Overview

Recommended Prerequisites

These preparatory courses are optional, but we recommend you to complete the stated prep course(s) or possess the equivalent knowledge prior to enrolling in this course:Real Estate Financial Modeling (REFM) Course Overview

Build a dynamic Real Estate Financial model to evaluate the investment return profile of a development project in Excel. This Excel-based real estate financial modeling course is designed for development professionals, lending/banking analysts, surveyors, and anyone interested in mastering the art of building real estate development models from scratch. In this real estate modeling course, you will learn step-by-step how to build a dynamic financial model that incorporates sensitivity analysis of development costs, sales prices, and other aspects of development.

In this real estate modeling course, you will learn step-by-step how to build a dynamic financial model that incorporates sensitivity analysis of development costs, sales prices, and other aspects of development.

Who should take this course?

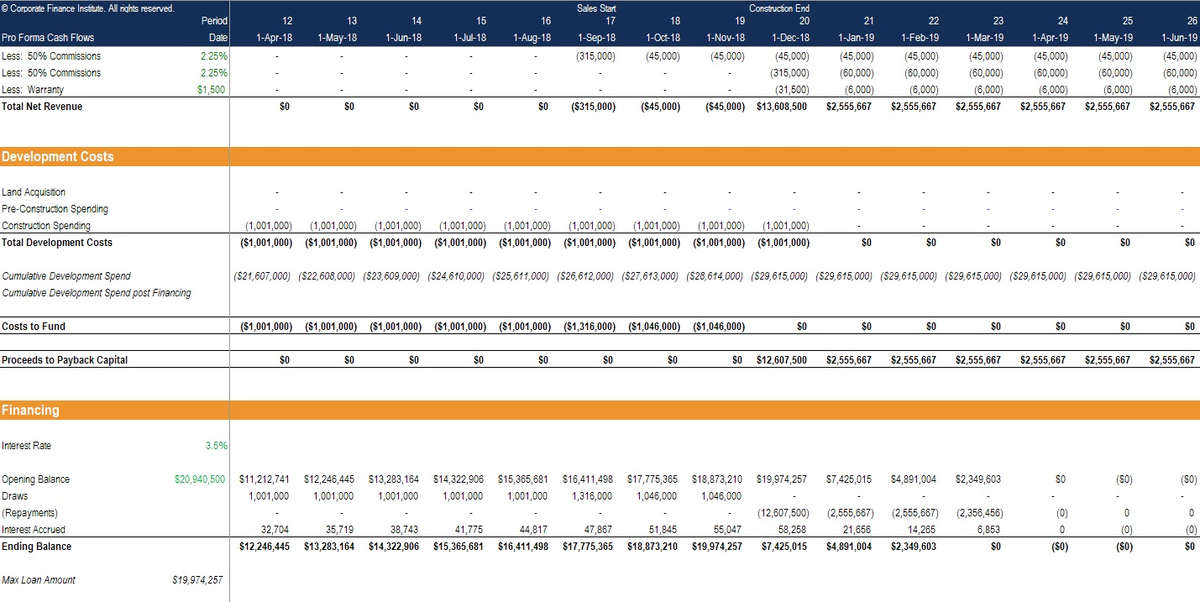

This real estate development financial modeling in Excel course is designed for anyone who is seeking to develop intermediate to advanced financial modeling skills and become an expert financial modeler for real estate development.Cap rate and NOI

Real Estate Financial Modeling Learning Content

- Real estate industry Overview

- Calculate Cap Rate and Net Operating Income (NOI)

- Build an interactive financial model to assess a project’s financial viability

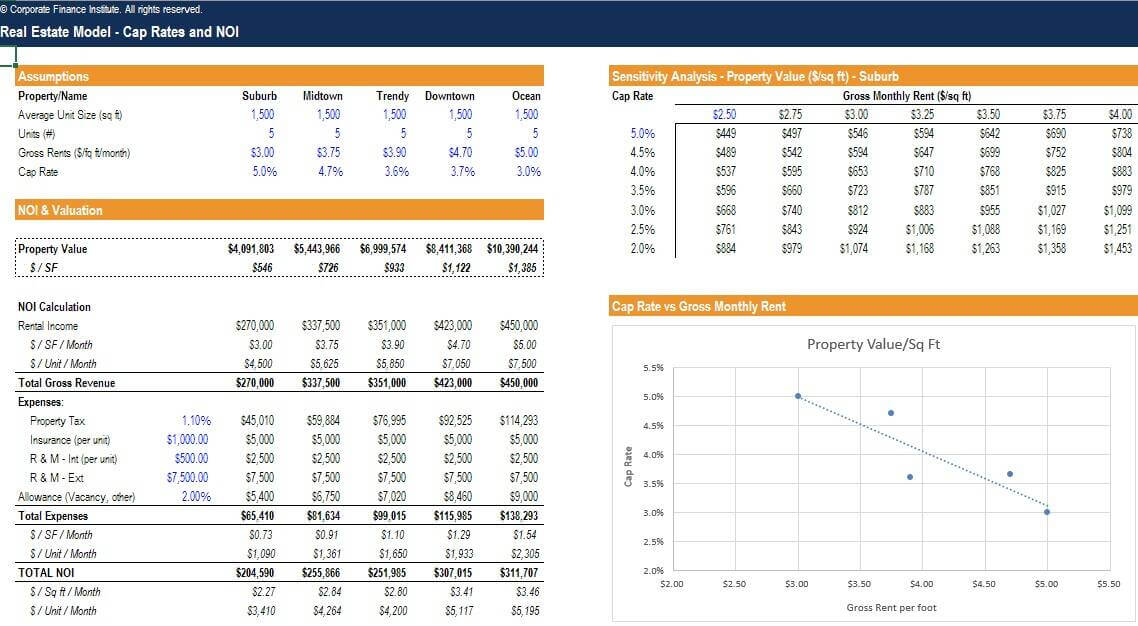

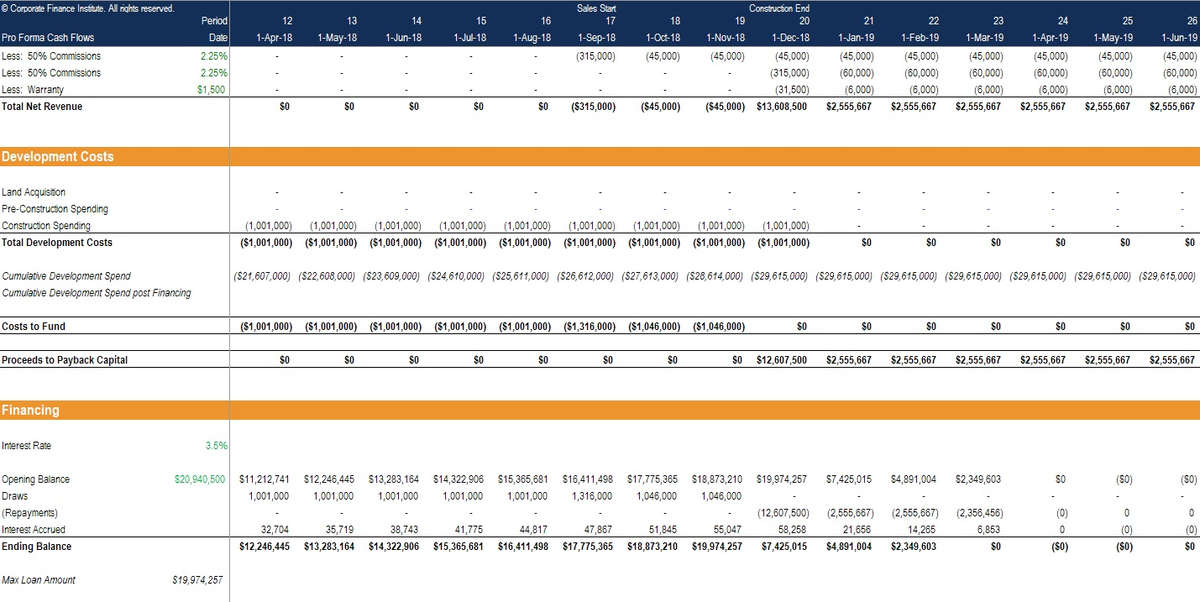

- Understand how to project real estate financing (both debt and equity) flow in and out depending on stage of development

- Design and structure of an Excel-based project finance model

- Modeling cash flows for a real estate development project

- Build in “triggers” and sensitivities to understand a project’s exposure to key drivers

- Develop ownership and financial structures (debt & equity)

- Calculate Internal Rate of Return (IRR), Return on Sales, Return on Cost

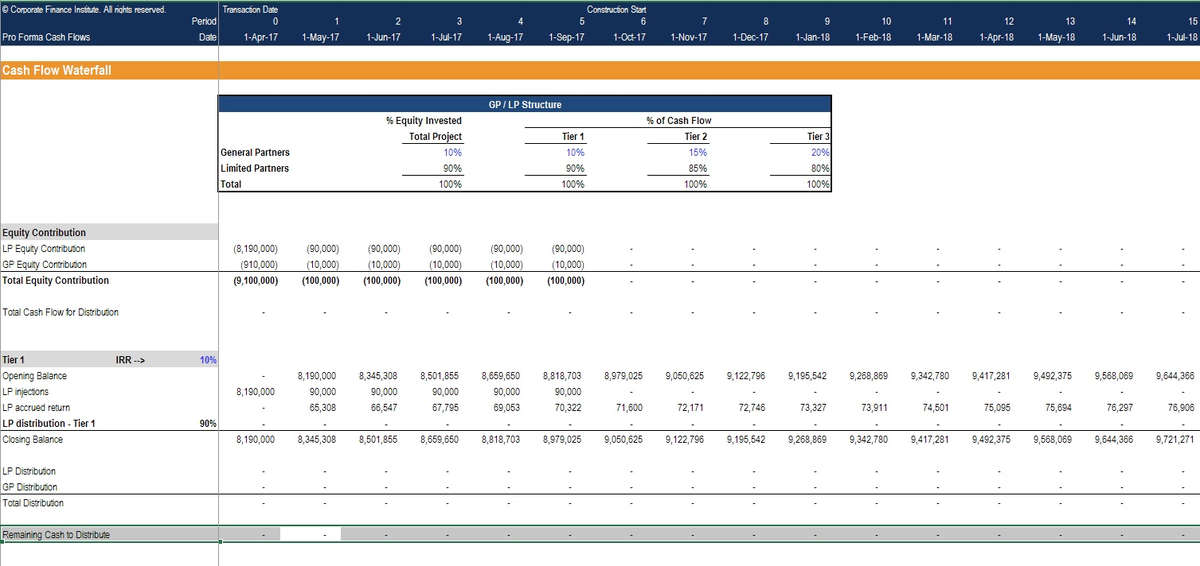

- Joint Venture (JV structures)

- Cash flow waterfalls (3 tier cash flow waterfall)

- Promotes and disproportionate returns

- Produce a one-page investment summary memo

- Includes blank and completed financial models to download

- Certificate of completion

Real Estate Financial Model

JV and Cash Flow Waterfall

Register now for CFI’s real estate financial modeling course!

Register now for CFI’s real estate financial modeling course!

Prerequisite Courses

Recommended courses to complete before taking this course.

Prerequisite Skills

Recommended skills to have before taking this course.

- Excel

- Valuation

- Financial modelling

Real Estate Financial Modeling

Level 5

2h 14min

100% online and self-paced

Field of Study: Finance

Start LearningWhat you'll learn

Introduction

Land Loans and Construction Loans

Real Estate Development Model

Joint Ventures & Cash Flow Waterfalls

Financial Analysis Output

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Financial Modeling & Valuation Analyst (FMVA®) Certification

- Skills Learned Financial modeling and valuation, sensitivity analysis, strategy

- Career Prep Investment banking and equity research, FP&A, corporate development

Commercial Real Estate Finance Specialization

- Skills Learned Real Estate Lending, Real Estate Financial Modeling, Construction Finance, Environmental Analysis and Due Diligence, Lease and Rent Roll Analysis

- Career Prep Credit Analysts, Risk Manager & Credit Adjudicator, Private Real Estate Lenders, Real Estate Investors and Advisors, Commercial Mortgage Brokers, Commercial Relationship Managers