Overview

Introduction to Banking Course Overview

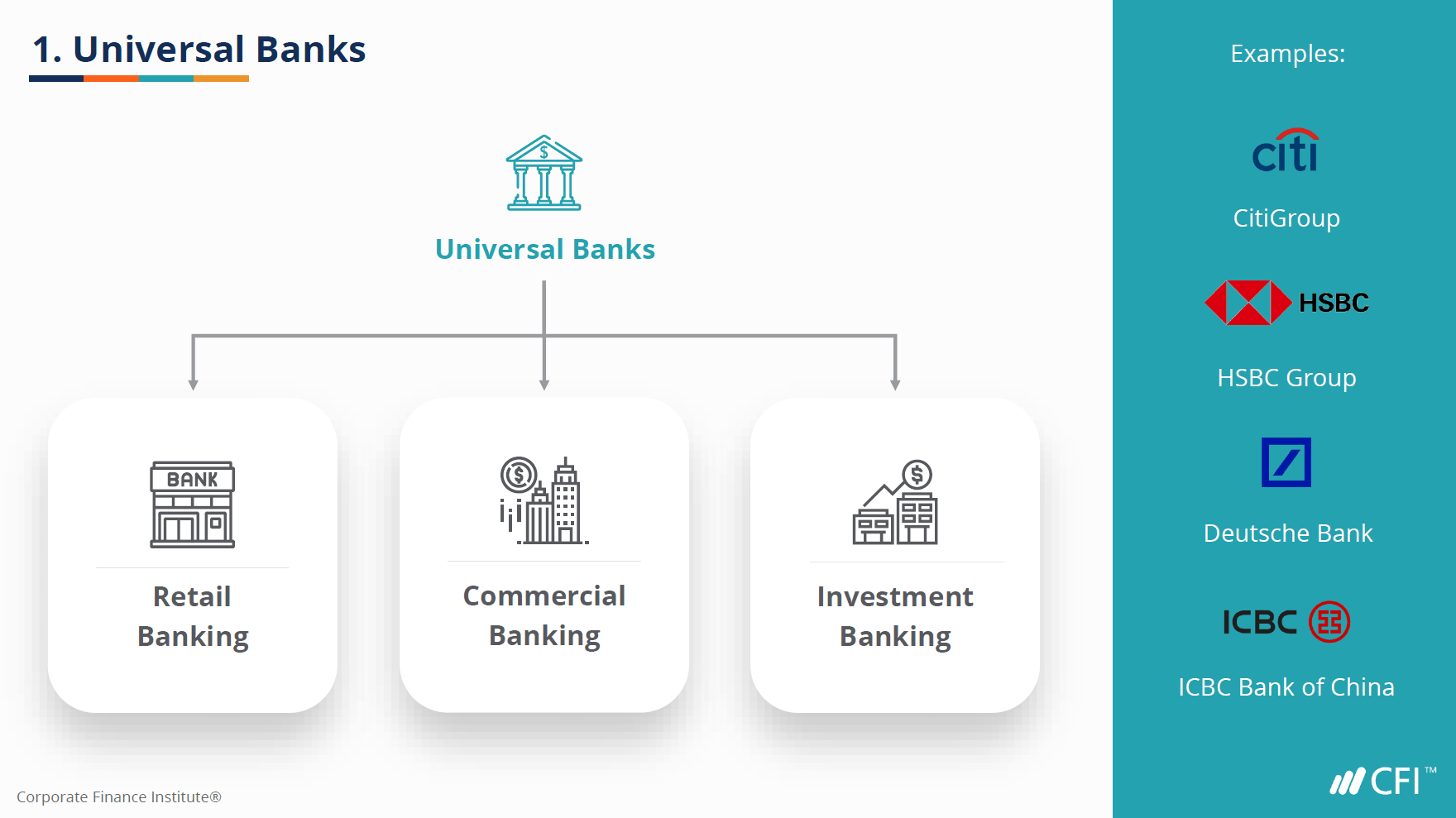

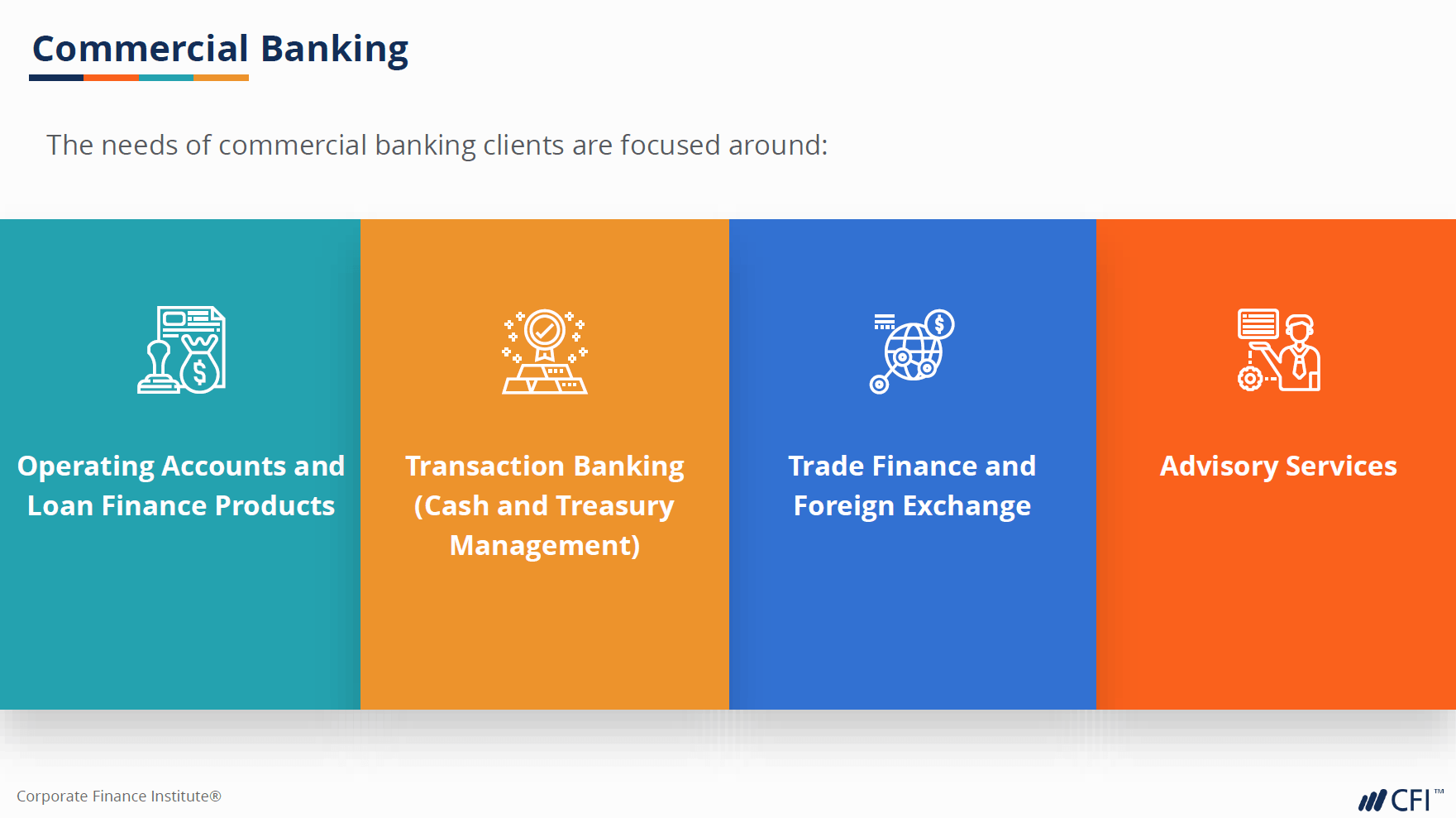

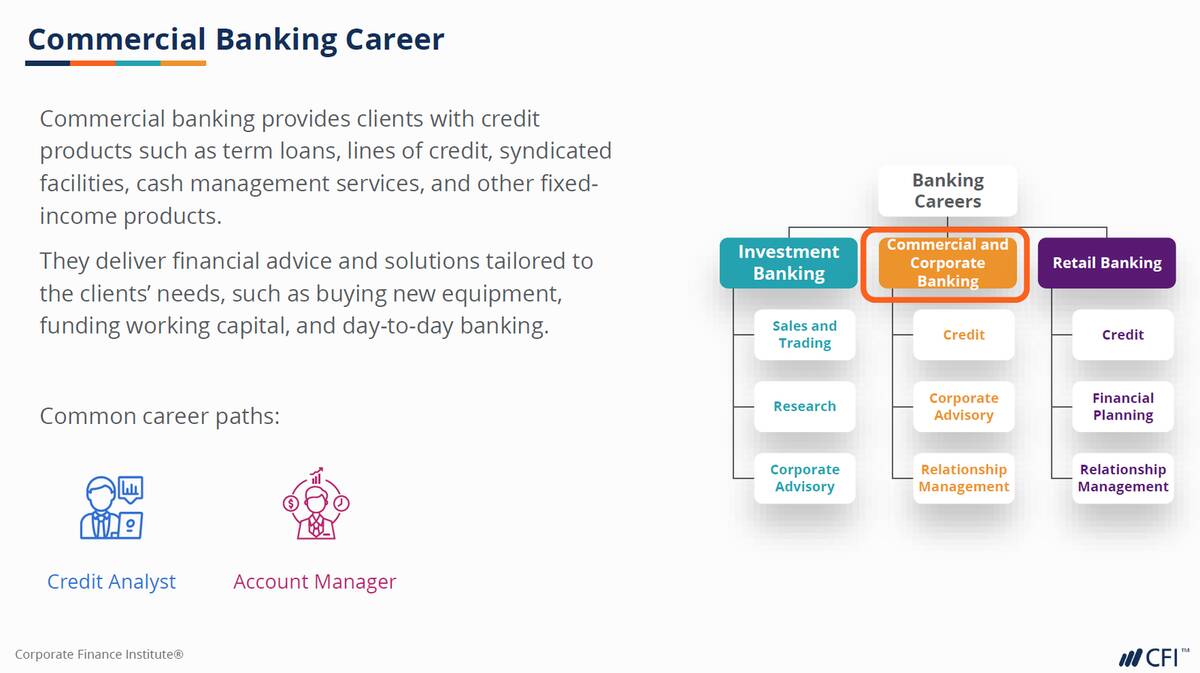

This Introductory course covers the fundamental knowledge about the banking industry. We will discuss the various types of financial institutions and how they differ in the types or products and services provided to their own customer groups. We can look at a bank’s balance sheet and income statement and understand how a bank generates return. Finally, we will explore the common career paths in different areas of banking.

Introduction to Banking Learning Objectives

Upon completing this course, you will be able to:- Understand the different types/structures of financial services firms

- Determine the different types of banking services that are provided

- Understand who the customers are for each type of service

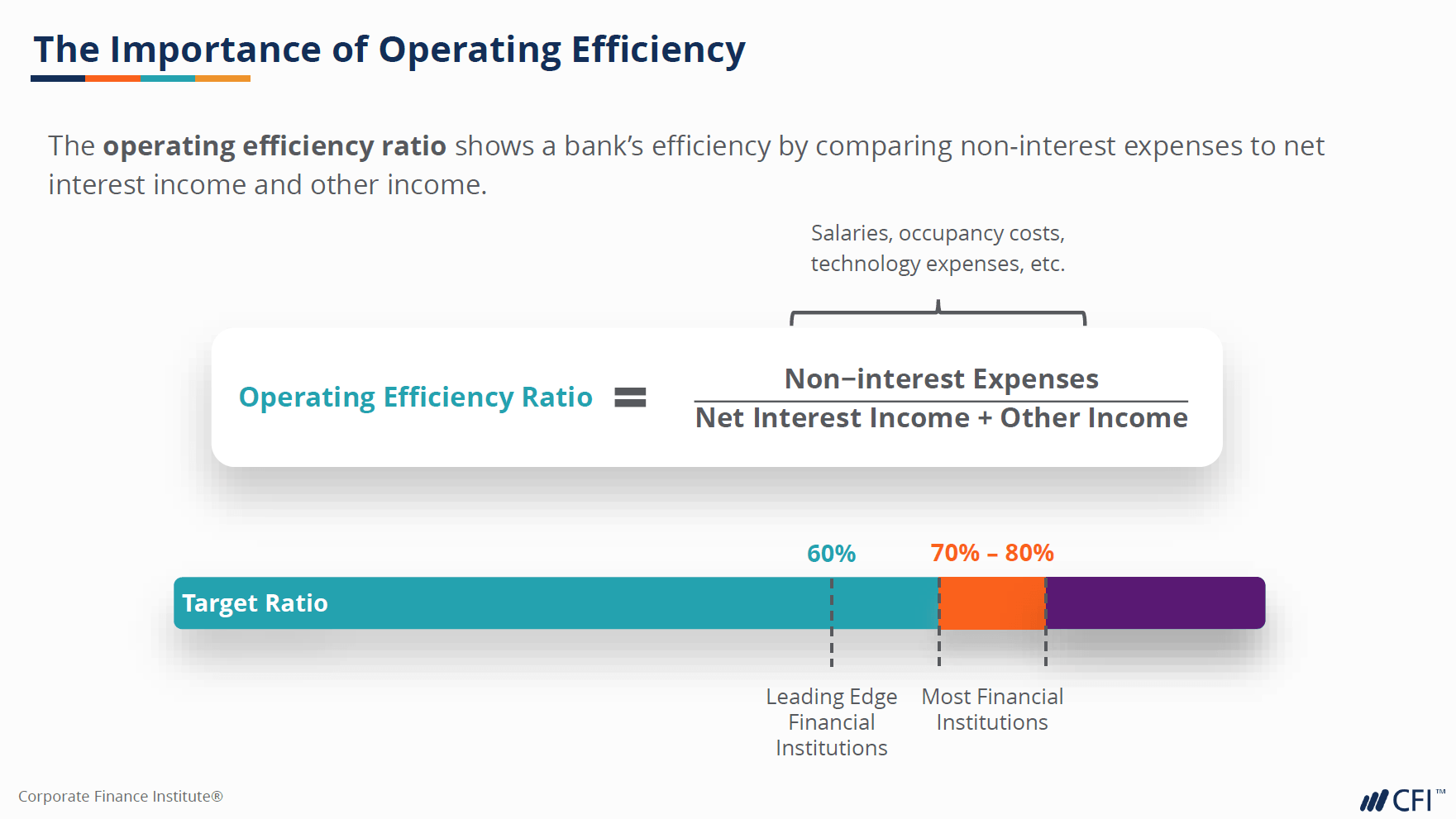

- Learn how a bank makes money

- Differentiate the various banking career paths

Who should take this course?

This Introduction to Banking course is perfect for any aspiring credit analysts working in insurance, underwriting, rating agencies, commercial lending, corporate credit analysis, and other areas of credit evaluation. It is also a great introductory course for anyone who would like to learn more about the banking industry.

Prerequisite Skills

Recommended skills to have before taking this course.

- Logical thinking

Introduction to Banking

Level 1

53min

100% online and self-paced

Field of Study: Finance

Start LearningWhat you'll learn

Categories and Types of Financial Institutions

Banking Services: What They Are and Who Uses Them

How Financial Institutions Generate Return

Course Summary

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Commercial Banking & Credit Analyst (CBCA®) Certification

- Skills Learned Financial Analysis, Credit Structuring, Risk Management

- Career Prep Commercial Banking, Credit Analyst, Private Lending

Risk Management Specialization

- Skills You’ll Gain Risk Identification, Regulatory Analysis, Risk Measurement, Risk Mitigation

- Great For: Market Risk Analyst, Credit Risk Analyst, Compliance Officer, consulting, Enterprise Risk Manager, Audit