Overview

Equipment Finance Course Overview

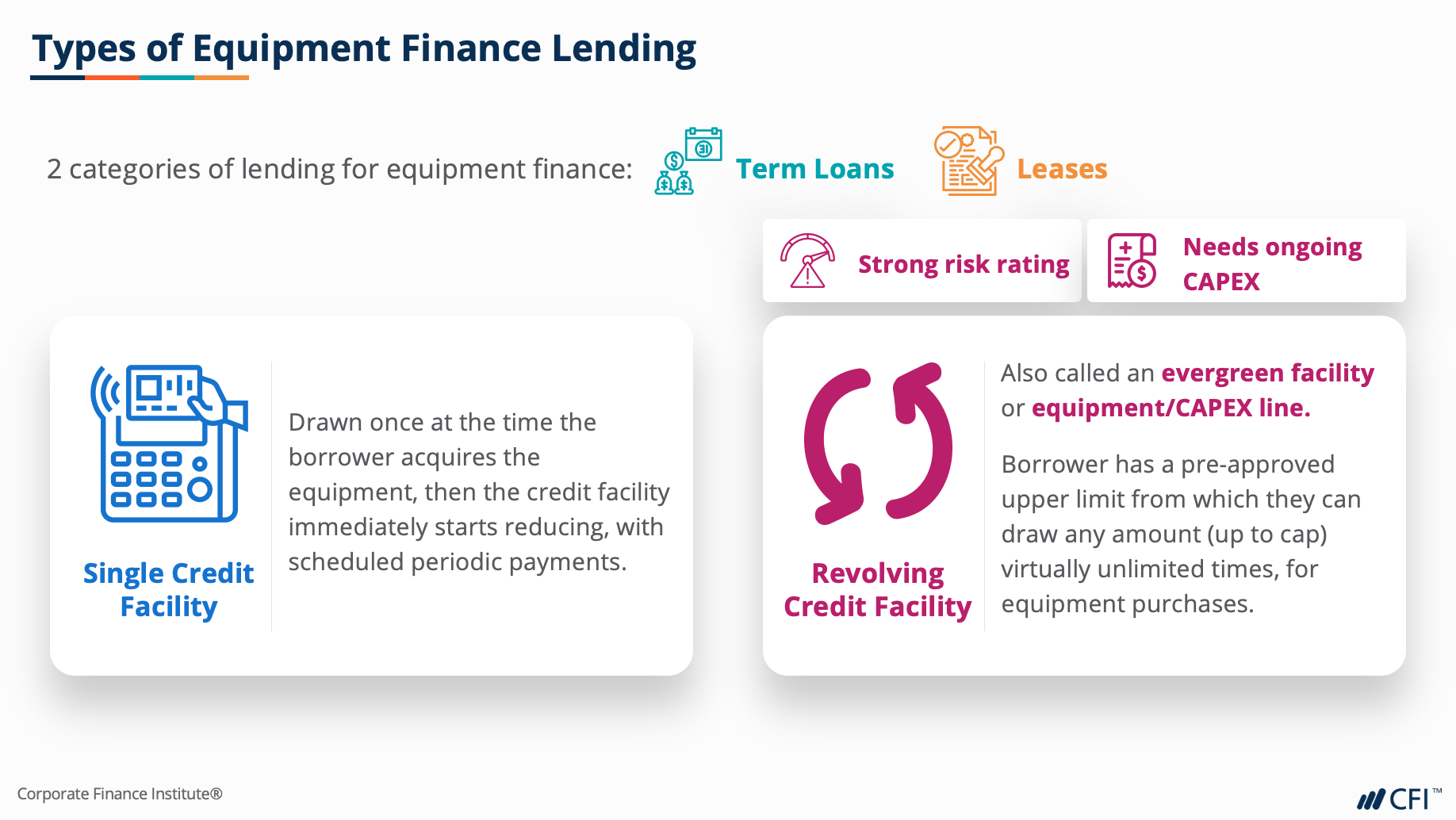

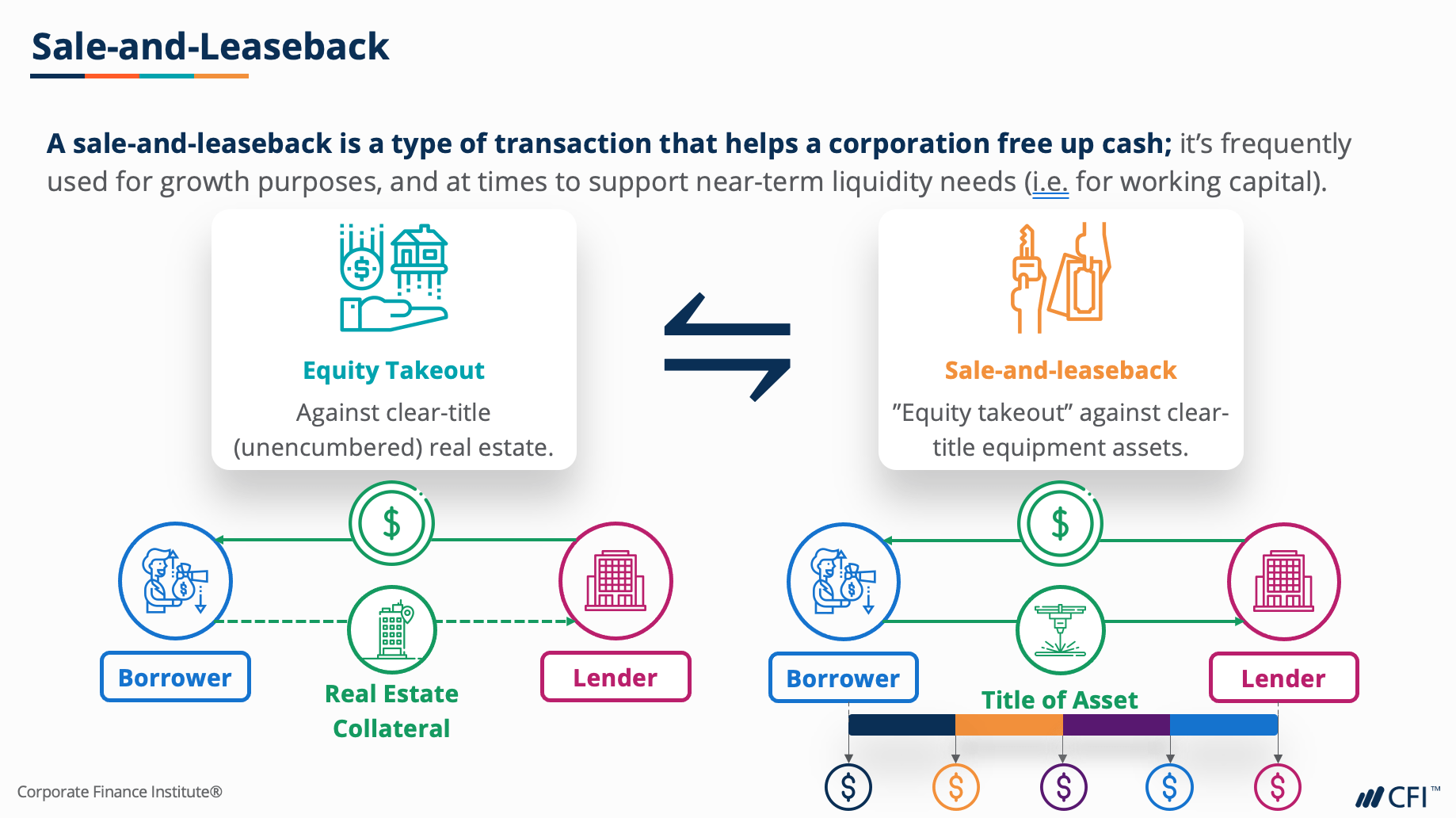

This Equipment finance course will explore the concepts behind non-real estate capital expenditures to grow fixed assets on the balance sheet. We will identify the sources of equipment financing to understand the different types of lenders before moving on to the differences and similarities between term loans, capital leases, and operating leases.

Equipment Finance Learning Objectives

Upon completing this course, students will be able to:- Identify different financing options for non-real estate capital expenditures,

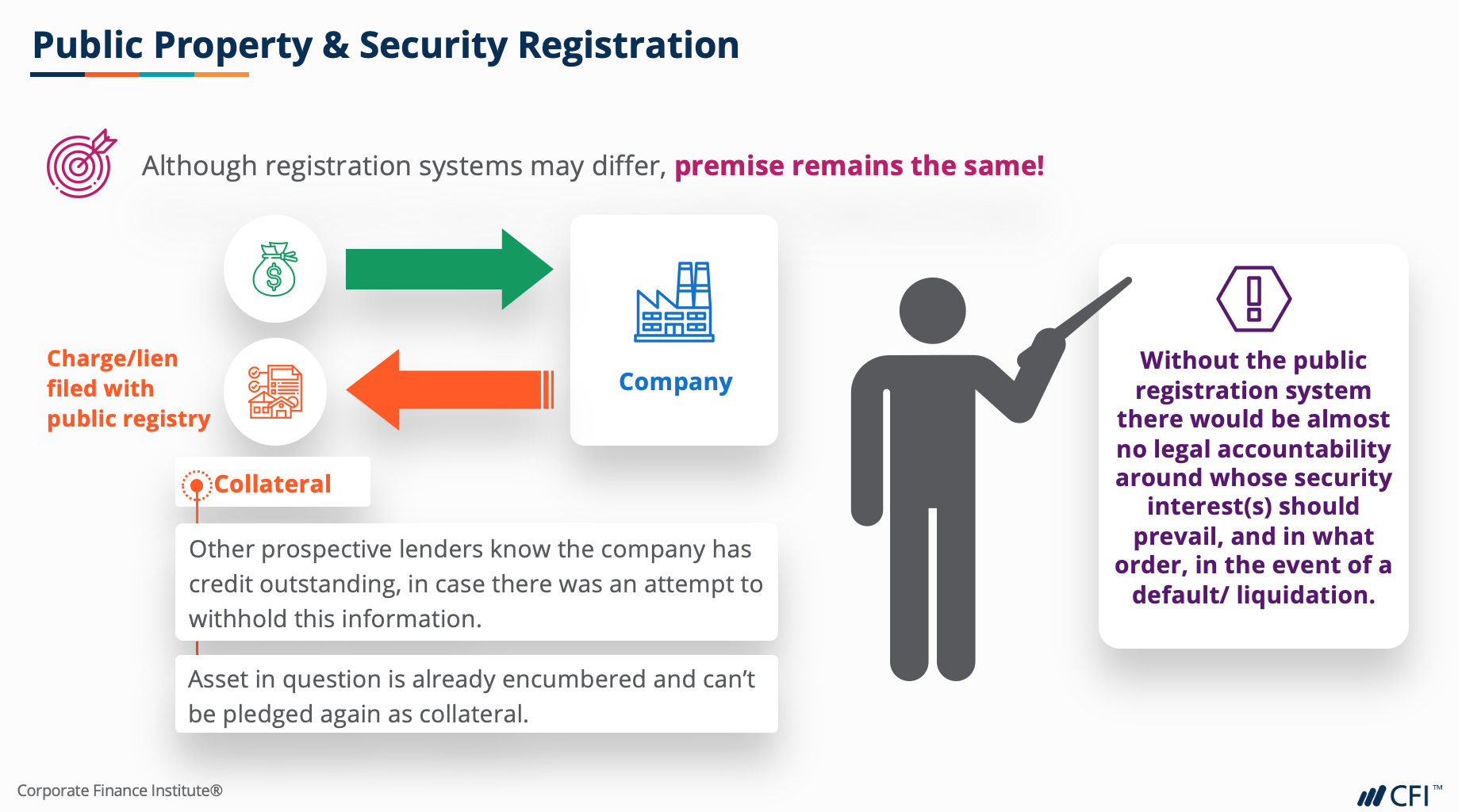

- Explain how security filings and public registries work,

- Define the differences and similarities between term loans, capital leases, and operating leases,

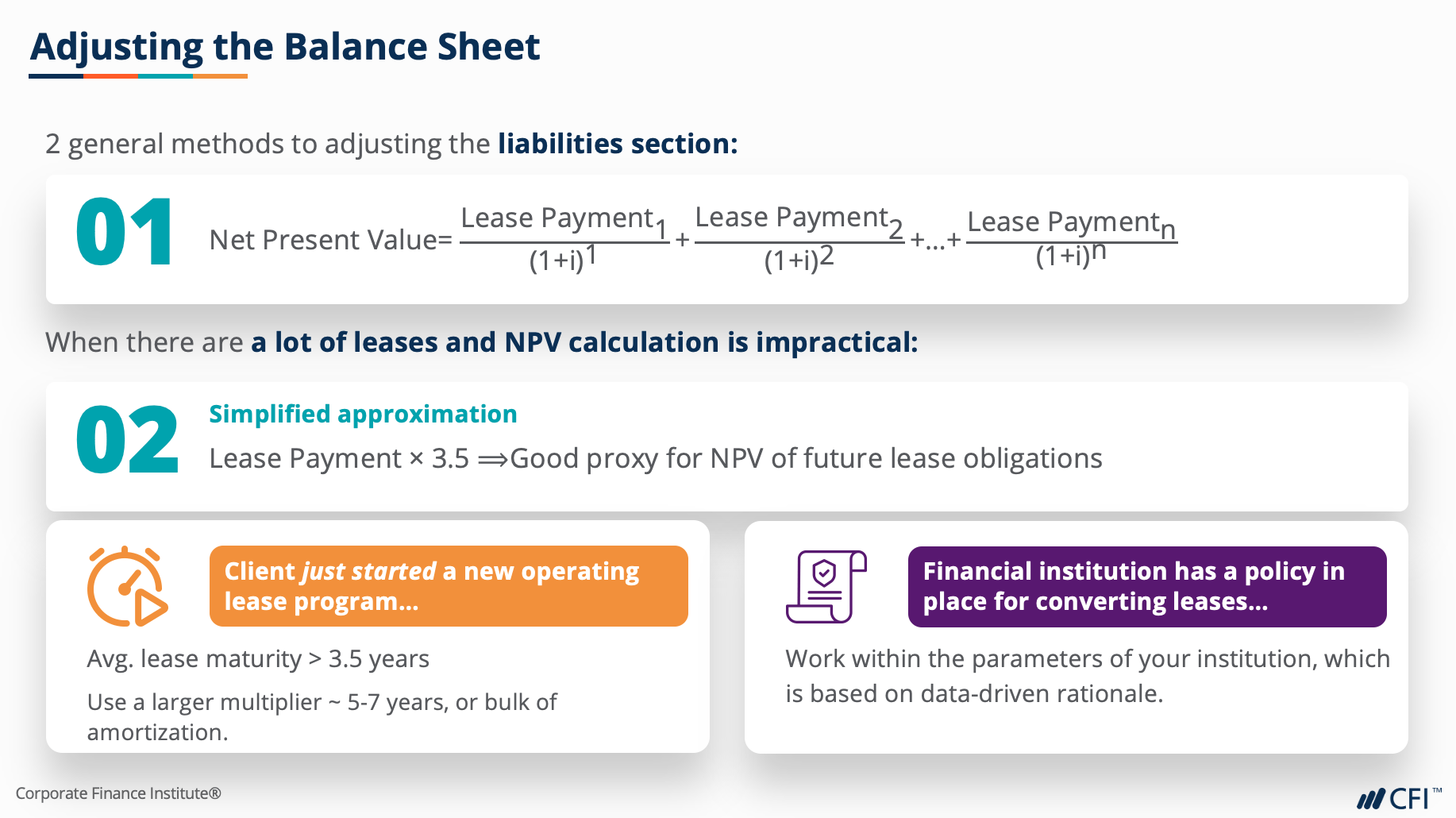

- Adjust financial statements for an example client that has an operating lease,

- Calculate adjusted lending ratios for borrowers that use operating leases

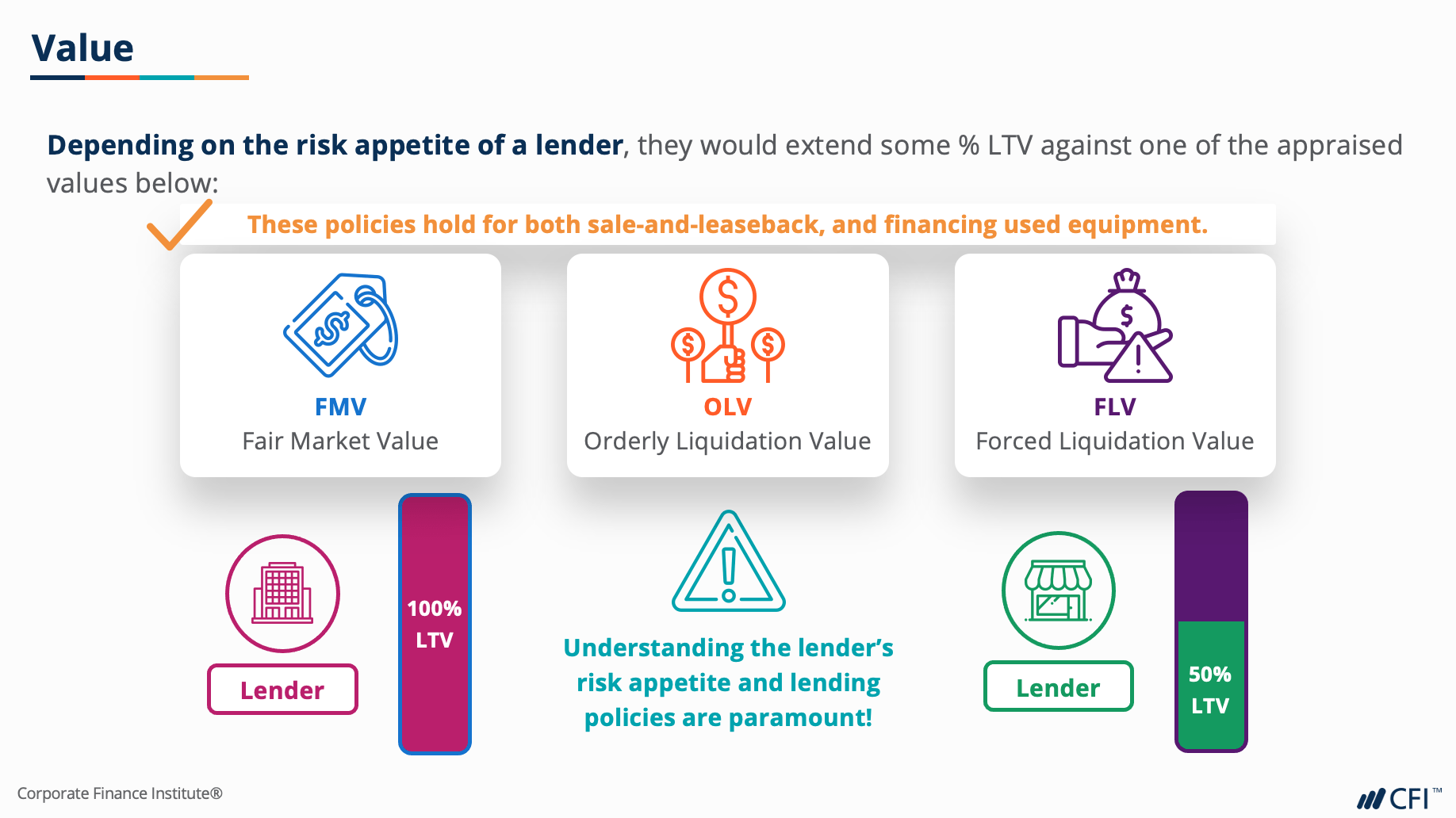

- Explain financing structures for new and used equipment.

Who should take this course?

This Equipment Finance course is designed for beginner and intermediate-level lending professionals, including relationship managers, analysts, and credit adjudicators in commercial banking or equipment finance operations. This content is also highly relevant to loan brokers and small business banking professionals, who are involved in these types of transactions day-to-day. By covering the different elements of equipment finance in specific detail, you will be able to identify better solutions around lending structures for clients & prospects. The exercises and tools explored in this course will be useful for any financial analyst who wishes to work in credit analysis, commercial banking, and other areas of lending and credit evaluation.

Prerequisite Courses

Recommended courses to complete before taking this course.

Equipment Finance

Level 3

1h 23min

100% online and self-paced

Field of Study: Finance

Start LearningWhat you'll learn

Introduction

Security & Registrations

Additional Concepts

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Commercial Banking & Credit Analyst (CBCA®) Certification

- Skills Learned Financial Analysis, Credit Structuring, Risk Management

- Career Prep Commercial Banking, Credit Analyst, Private Lending