Overview

Recommended Prep Courses

These preparatory courses are optional, but we recommend you to complete the stated prep course(s) or possess the equivalent knowledge prior to enrolling in this course:Mining Financial Modeling & Valuation Course Overview

Master the art of building a financial model to value a mining company, complete with assumptions, financials, valuation, sensitivity analysis, and output charts. In this mining financial modeling course, we will work through a case study of a real mining valuation for an asset by pulling information from the Feasibility Study, inputting it into Excel, building a forecast, and valuing the asset.

Mining Financial Modeling & Valuation Course Objectives

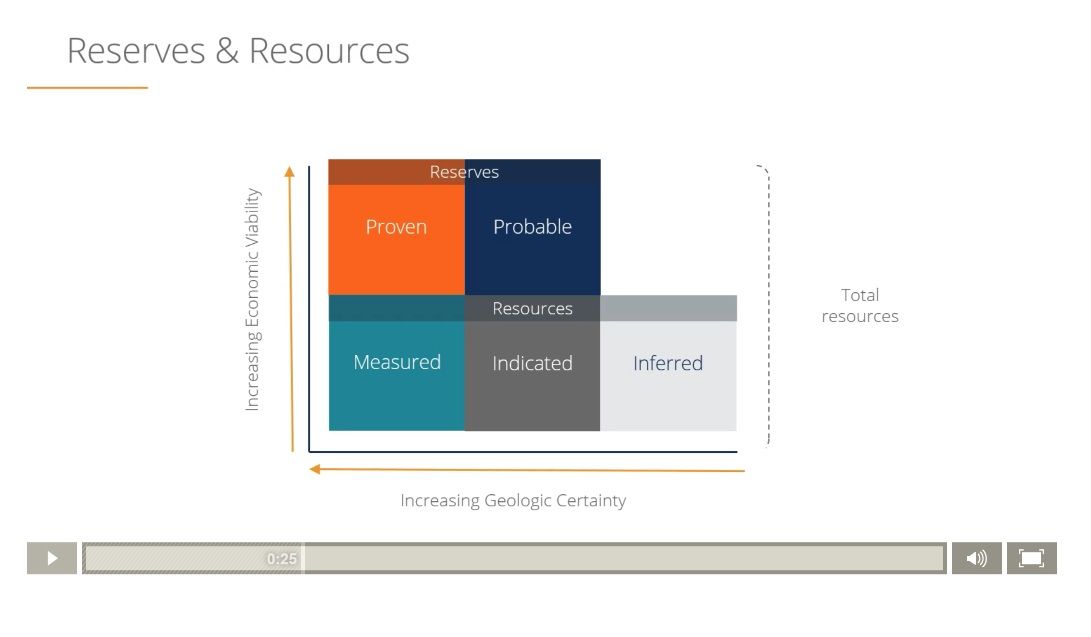

By the end of this mining valuation course you will be able to:- Understand key mining terms and definitions used in the industry and in valuation

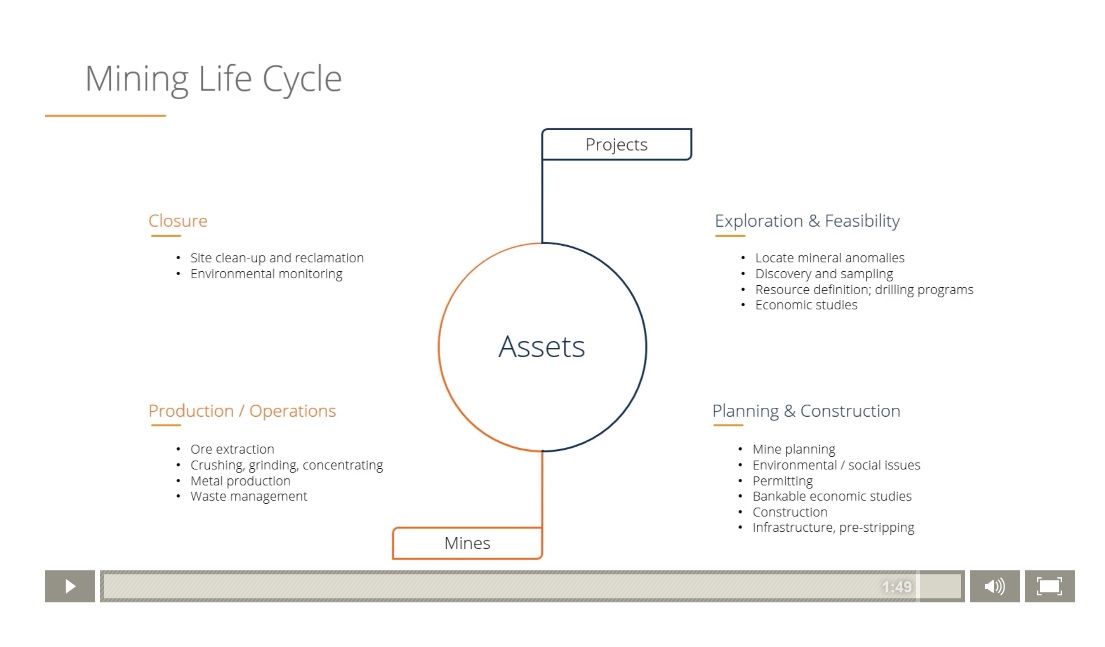

- Understand the mining life cycle from start to finish for assets, projects, and operating mines

- Read and extract the important information from a mining technical report (feasibility study)

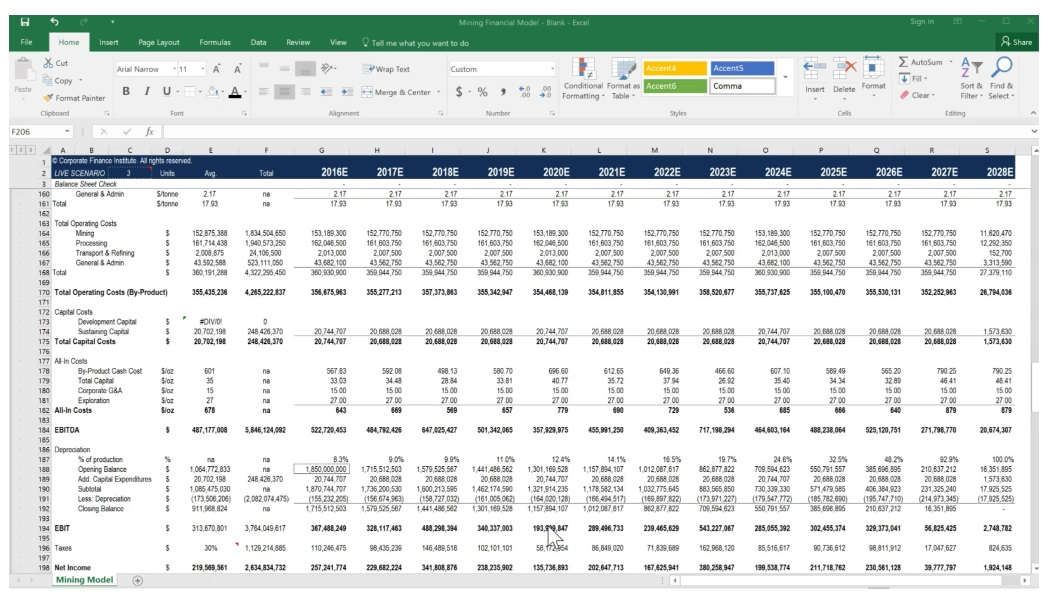

- Input key assumptions into a financial model that will drive revenue, expenses, and cash flow in the forecast

- Calculate production statistics based on a detailed mine plan from the technical report

- Build financial statements based on the mine plan

- Perform a discounted cash flow DCF valuation of the mining asset in Excel

- Build sensitivity analysis to test for different input assumptions

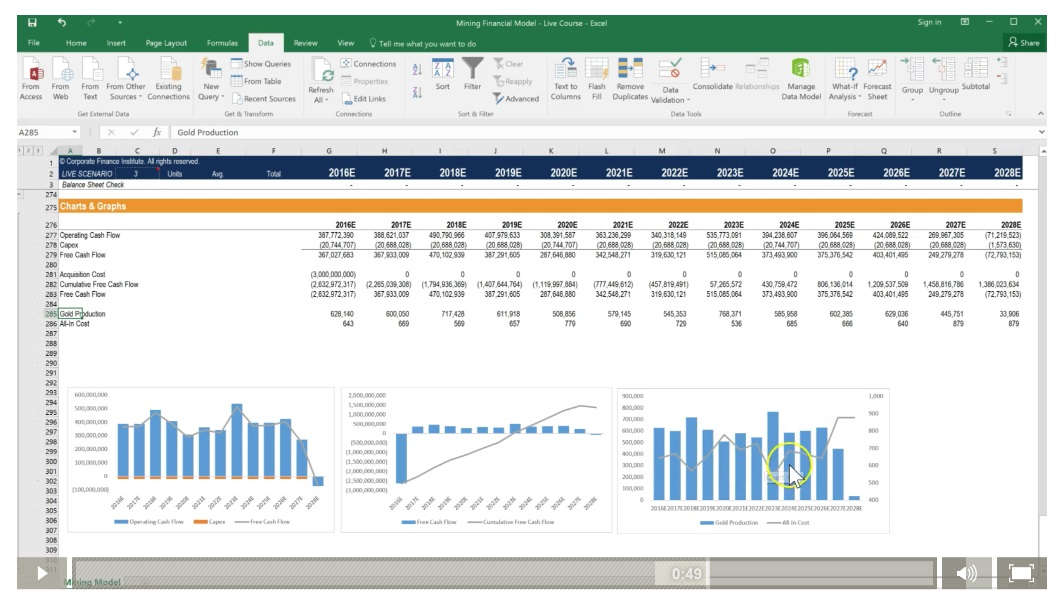

- Output relevant graphs and charts to illustrate the investment opportunity

- Understand valuation methods such as Net Asset Value (NAV), P/NAV, P/CF, Total Acquisition Cost (TAC)

Who should take this mining valuation course?

Master mining valuation and learn how to value a mining company in Excel. This course is designed for professionals seeking careers in investment banking, equity research, corporate development and financial planning an analysis (FP&A). This course simulates the experience of working as a corporate development professional at a mining company evaluating an acquisition opportunity. The objective is to take all the information from the technical study, put it into Excel, and determine the net asset value (NAV) of the mine. The completed model will serve as a useful tool for testing different metal prices and other assumptions such as grade, recovery rate, unit operating costs, capital expenditures, and more.

Prep Courses

This is an advanced mining valuation course and assumes a solid understanding of the following courses:- Excel Crash Course

- Building a Financial Model in in Excel

- Business Valuation

Prerequisite Courses

Recommended courses to complete before taking this course.

Prerequisite Skills

Recommended skills to have before taking this course.

- Excel

- Valuation

- Financial modelling

Mining Financial Model & Valuation

Level 4

1h 40min

100% online and self-paced

Field of Study: Finance

Start LearningWhat you'll learn

Introduction to the Mining Industry

Financial Model - Mining Section

Financial Model - Financial Statement Section

Financial Model - DCF Valuation

Sensitivity Analysis

Summary Charts & Graphs

Completed Model & Case Study

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Financial Modeling & Valuation Analyst (FMVA®) Certification

- Skills Learned Financial modeling and valuation, sensitivity analysis, strategy

- Career Prep Investment banking and equity research, FP&A, corporate development