Overview

Loan Pricing Course Overview

This Loan Pricing course looks at the fundamentals and factors banks consider when pricing a loan. We will examine how interest rates, loan structures, and different characteristics of a loan can affect the loan’s pricing. This Loan Pricing course will also explore how a bank earns revenue and what affects its profitability. This course will include an interactive case study that shows you a practical demonstration using a risk rating and profitability model in Excel. We will also cover different levers that a credit analyst can use during client negotiations and how they can affect the pricing and profitability of a loan.

Loan Pricing Learning Objectives

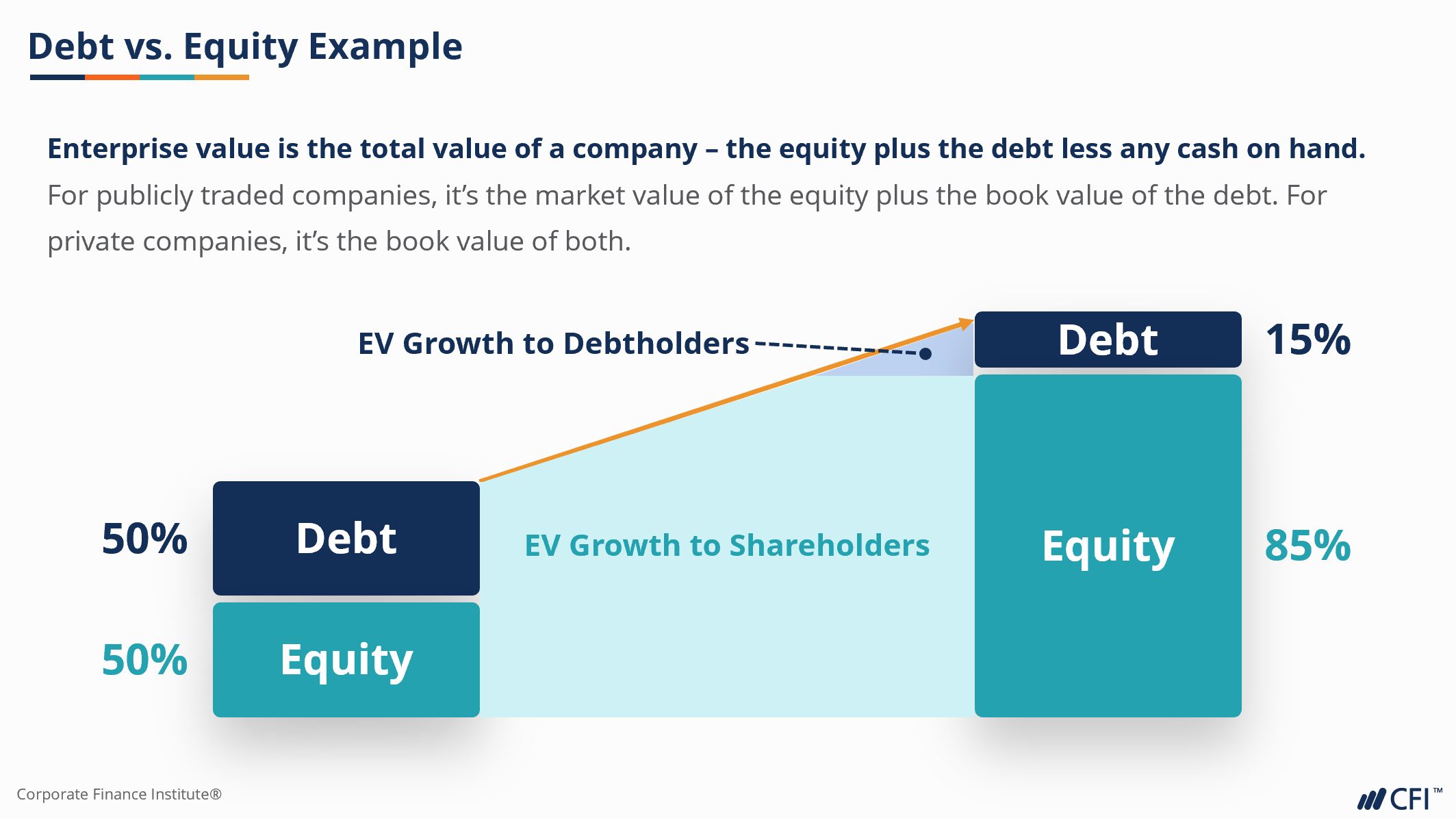

Upon completing this course, you will be able to:- Explain debt as a funding source, its pros, and its cons

- Identify loan types and their relative degree of profitability

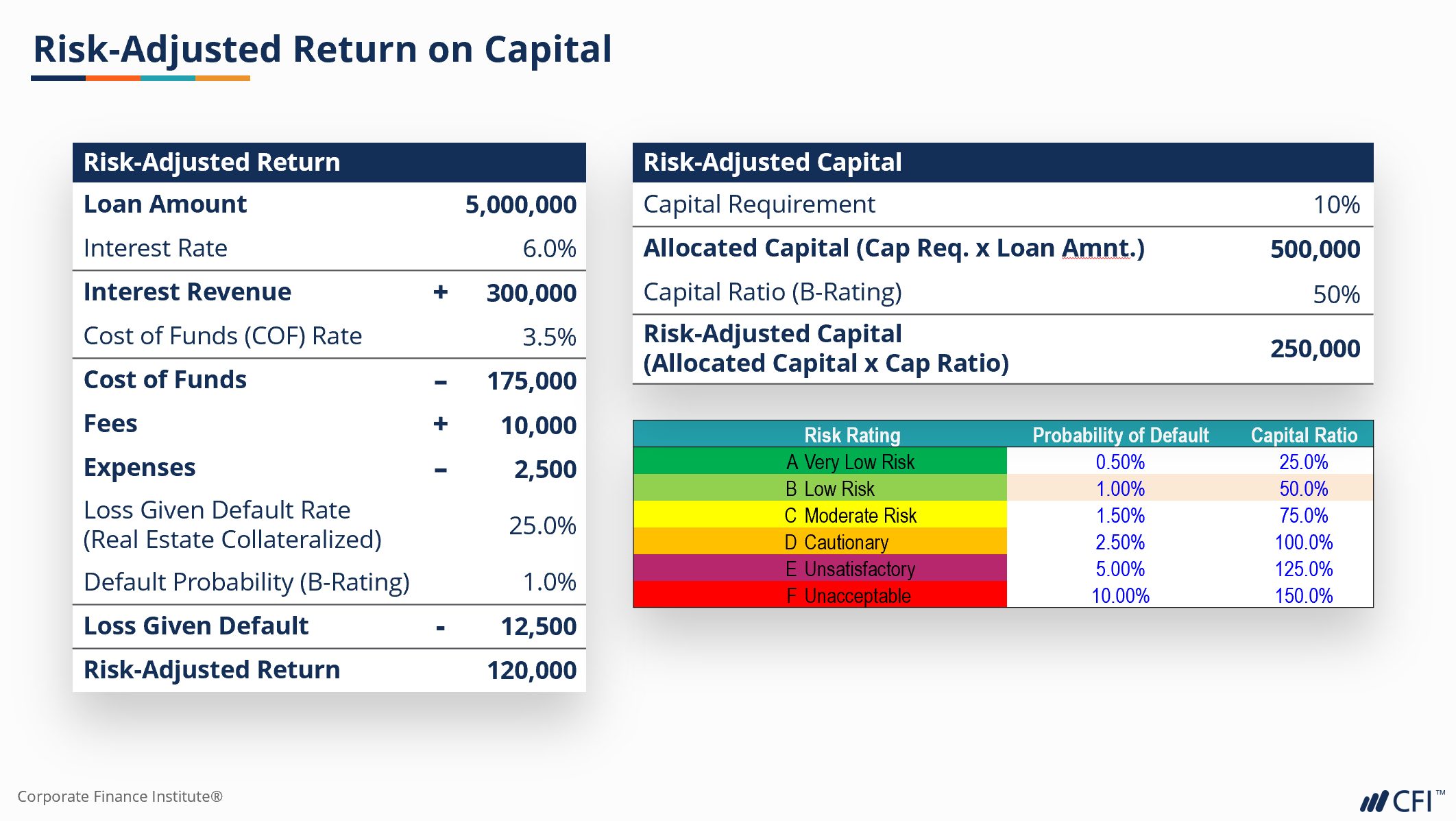

- Define risk-adjusted return, and risk-adjusted return on capital

- Calculate and interpret an example risk rating

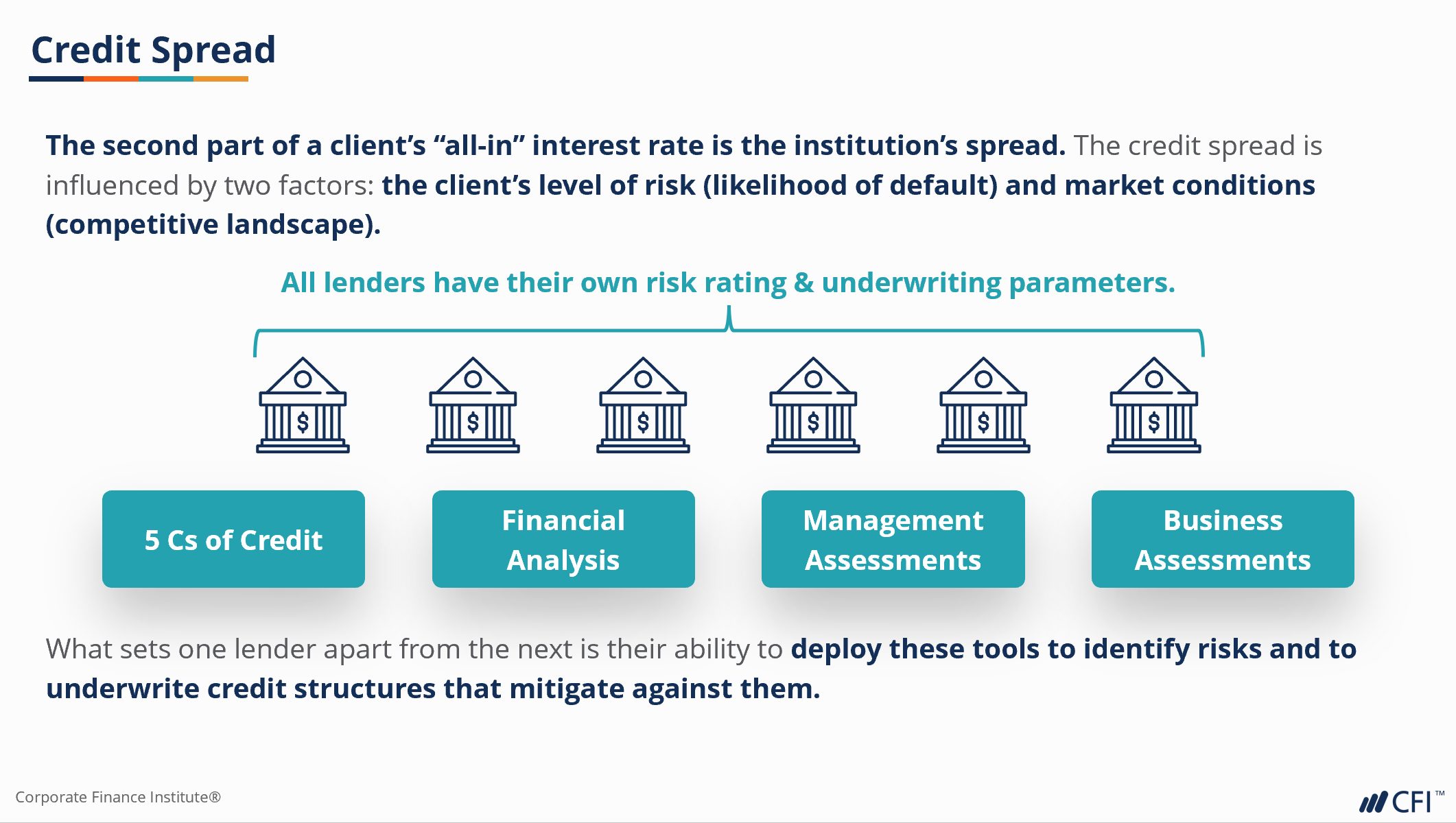

- Recommend pricing structures based on risk rating and loan type

Who should take this course?

This Loan Pricing course is designed for current and aspiring Commercial Banking and lending professionals, including Relationship Managers, Credit Analysts, and Risk Management professionals seeking a more comprehensive understanding of loan pricing and profitability. This course provides a real-world perspective and a hands-on case study outlining how a financial institution would evaluate a client’s default risk and how they might structure borrowing accordingly to optimize risk-adjusted return on capital. The practical exercises, case study, and tools explored in this course will be useful for any credit professional or financial analyst that wishes to work in private lending, business banking, commercial banking, or corporate banking.Prerequisite Courses

Recommended courses to complete before taking this course.

Prerequisite Skills

Recommended skills to have before taking this course.

- Critical thinking

- Basic Math

- Excel

Loan Pricing

Level 4

1h 47min

100% online and self-paced

Field of Study: Finance

Start LearningWhat you'll learn

Introduction

Revenue & Profitability

Conclusion

Qualified Assessments

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Commercial Banking & Credit Analyst (CBCA®) Certification

- Skills Learned Financial Analysis, Credit Structuring, Risk Management

- Career Prep Commercial Banking, Credit Analyst, Private Lending