Overview

How to Read a Lease and Analyze a Rent Roll Overview

Real estate leases are extremely important to understand, as the lease payments may become the primary source of repayment for any financing you may extend to the borrower.

This course explores the contents and key components of a typical lease. We will discuss different lease types and the key risk considerations. Then, we will learn to calculate lease rates and analyze the terms and conditions. We will also consider estoppel certificates. Finally, we will explore how to read and evaluate a rent roll.

How to Read a Lease and Analyze a Rent Roll Learning Objectives

- Upon completing this course, you will be able to:

- Outline the contents of a typical lease

- Analyze the key components of a lease

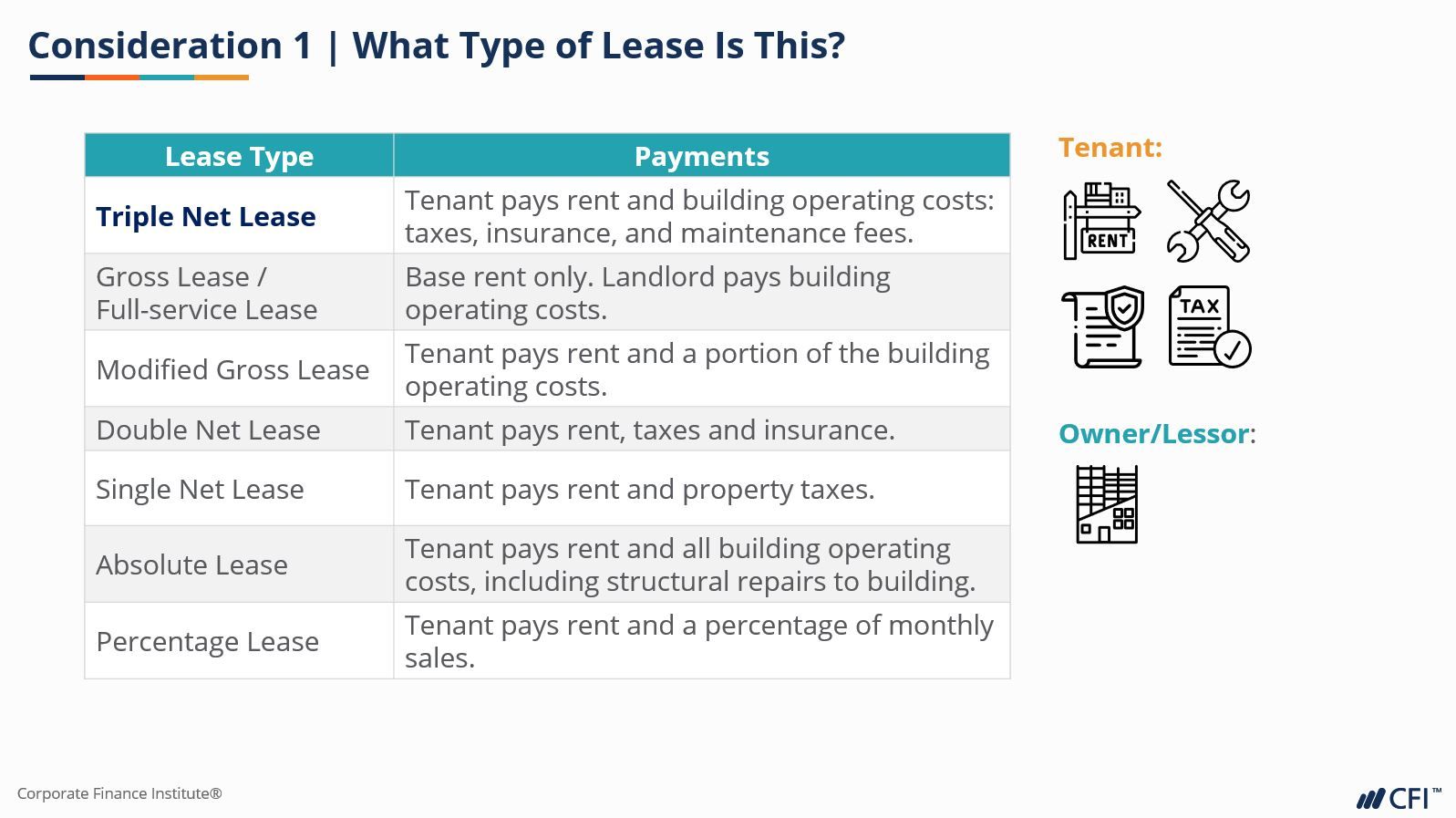

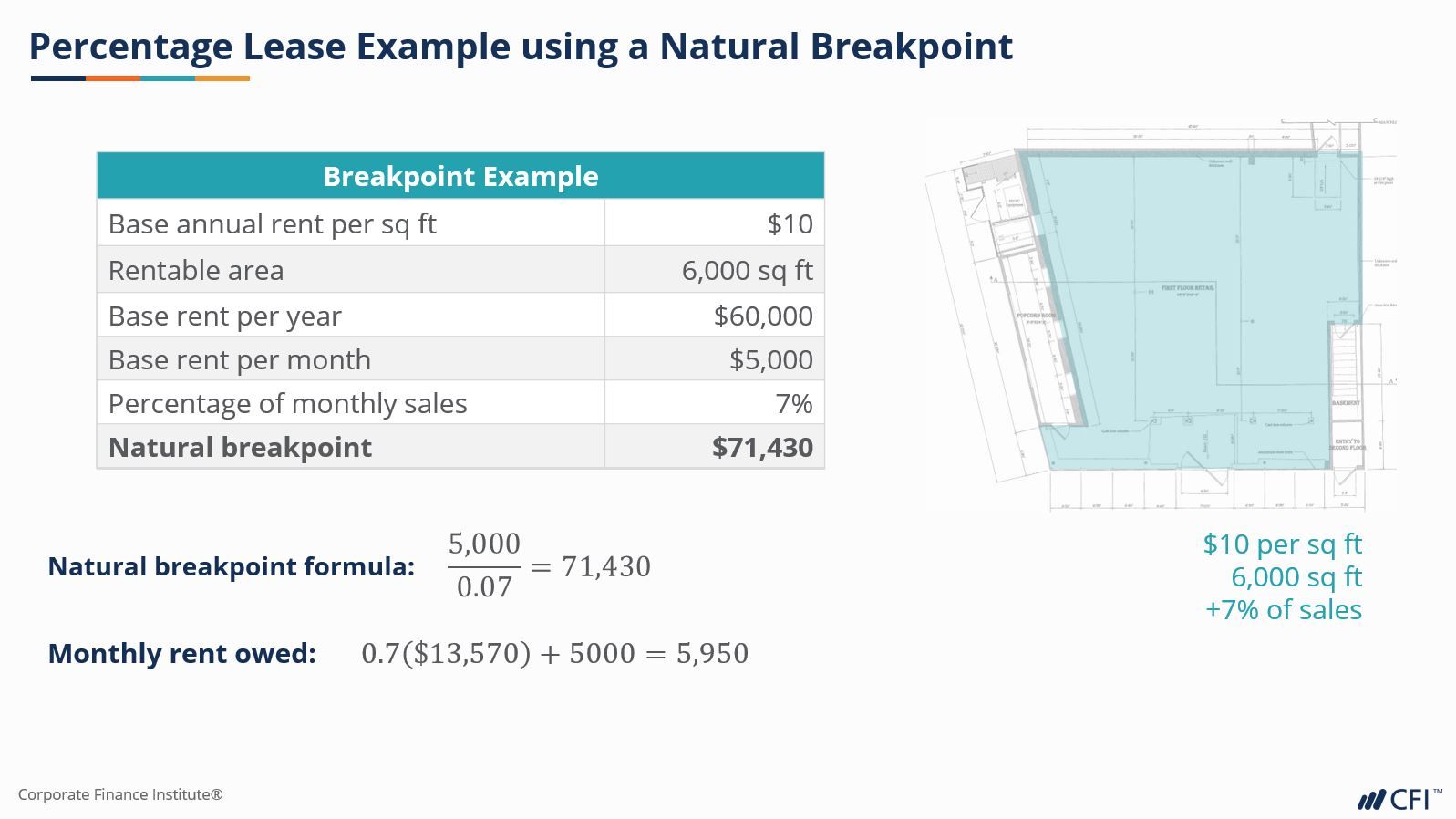

- Explore different lease types

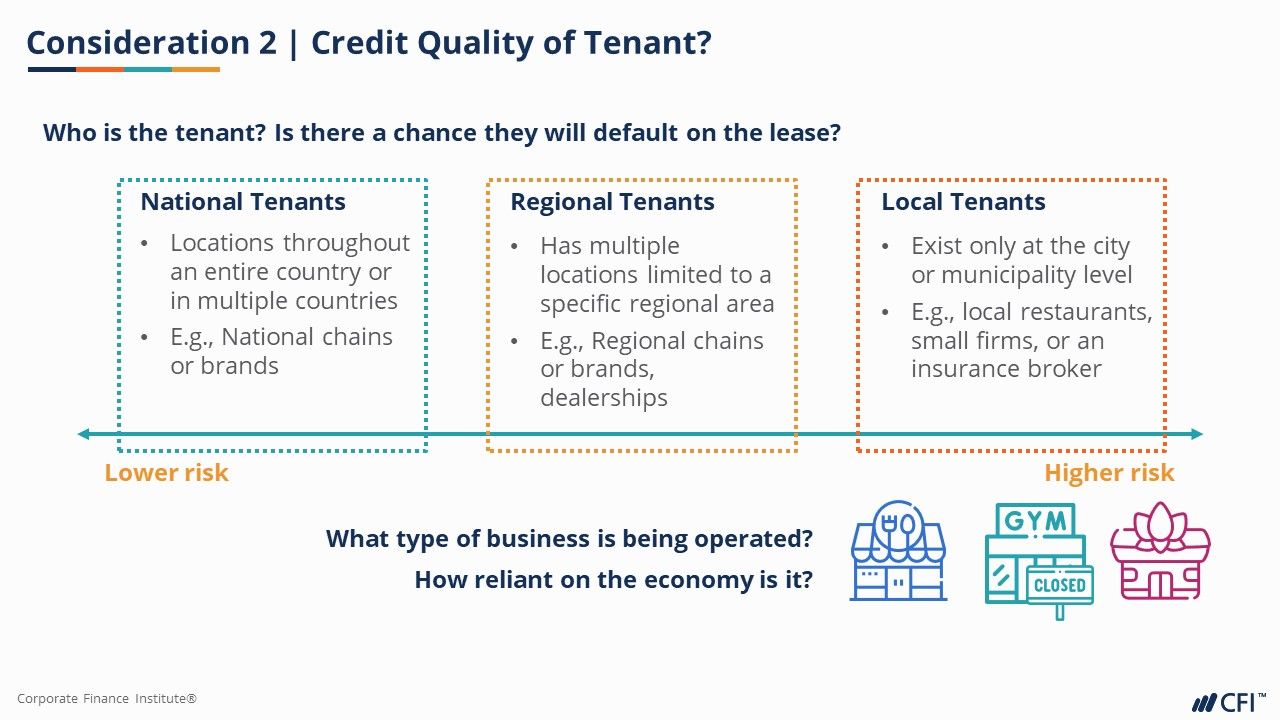

- Identify red flags in leases

- Read and analyze a rent roll

Who should take this course?

This How to Read a Lease & Analyze a Rent Roll course is perfect for any aspiring credit analyst who wants to make a career for themselves in the real estate lending sector. This course explores concepts useful for beginner and intermediate-level banking and real estate professionals or business and finance students seeking to better understand a key part of due diligence in making commercial real estate financing decisions.

The exercises and tools explored in this course will be useful for any financial analyst who wishes to work in credit analysis, commercial banking, and other areas of lending and credit evaluation.

Prerequisite Skills

Recommended skills to have before taking this course.

- Critical thinking

How to Read a Lease and Analyze a Rent Roll

Level 3

1h 22min

100% online and self-paced

Field of Study: Specialized Knowledge

Start LearningWhat you'll learn

Contents of a Real Estate Lease

Analyzing a Real Estate Lease

Estoppel Certificates

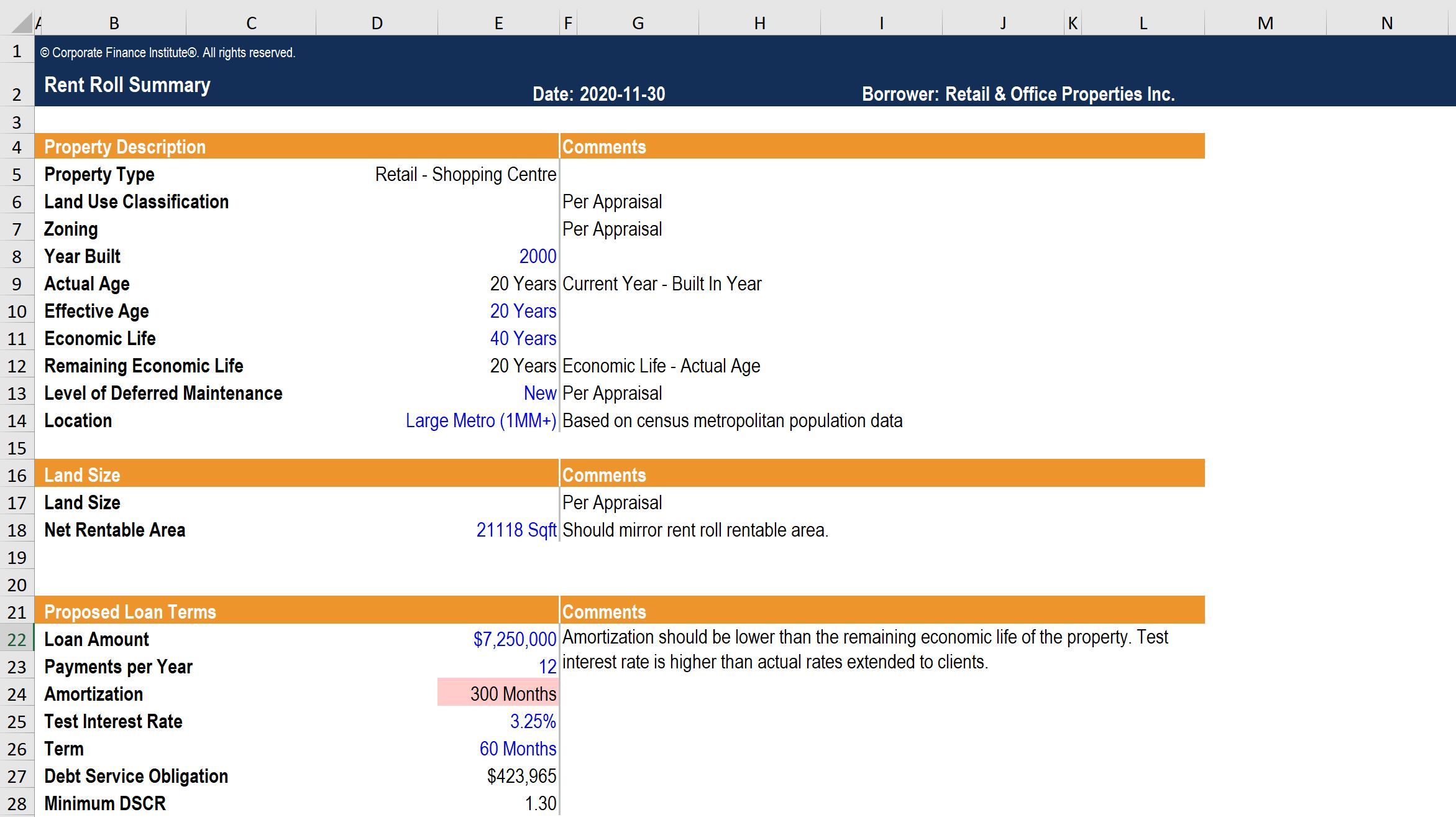

Evaluating a Rent Roll

Conclusion

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Commercial Real Estate Finance Specialization

- Skills Learned Real Estate Lending, Real Estate Financial Modeling, Construction Finance, Environmental Analysis and Due Diligence, Lease and Rent Roll Analysis

- Career Prep Credit Analysts, Risk Manager & Credit Adjudicator, Private Real Estate Lenders, Real Estate Investors and Advisors, Commercial Mortgage Brokers, Commercial Relationship Managers