Overview

Futures Pricing and Commodity Futures Course Overview

This course provides an overview of different futures and forward contracts, how they are priced, and various trading strategies such as hedging, speculating, and arbitrage. You will have the opportunity to work through practice examples and learn how to identify key information on Refinitiv Workspace. By the end of this course, you will have an enhanced understanding of futures and forwards, which will prepare you for learning other derivatives and advanced strategies. In this course, we will explore:

In this course, we will explore:

- Futures & forwards review

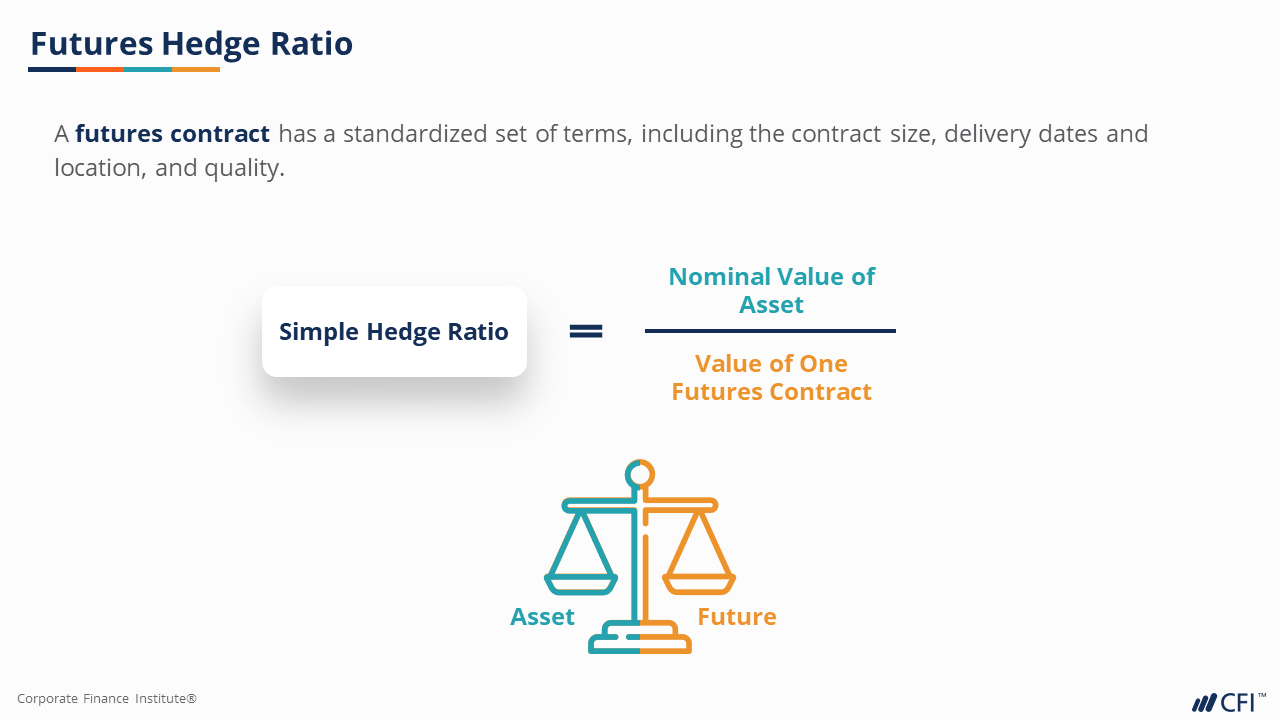

- Futures & forwards contracts

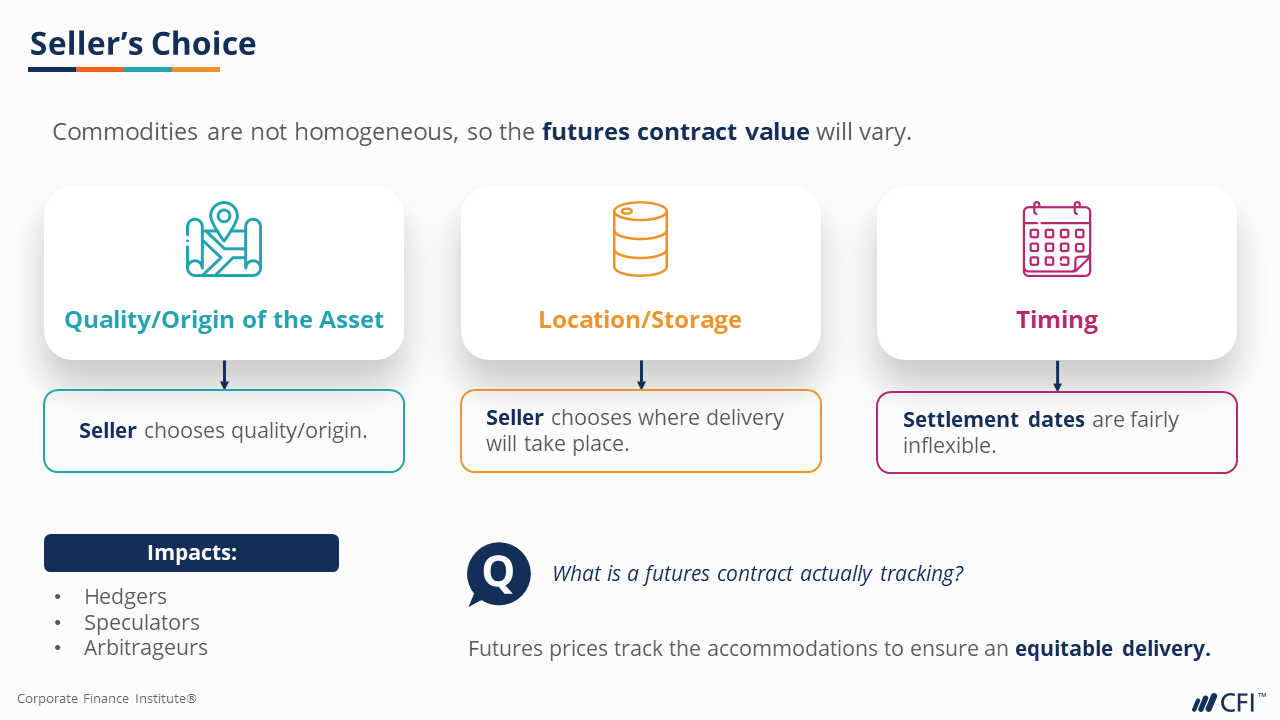

- Commodity contracts

Futures Pricing and Commodity Futures Learning Objectives

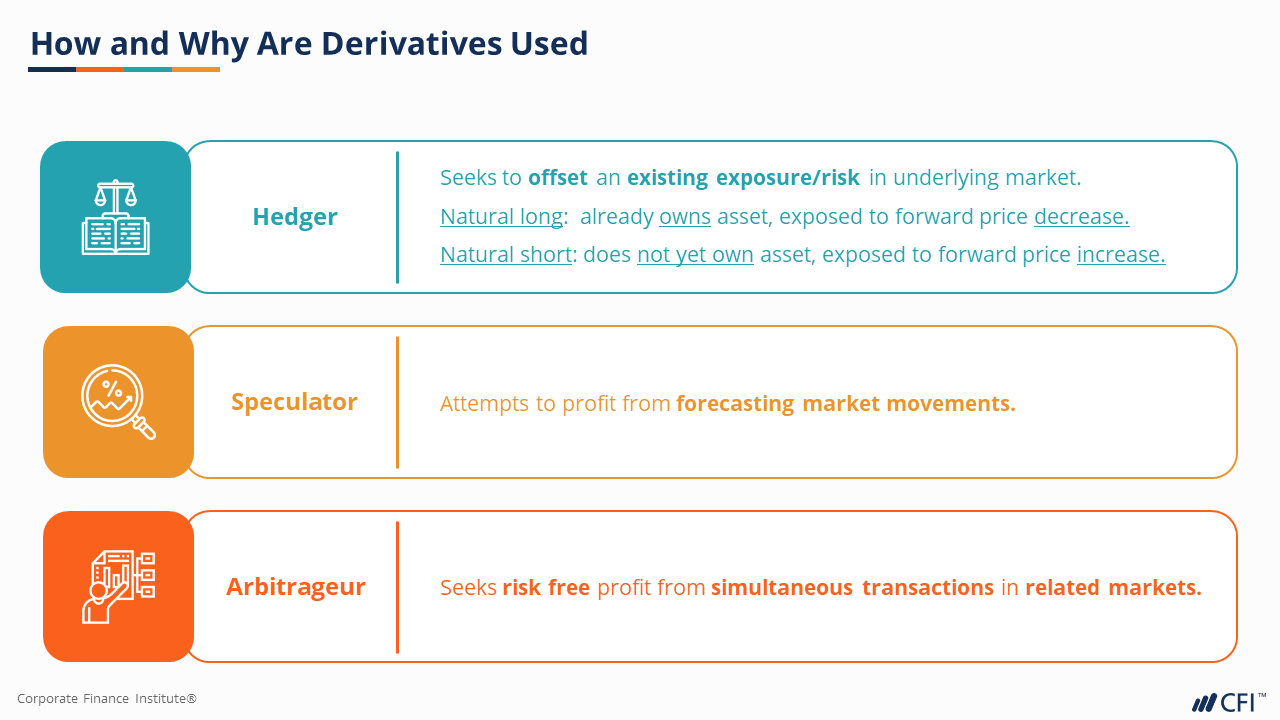

Upon completing this course, you will be able to:- Identify what futures and forwards are, and how they can be used

- Understand how to calculate futures prices and identify if they are in contango or backwardation markets

- Explain how to identify an arbitrage opportunity using futures and forwards

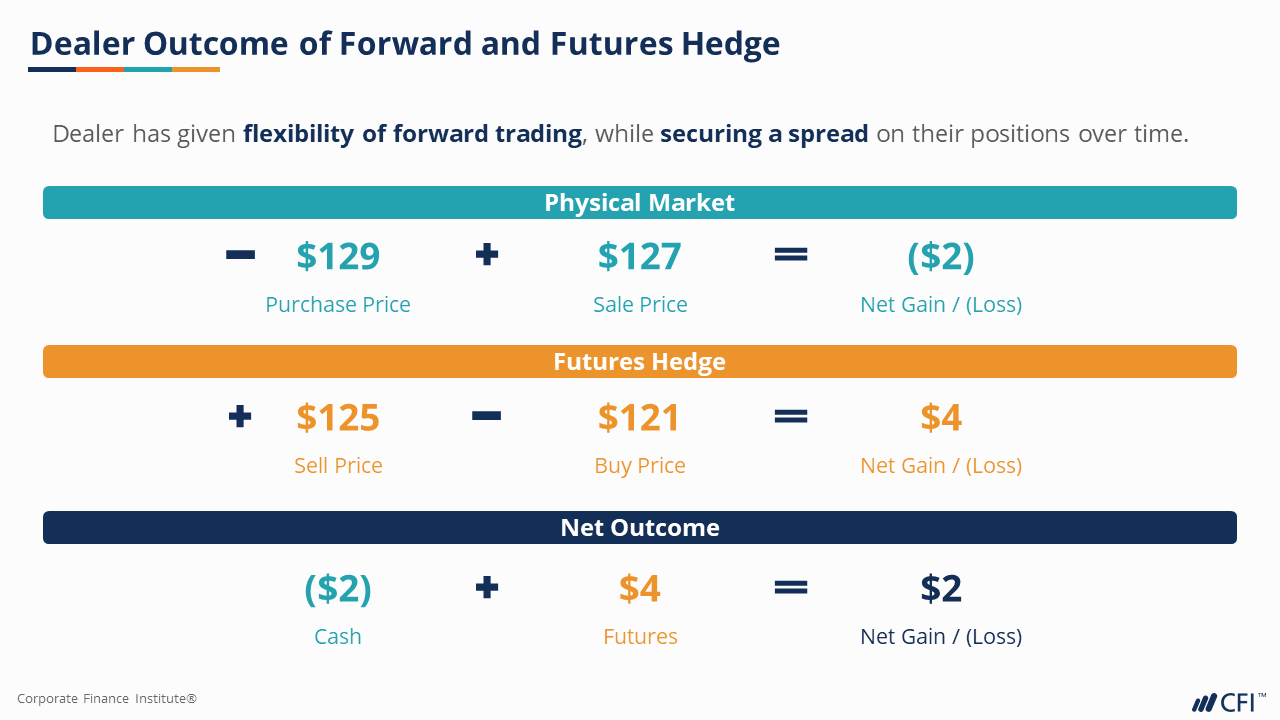

- Understand how market makers help the derivatives market flourish

Who Should Take This Course?

This futures course is perfect for anyone who would like to build up their understanding of derivatives, specifically futures and forwards. This course is designed to equip anyone who desires to begin a career in the capital markets as a derivatives trader.Prerequisite Courses

Recommended courses to complete before taking this course.

Futures Pricing and Commodity Futures

Level 3

1h 46min

100% online and self-paced

Field of Study: Finance

Start LearningWhat you'll learn

Course Introduction

Futures & Forwards Review

Pricing Futures Contracts

Commodity Futures Contracts

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Capital Markets & Securities Analyst (CMSA®) Certification

- Skills Learned Trading strategies used in the finance and capital markets

- Career Prep Work in capital markets, whether on the buy-side or the sell-side