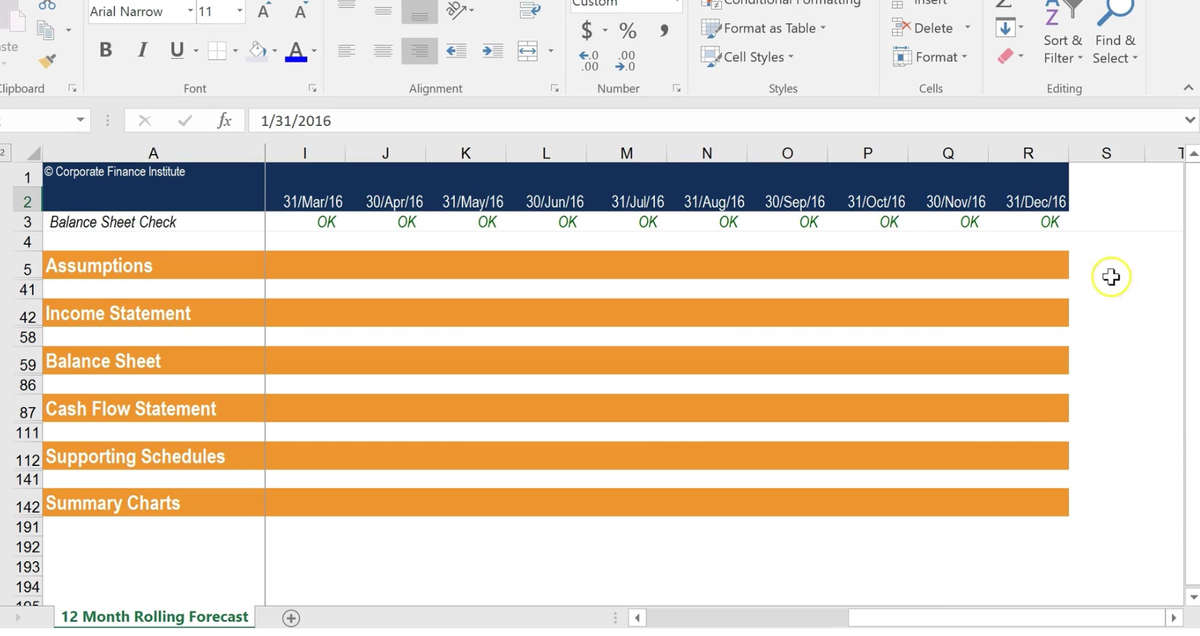

Building Your Financial Model in Excel

Final Product

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Financial Modeling & Valuation Analyst (FMVA®) Certification

- Skills Learned Financial modeling and valuation, sensitivity analysis, strategy

- Career Prep Investment banking and equity research, FP&A, corporate development

Commercial Banking & Credit Analyst (CBCA®) Certification

- Skills Learned Financial Analysis, Credit Structuring, Risk Management

- Career Prep Commercial Banking, Credit Analyst, Private Lending