Overview

Loan Default Prediction with Machine Learning Course Overview

Machine Learning is about making predictions using data. In this course, you’ll learn to use basic Machine Learning skills to predict which customers are likely to default on their loans.

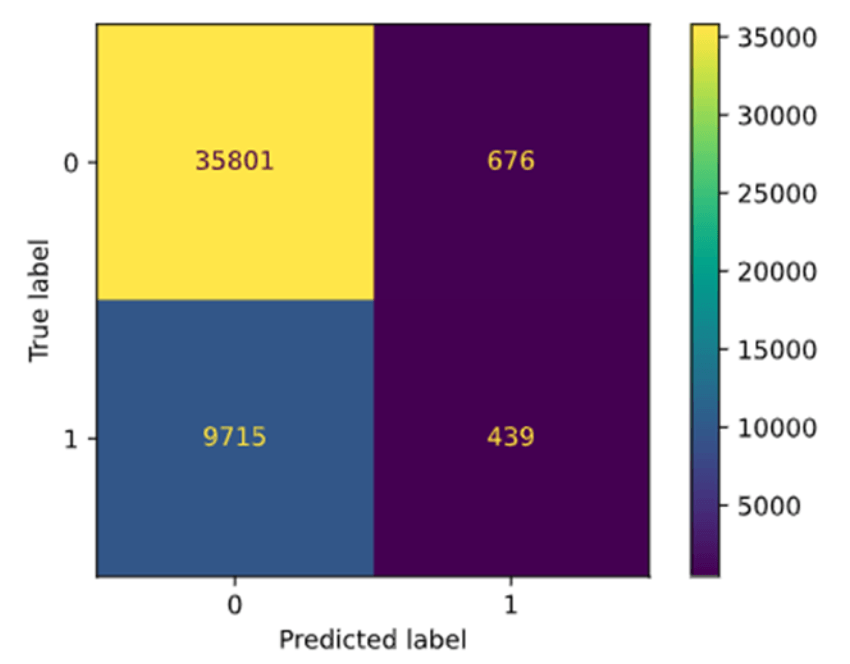

Once your model classifies each loan, you’ll learn to visualize your predictions to see how well the model performed.

Predicting defaults and creditworthiness is hugely valuable to risk management and pricing decisions.

We will cover the entire Machine Learning process in Python, reinforcing concepts from Python fundamentals. You’ll learn how to create predictive classification models, fine-tune and test your process, and how to interpret the results.

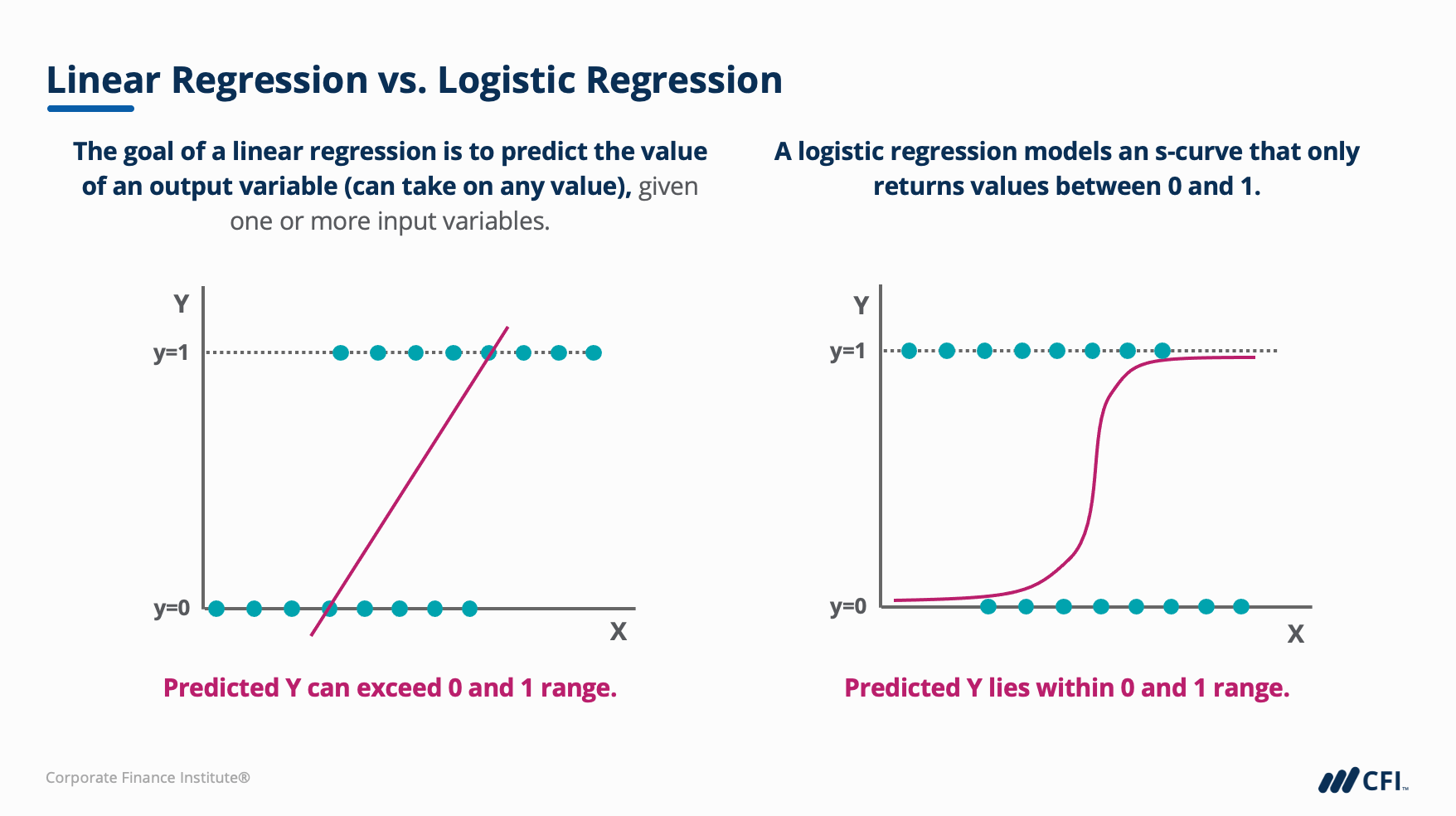

Machine Learning is a hot topic in the world of data, particularly data science. At a basic level, Machine Learning is not as complex as it may sound. If you’ve ever done linear regression, you may be surprised to learn that you’ve already taken steps toward this exciting world.

Join Andrew for a comprehensive step-by-step walkthrough of the Machine Learning process.

Loan Default Prediction with Machine Learning Objectives

Upon completing this course, you will be able to:- Explain and discuss the main steps of the Machine Learning cycle

- Load and clean data into a python notebook

- Use Exploratory Data Analysis to identify variables with likely predictive power

- Use Feature Engineering to transform data into a more useful format

- Build a logistic regression and random forest prediction model

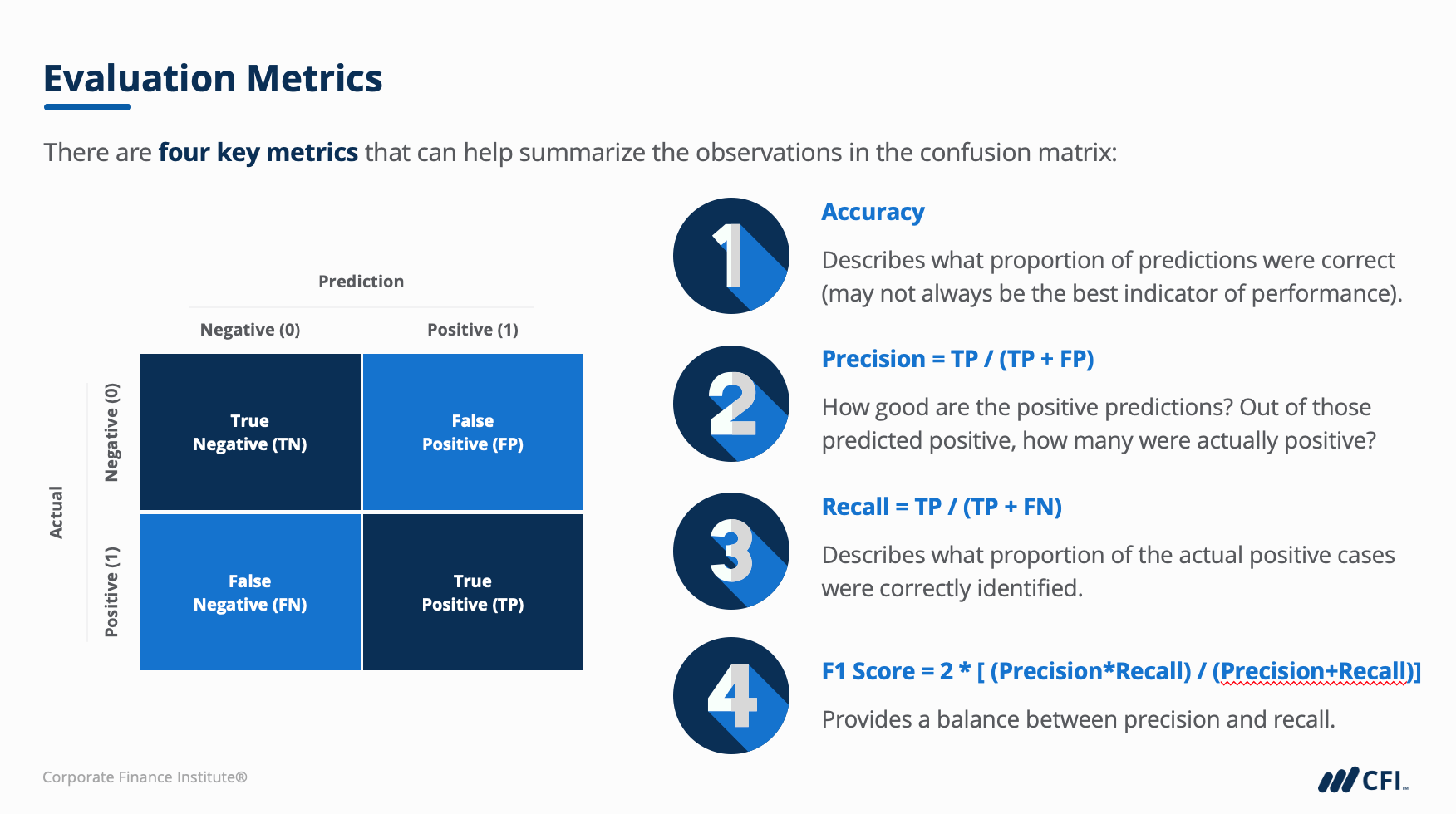

- Evaluate and compare model performance using common evaluation metrics

Who should take this course?

The Machine Learning cycle is one of the most foundational aspects of Data Science. Using this process, we can learn to make predictions using all types of data and variables. Anyone looking to make predictions in a practical Python environment should absolutely be doing this course.Prerequisite Courses

Recommended courses to complete before taking this course.

Loan Default Prediction with Machine Learning

Level 5

3h 56min

100% online and self-paced

Field of Study: Finance

Start LearningWhat you'll learn

Load & Clean Data

Exploratory Data Analysis

Classification with Logistic Regression

Model Evaluation

Classification with Random Forest

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

FinTech Industry Professional (FTIP®)

- Skills Learned Financial Technology Fundamentals, Data Science and Machine Learning, Cryptocurrencies and Blockchain

- Career Prep Data Science and Machine Learning, Data Analyst, Business Analyst, Software Developer