Overview

Foreign Exchange Fundamentals Course Overview

This prep course on foreign exchange (“FX”) covers the fundamental knowledge you need to know about the FX markets. You will learn more about the historical development of the FX market, the different exchange systems that exist, and the many market participants. You will also learn about various foreign exchange platforms, along with regulations.

Foreign Exchange Fundamentals Learning Objectives

Upon completing this course, you will be able to:- Outline the historical development of the foreign exchange market.

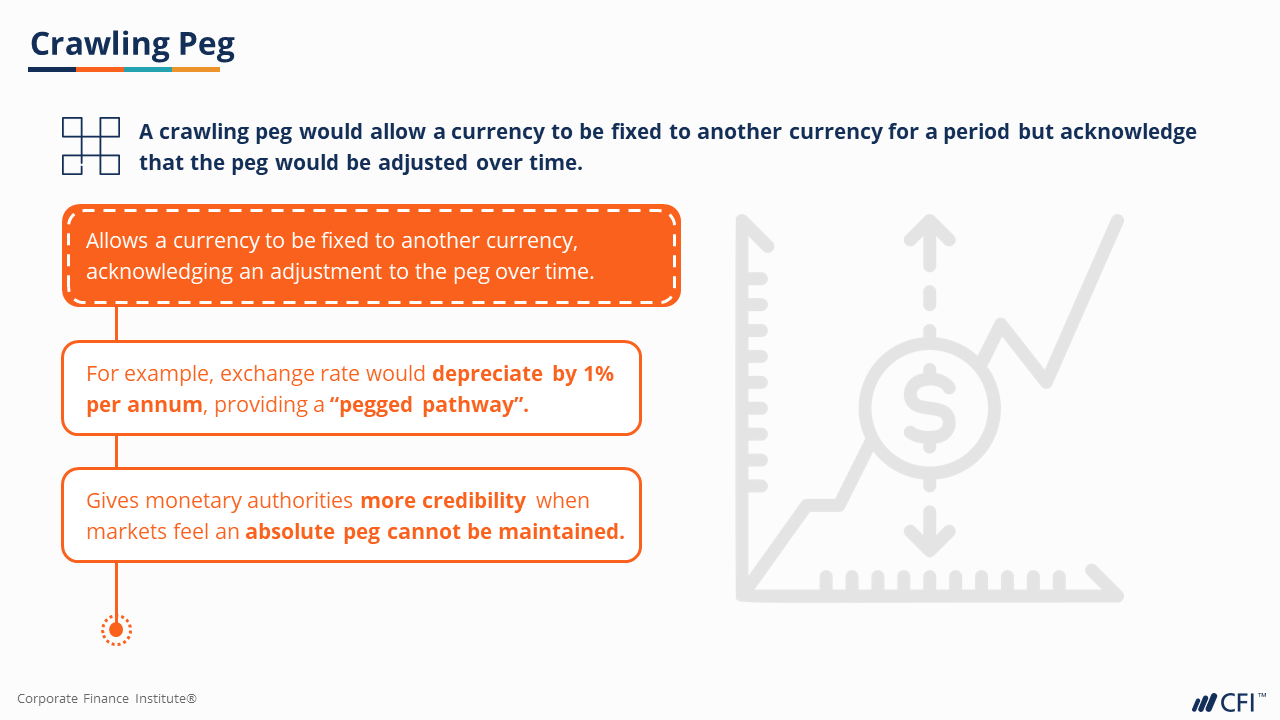

- Describe the different foreign exchange systems that exist.

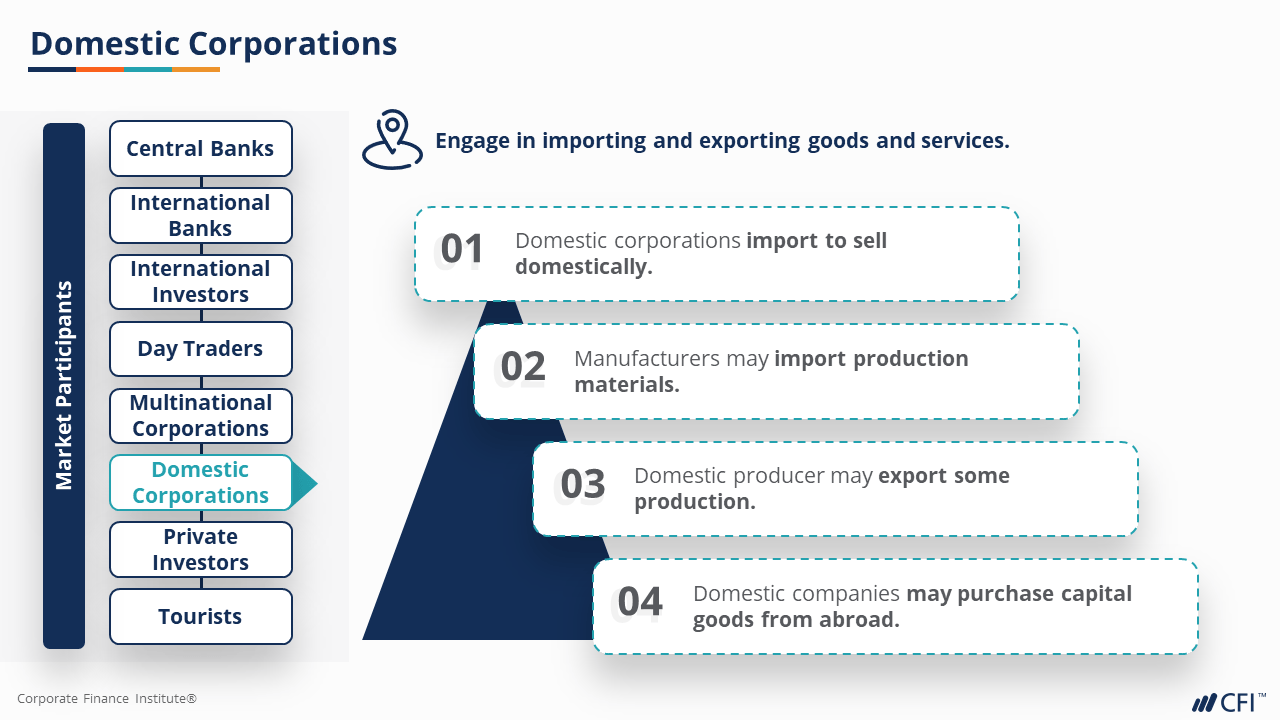

- Identify the market participants in the foreign exchange market.

- Identify foreign exchange platforms that facilitate foreign exchange transactions.

- Examine the settlement process and various market drivers.

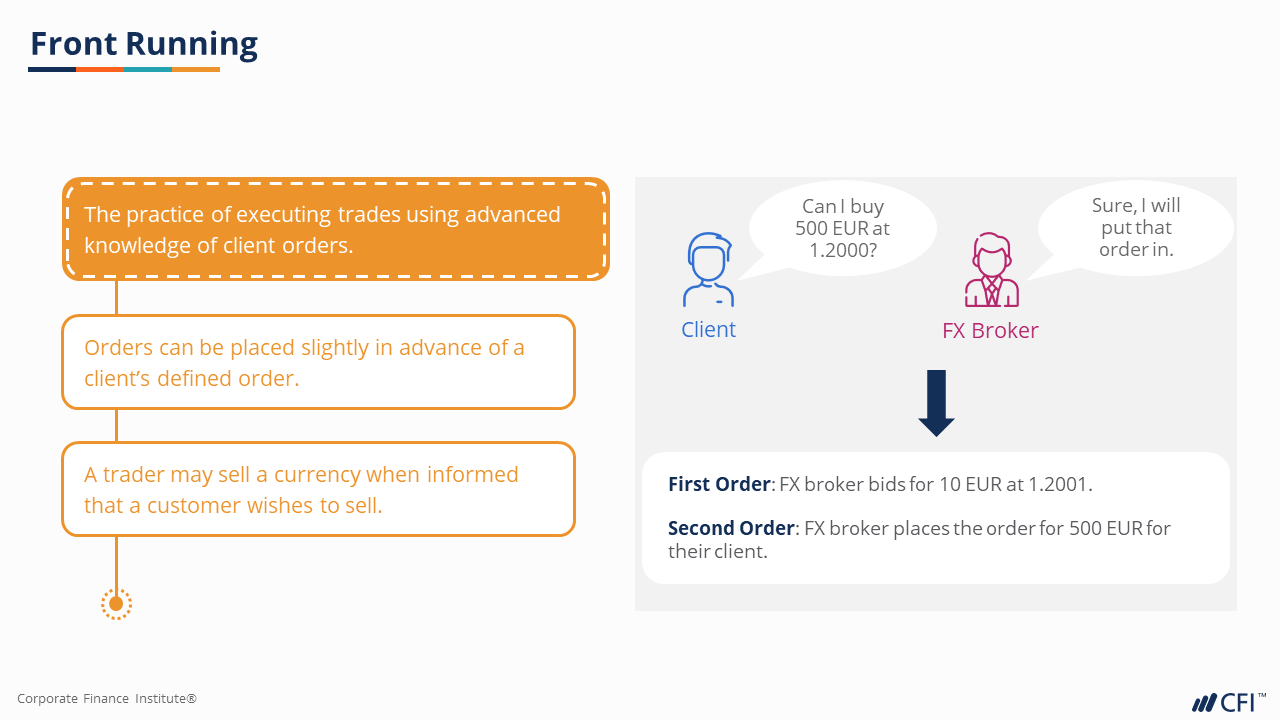

- Identify the markets regulatory architecture.

Who Should Take This Course?

This foreign exchange course is great for anyone looking to understand more about capital markets. It teaches a generic overview of foreign exchange and is a great prep course for more advanced topics in FX. This course is designed to equip anyone who desires to begin a career in fixed income, equity, sales, trading, or other areas of finance with the fundamental knowledge of foreign exchange.

Prerequisite Skills

Recommended skills to have before taking this course.

- Critical thinking

Foreign Exchange Fundamentals

Level 1

1h 6min

100% online and self-paced

Field of Study: Finance

Start LearningWhat you'll learn

Market Participants

Settlement Process

Regulatory Environment

Course Summary

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Capital Markets & Securities Analyst (CMSA®) Certification

- Skills Learned Trading strategies used in the finance and capital markets

- Career Prep Work in capital markets, whether on the buy-side or the sell-side