Overview

Credit Fixed Income Course Overview

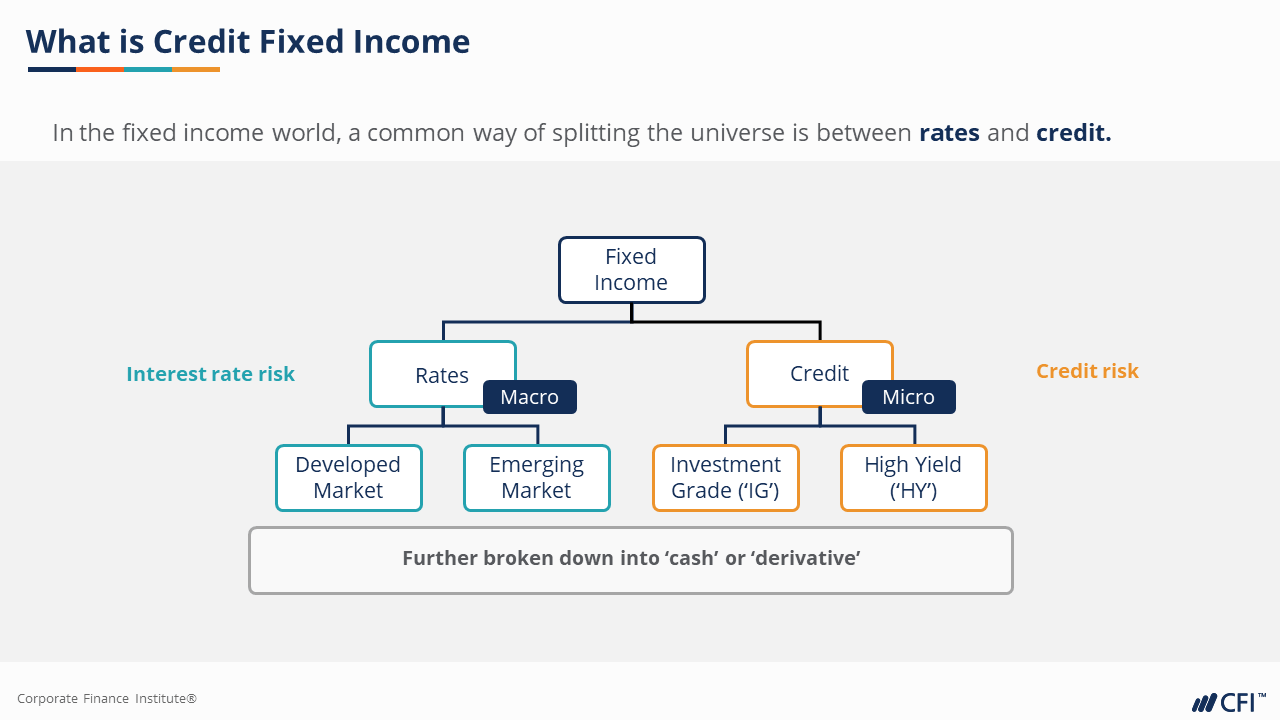

In this Credit Fixed Income course, we will introduce key concepts for credit analysts, investors, and traders. We will explore what is credit fixed income and the nuances of corporate bonds, as well as examine many of the measures of the additional yield that credit products provide. Building upon that foundation, we will look at trading corporate bonds, as well as explain asset swaps, credit default swaps, credit derivatives, credit-linked notes, and first-to-default baskets.

Credit Fixed Income Learning Objectives

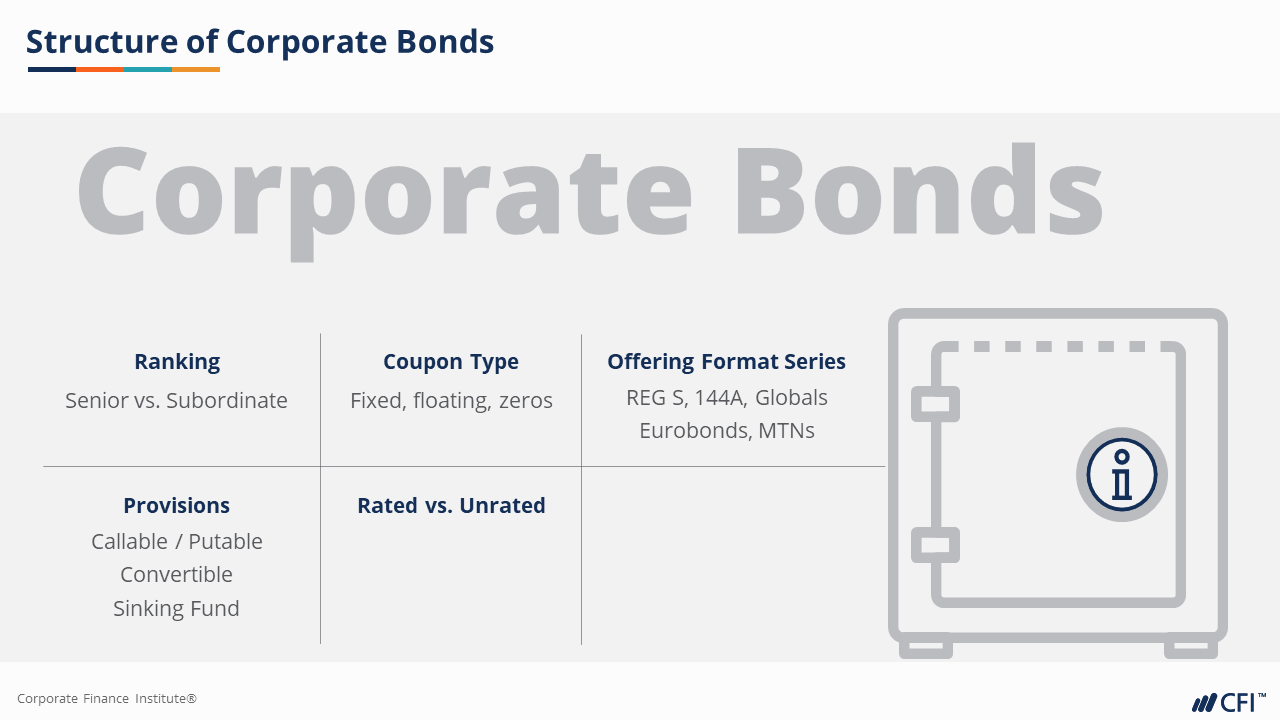

Upon completing this course, you will be able to:- Describe key characteristics of corporate bonds, from liquidity preference and coupon type, to offering formats, and provisions

- Appreciate the corporate bond issuer landscape from a trader/investor’s perspective, being able to speak to the various industry categories and provide examples of significant market players

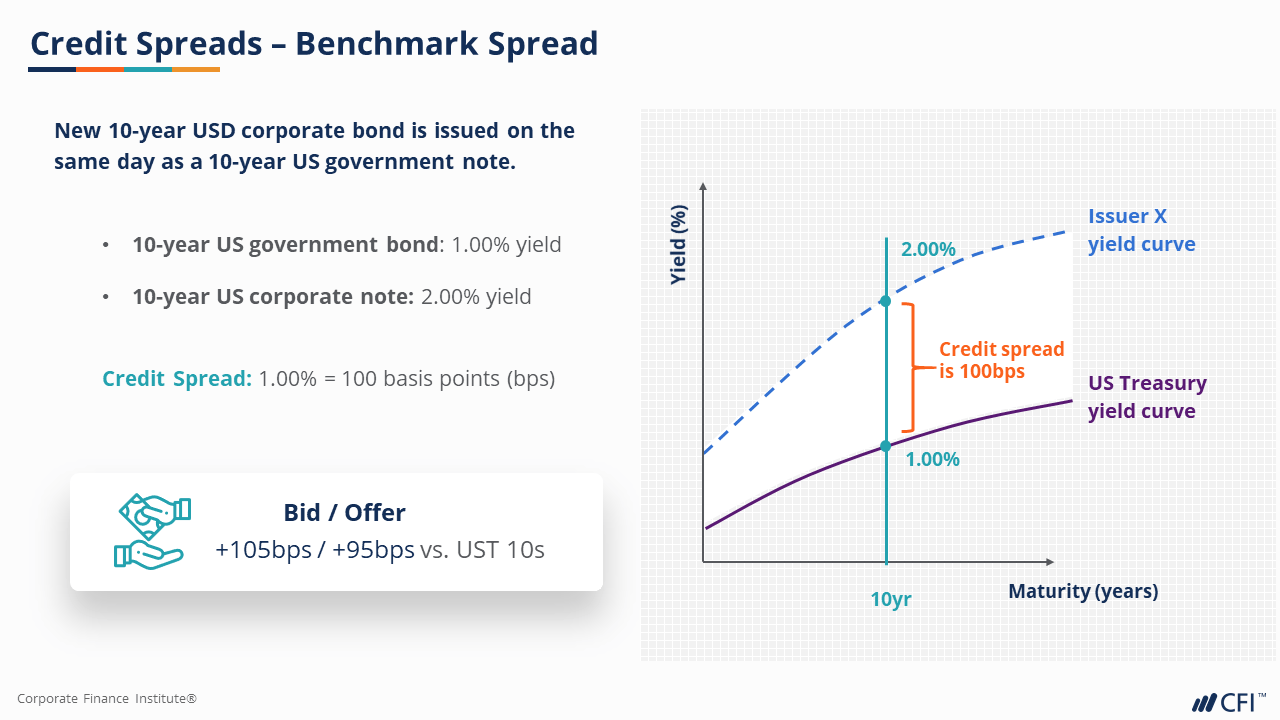

- Discuss the key quantitative measures (i.e. types of spreads) used in reference to bonds by industry professionals

- Understand the mechanics of credit spreads and their relationships to each other

- Identify specific credit products that can provide investors additional yield and explain why these products can provide incremental returns in relation to others (‘relative value’)

Who Should Take This Course?

This Credit Fixed Income course is perfect for anyone who would like to develop a deeper understanding of spread products in fixed income. For the individual wanting to gain more breadth in corporate bonds and credit derivative product knowledge, this course explores a diverse range of topics on spread products from bonds to credit derivatives.

This course is designed to equip anyone who desires to begin a career in the capital markets on a fixed income desk or to help prepare for career advancement from junior to more senior fixed income trading or sales positions.

Prerequisite Courses

Recommended courses to complete before taking this course.

Credit Fixed Income

Level 3

1h 43min

100% online and self-paced

Field of Study: Finance

Start LearningWhat you'll learn

Course Introduction

Credit Derivatives

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Capital Markets & Securities Analyst (CMSA®) Certification

- Skills Learned Trading strategies used in the finance and capital markets

- Career Prep Work in capital markets, whether on the buy-side or the sell-side