Overview

Excel VBA for Finance Course Overview

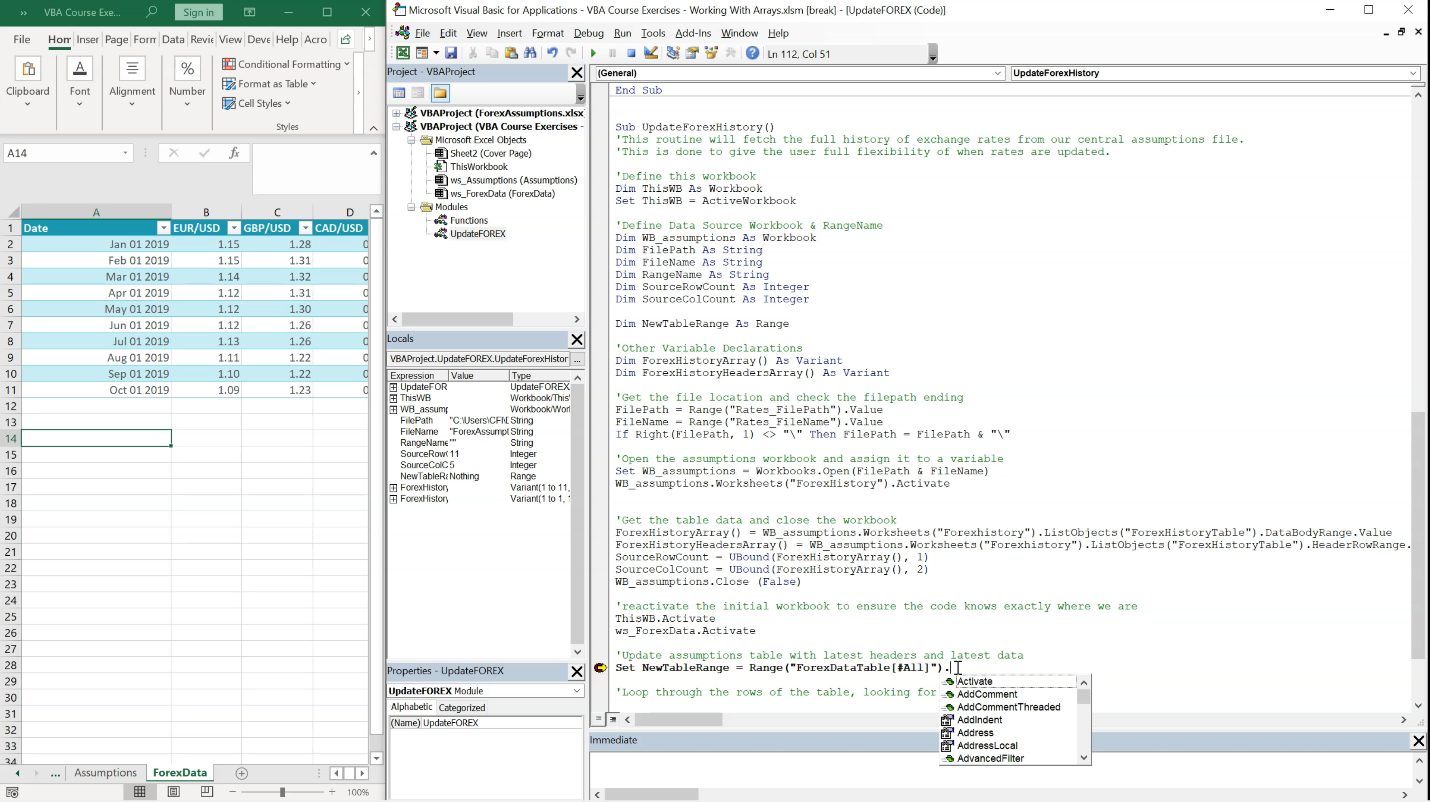

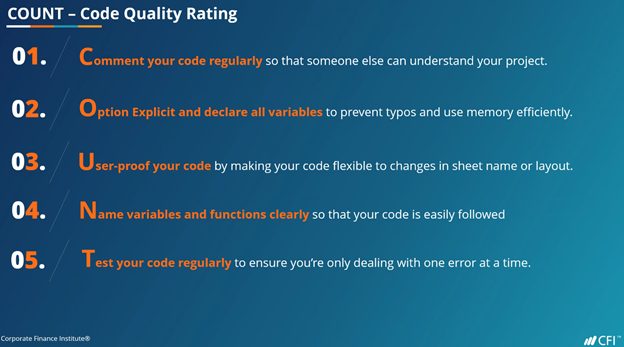

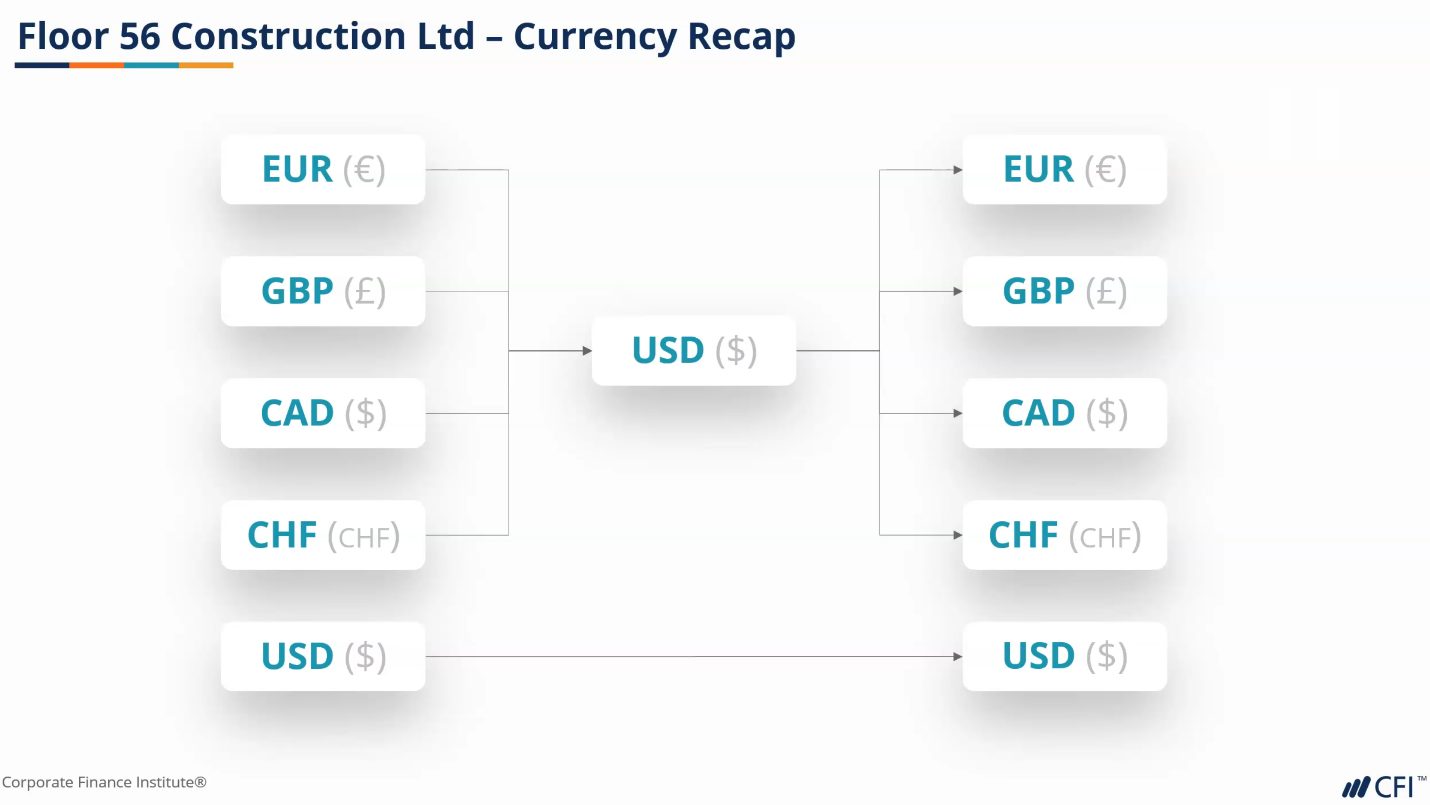

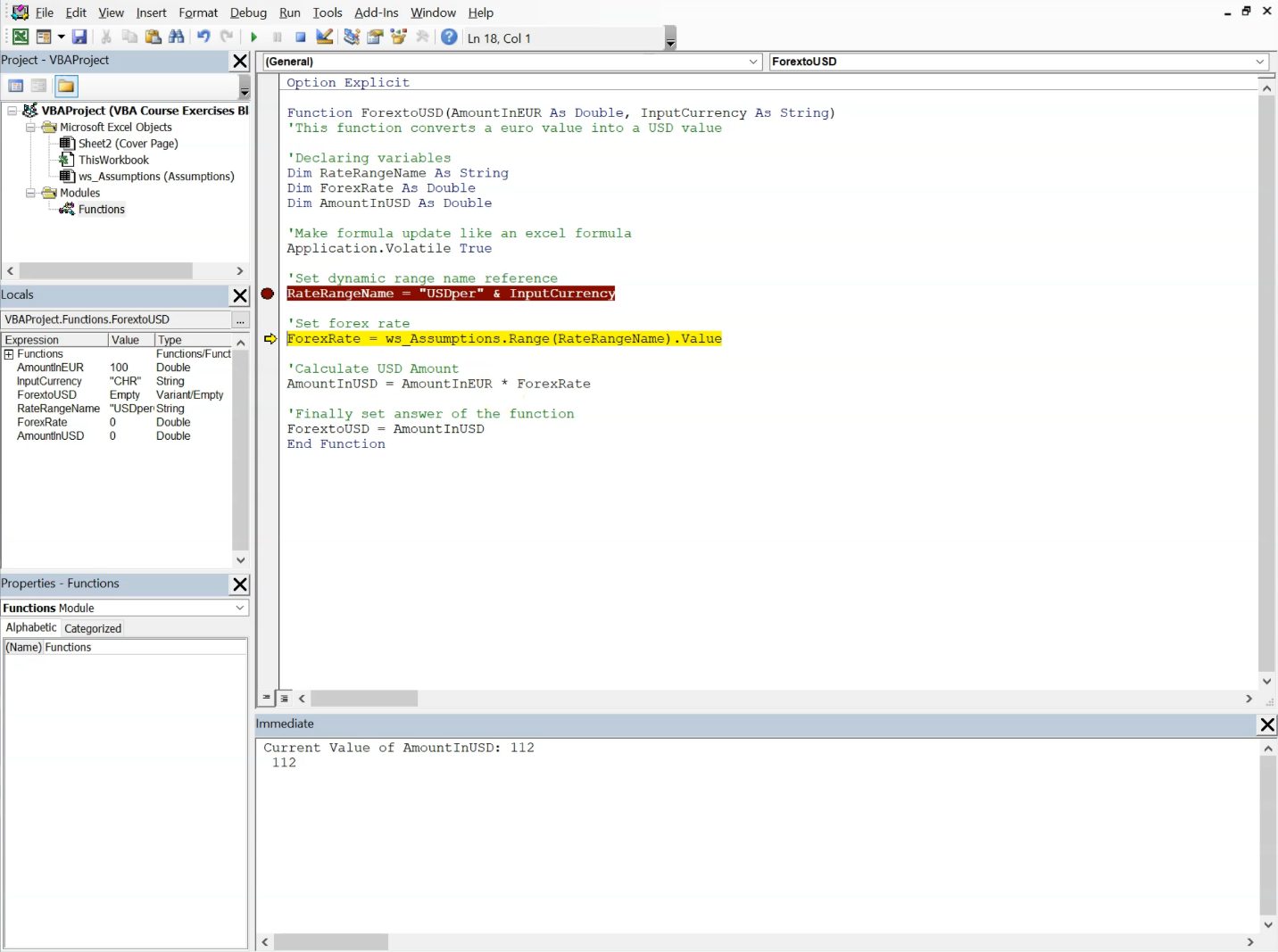

This practical course is designed to introduce finance professionals and data analysts, already proficient in Excel, to the world of Excel VBA. We start with the basics: setting up the VBA environment, understanding the relevance of VBA in your work, and creating custom formulas. As you gain confidence, we’ll move to more complex topics, including error handling, sharing and publishing your functions, automating tasks, and working with arrays. Excel VBA is a powerful tool for automating repetitive tasks and simplifying complex calculations. To give you real-world experience, we incorporate a case study involving a multinational company. Here, you’ll apply what you’ve learned by building a custom function, offering you practical insights into various essential VBA topics and techniques. This course is your step towards mastering Excel VBA, making your data analysis tasks more efficient and effective.

Excel VBA for Finance Learning Objectives

By the end of this course, you will be able to:- Know when and why to use VBA

- Create Custom Formulas in VBA to be used in Excel

- Identify coding errors, and manage errors in your data

- Publish your custom Functions and share them with your colleagues

- Create Events, and Automate Tasks

- Source large datasets

Who should take this course?

Our Excel VBA for Finance course is specifically tailored for professionals who already have a good grasp of Excel and are looking to leverage its full potential. This course is an excellent fit for those aiming to enter or excel in fields like investment banking, sales and trading, treasury, or other finance sectors. It’s also ideal for those aspiring to become Business Analysts. While Excel VBA operates similarly on both Mac and Windows, certain features differ in performance. Therefore, we recommend using a Windows system to fully benefit from the training. By the end of this course, you’ll be equipped with a solid foundation in Excel VBA, enhancing your efficiency and effectiveness in various financial roles.

Software Requirements

Excel for Windows or Mac

Prerequisite Skills

Recommended skills to have before taking this course.

- Excel

Excel VBA for Finance

Level 3

3h 54min

100% online and self-paced

Field of Study: Finance

Start LearningWhat you'll learn

Custom Formulas

Errors and Exceptions

Finalize and Publish Functions

Events & Automations

Working with Arrays

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Data Analysis in Excel Specialization

- Skills Learned Data Modelling & Analysis, Data Transformation, Data Visualization

- Career Prep Data Analyst, Business Intelligence Specialist, Data Scientist, Finance Analyst

Financial Planning & Analysis Professional

- Skills You’ll Gain Accounting, Finance, Excel, Data Analysis, Financial Statement Analysis, Financial Modeling, Budgeting, Forecasting, Power Query, Power BI, Data Visualization, Economics, and more

- Great For The FPAP certification focuses on practical, desk-ready skills that are immediately applicable to current FP&A professionals or anyone seeking to land a role in FP&A