Overview

ESG Disclosure course overview

As corporate ESG performance is rapidly becoming a key indicator of a company’s ability to compete, it is crucial to understand the perspective around and have the ability to work with ESG issues to inform financial decision-making. This course will explain the critical concepts behind ESG disclosure and why it’s essential, along with the properties of high-quality disclosures. We will look at examples of both investor-facing and public-facing reporting frameworks before discussing emerging trends in ESG Reporting. Next, we will move on to quantitative & qualitative disclosures to better understand the use cases, objectives, and impacts of different disclosure methods.

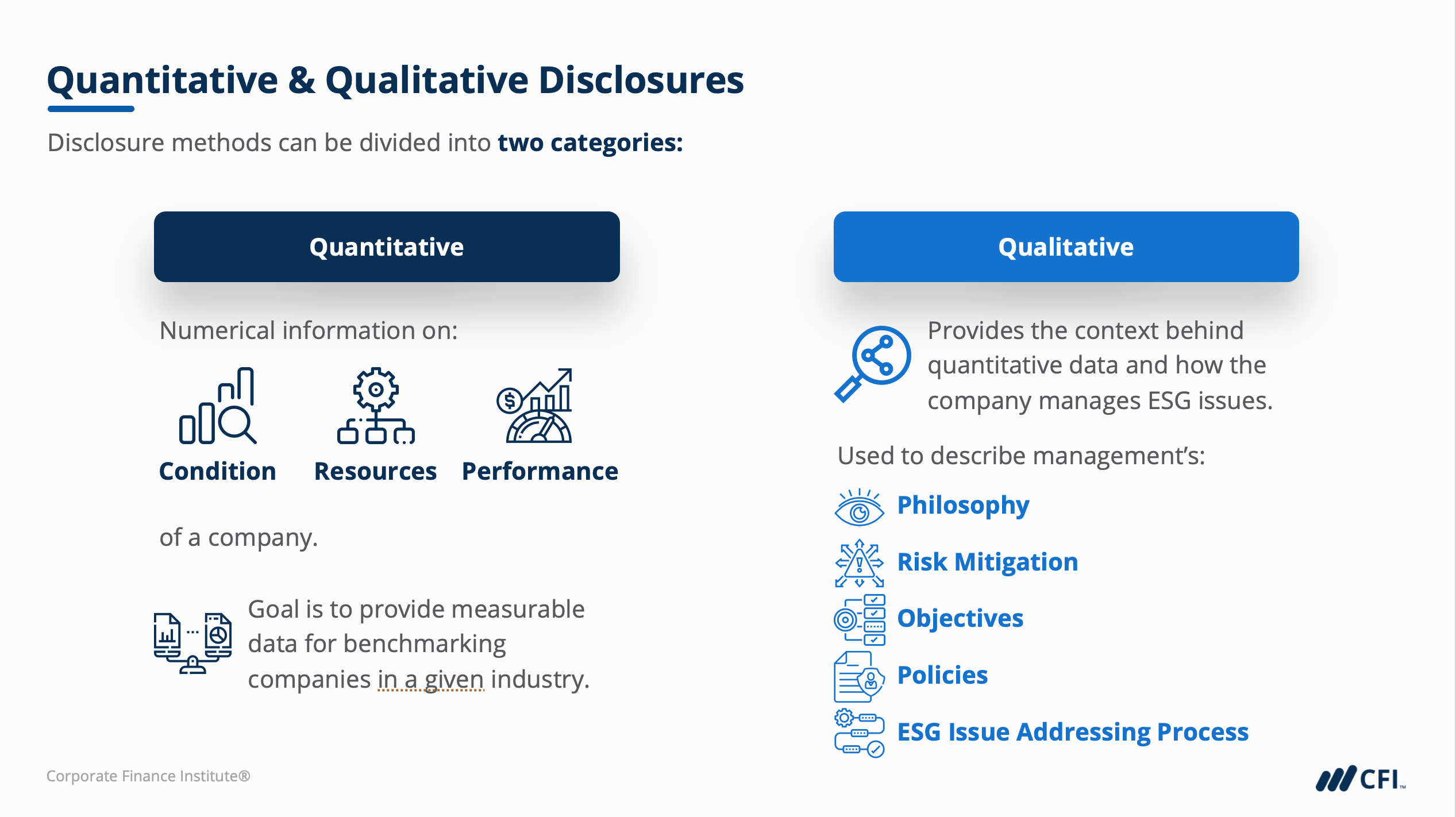

We will look at examples of both investor-facing and public-facing reporting frameworks before discussing emerging trends in ESG Reporting. Next, we will move on to quantitative & qualitative disclosures to better understand the use cases, objectives, and impacts of different disclosure methods.

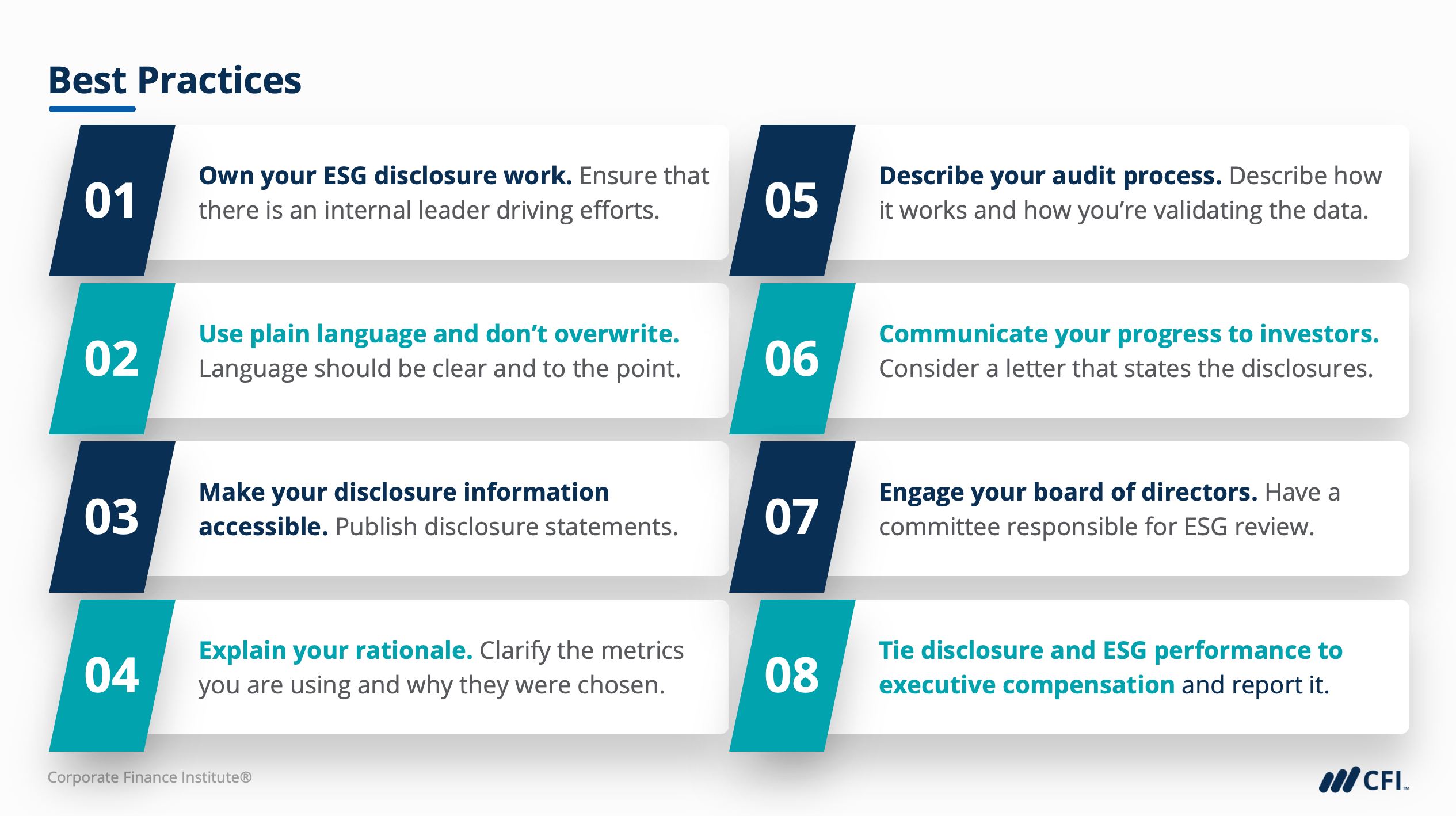

After, we’ll explore how to prepare and position ESG disclosure to meet different expectations and requirements from investors, policymakers, customers, and rating agencies, while also discussing best practices.

After, we’ll explore how to prepare and position ESG disclosure to meet different expectations and requirements from investors, policymakers, customers, and rating agencies, while also discussing best practices.

Then, we’ll work through how to interpret ESG disclosure and analyze disclosure quality to understand how stakeholders evaluate ESG risk and opportunity. Finally, we’ll put everything we’ve learned into practice in a case study where we will compare two companies’ ESG disclosures using real, publicly available information.

Then, we’ll work through how to interpret ESG disclosure and analyze disclosure quality to understand how stakeholders evaluate ESG risk and opportunity. Finally, we’ll put everything we’ve learned into practice in a case study where we will compare two companies’ ESG disclosures using real, publicly available information.

ESG Disclosure learning objectives

Upon completing this course, you will be able to:- Explain the key concepts behind ESG disclosure.

- Define and evaluate the use cases, objectives, and impacts of quantitative & qualitative disclosure methods.

- Prepare & position ESG disclosure to meet a variety of requirements from investors, policymakers, customers, and rating agencies.

- Work through how to interpret ESG disclosure and analyze quality to see how stakeholders evaluate ESG risk & opportunity.

- Compare two companies’ disclosures using real, publicly available information.

Who should take this course?

This ESG Disclosure course is perfect for investment professionals, management consultants, and financial analysts of all walks, as well as investor relations teams and senior managers at both private and public companies.

Prerequisite Courses

Recommended courses to complete before taking this course.

ESG Disclosure

Level 2

50min

100% online and self-paced

Field of Study: Specialized Knowledge

Start LearningWhat you'll learn

Fundamentals of ESG Disclosures

Quantitative & Qualitative Disclosures

Case Study

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Environmental Social, and Governance Specialization

- Skills Learned ESG Analysis, ESG Integration, ESG Investing, ESG & Business Intelligence

- Career Prep Asset Management, Management Consulting, Business Analyst, Credit Analyst, Corporate Development, Senior Leadership