Overview

Structuring a Construction Loan Course Overview

This construction loan course dives into the factors that affect the structure of a loan for construction and real estate development. In this course, we break down the line items of a construction budget and proforma. We then look at how to calculate the interest expense and maximum loan amount on the construction loan by examining the timing of spend of different line items from the construction budget. We also examine quantitative and qualitative terms in the term sheet and how they affect the structure of the construction loan. Finally, this course builds out different construction development scenarios and looks at how loan repayment works in all these scenarios.

Structuring a Construction Loan Learning Objectives

Upon completing this course, you will be able to:- Understand the line items in a developer’s budget and derive a risk-assessed loan-to-cost

- Review development and construction cash flows to calculate interest and financing fee values and funding mechanisms

- Determine how the price of debt ties into the budget and project evaluation

- Appreciate how qualitative loan terms can impact loan-to-cost and interest rates

- Calculate various take-out scenarios

- Examine how mezzanine debt and promote structures may fit into the total project assessment

Who should take this course?

This course is designed for current and aspiring Commercial Banking professionals in construction and real estate development. This course is also a great resource for real estate analysts and commercial mortgage brokers who wish to deepen their understanding of how construction loans are structured. By diving deeper into the lender’s perspective when structuring a loan, this course provides valuable insights for lenders, as well as brokers and advisors.

Prerequisite Courses

Recommended courses to complete before taking this course.

Structuring a Construction Loan

Level 3

1h 4min

100% online and self-paced

Field of Study: Specialized Knowledge

Start LearningWhat you'll learn

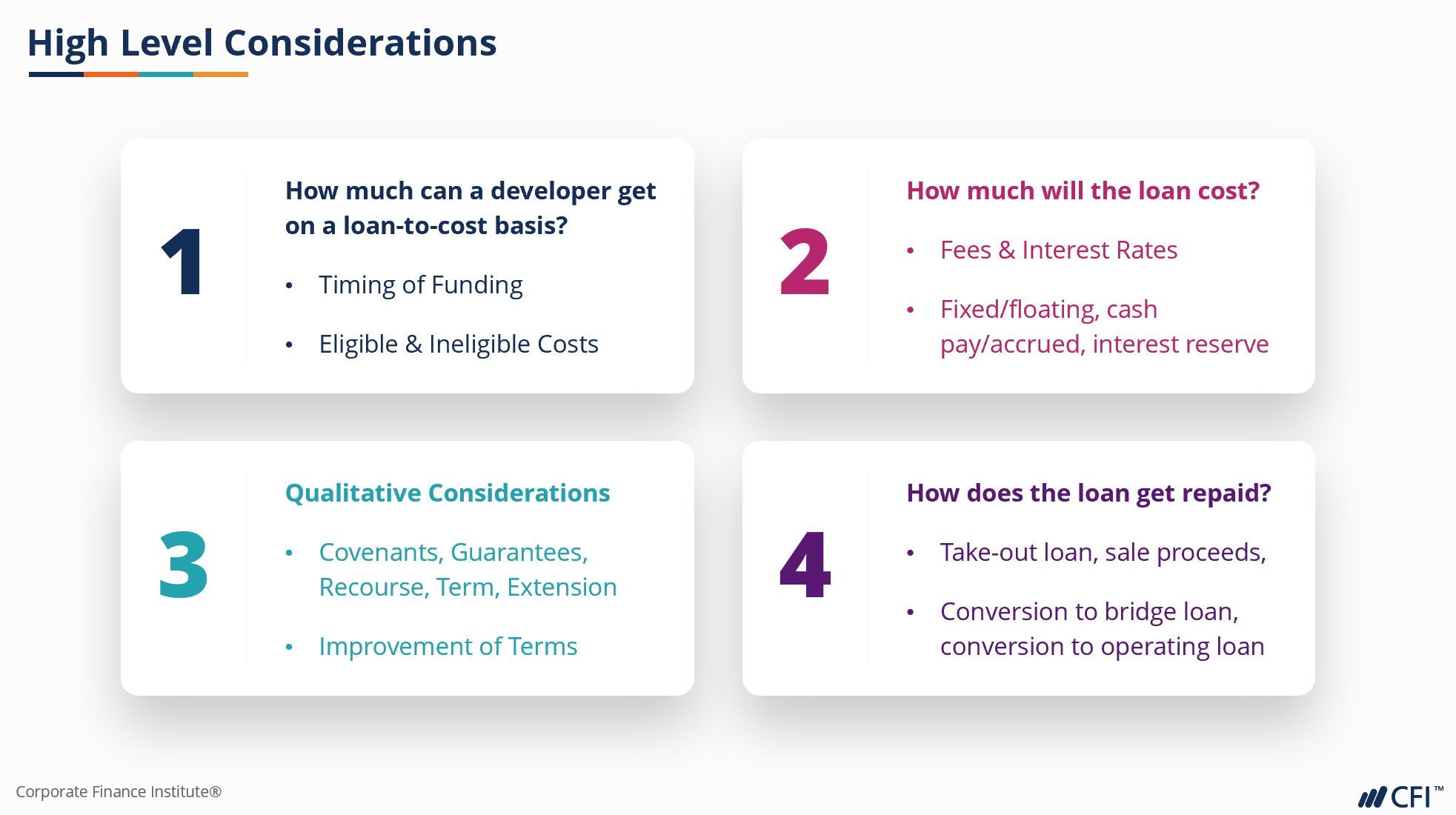

Reaching Loan-to-Cost

Quantitative Terms in the Term Sheet

Qualitative Terms in the Term Sheet

Construction Loan Repayment

Final Considerations

Conclusion

Qualified Assessments

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Commercial Real Estate Finance Specialization

- Skills Learned Real Estate Lending, Real Estate Financial Modeling, Construction Finance, Environmental Analysis and Due Diligence, Lease and Rent Roll Analysis

- Career Prep Credit Analysts, Risk Manager & Credit Adjudicator, Private Real Estate Lenders, Real Estate Investors and Advisors, Commercial Mortgage Brokers, Commercial Relationship Managers