Overview

High-Yield Bonds, Subordinated Debt, and Loans Course Overview

In this High-Yield Bonds, Subordinated Debt, and Loans course, we will explore the high-yield category of fixed-income capital markets. We will introduce each asset type and examine their markets. Then, we will look at each asset’s issuers and issuance procedures. We will examine the features and properties of these assets. Finally, we will look at the buyers of these assets, the key risks of buying them, and how you can trade them. This course provides you with the important information you need to consider before delving into high-yield investments. This course uses real market data and examples of high-yield bonds, subordinated debt, and loan screens from leading market data platforms. We also explore the different aspects of high-yield investments and how they apply to real investments that you may encounter as a financial analyst.

This course uses real market data and examples of high-yield bonds, subordinated debt, and loan screens from leading market data platforms. We also explore the different aspects of high-yield investments and how they apply to real investments that you may encounter as a financial analyst.

High-yield bonds, Subordinated Debt, and Loans Learning Objectives

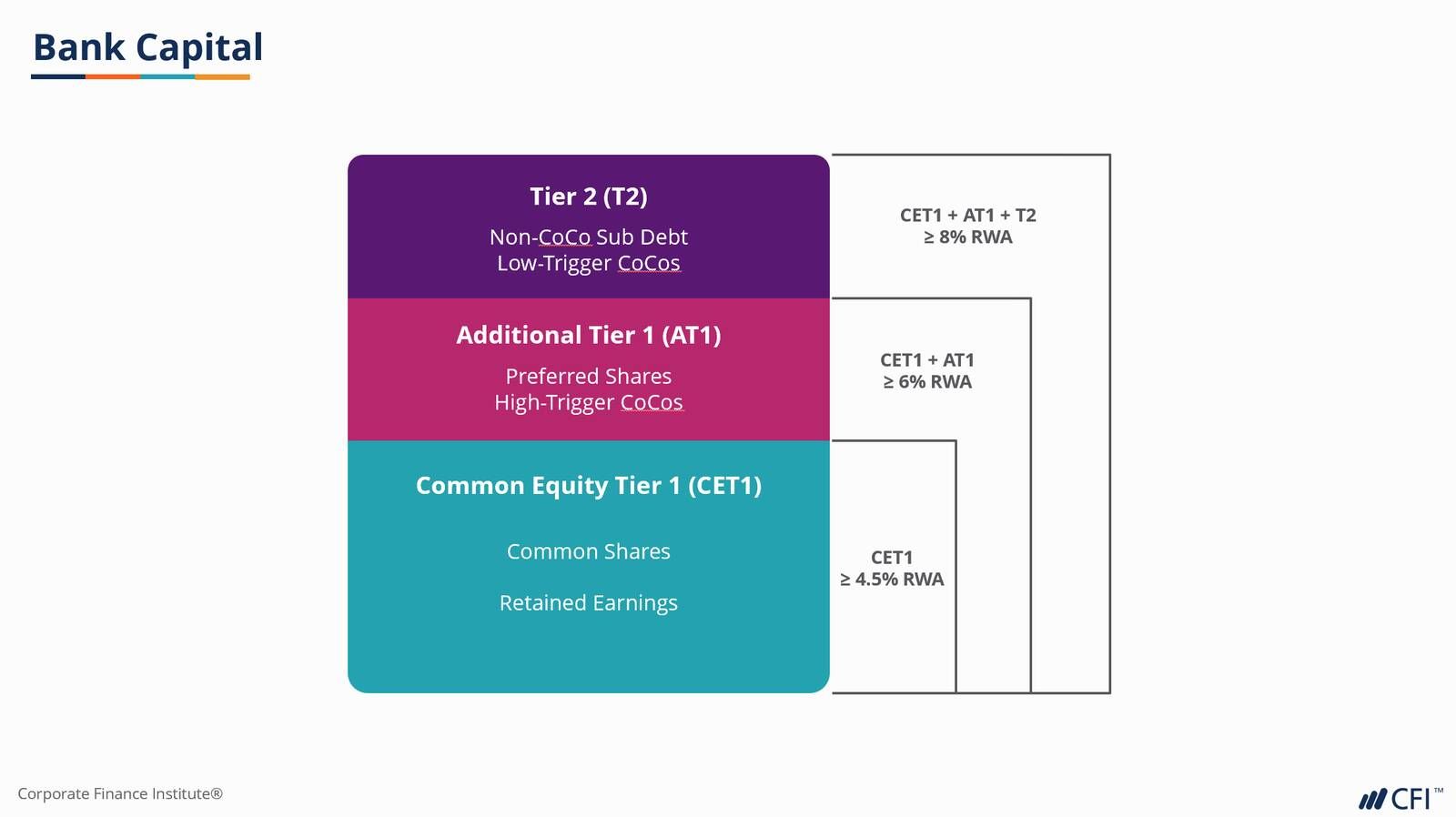

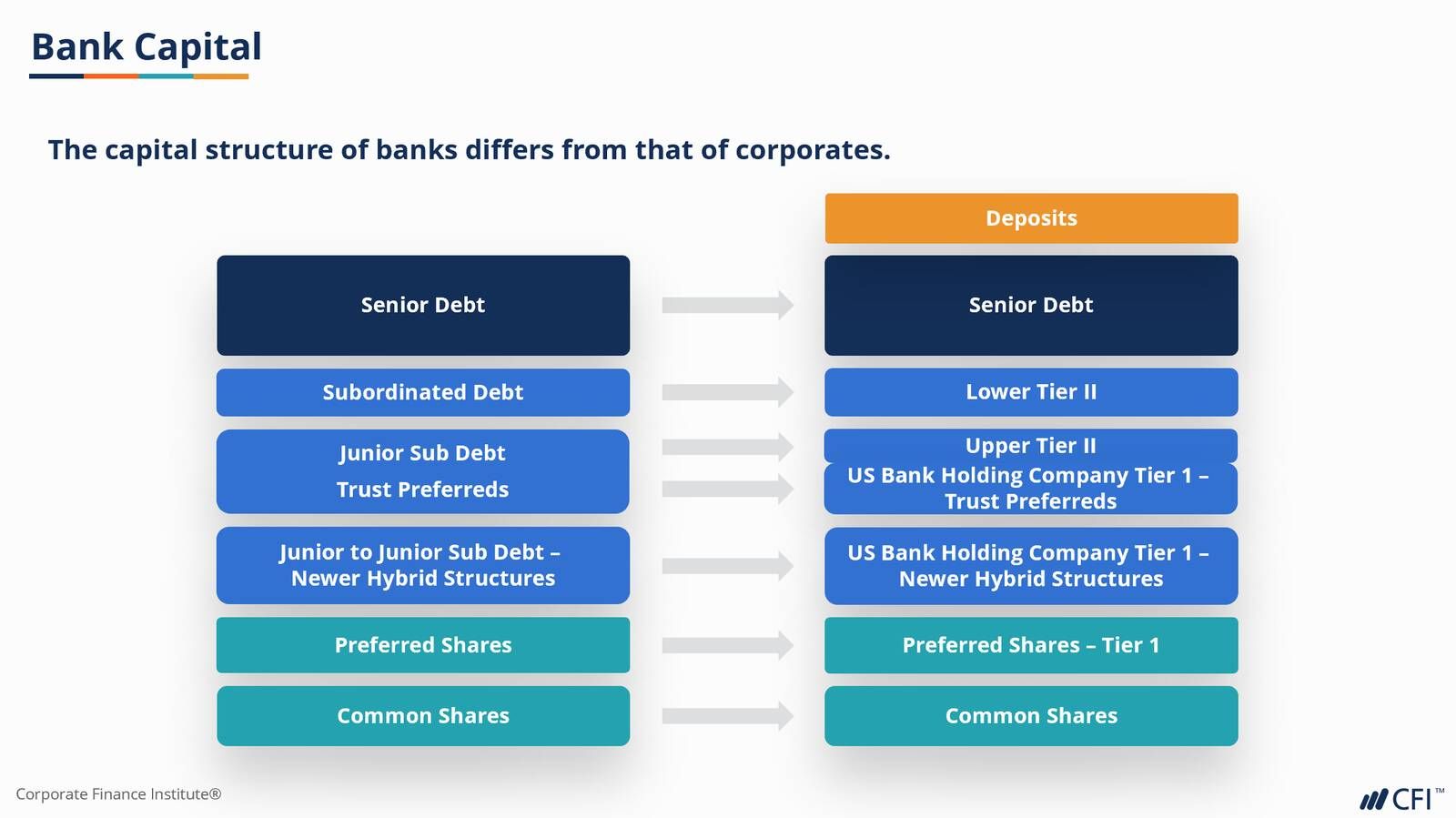

Upon completing this course, you will be able to:- Understand the capital stack, high-yield bonds, subordinated debt, and loans as investments

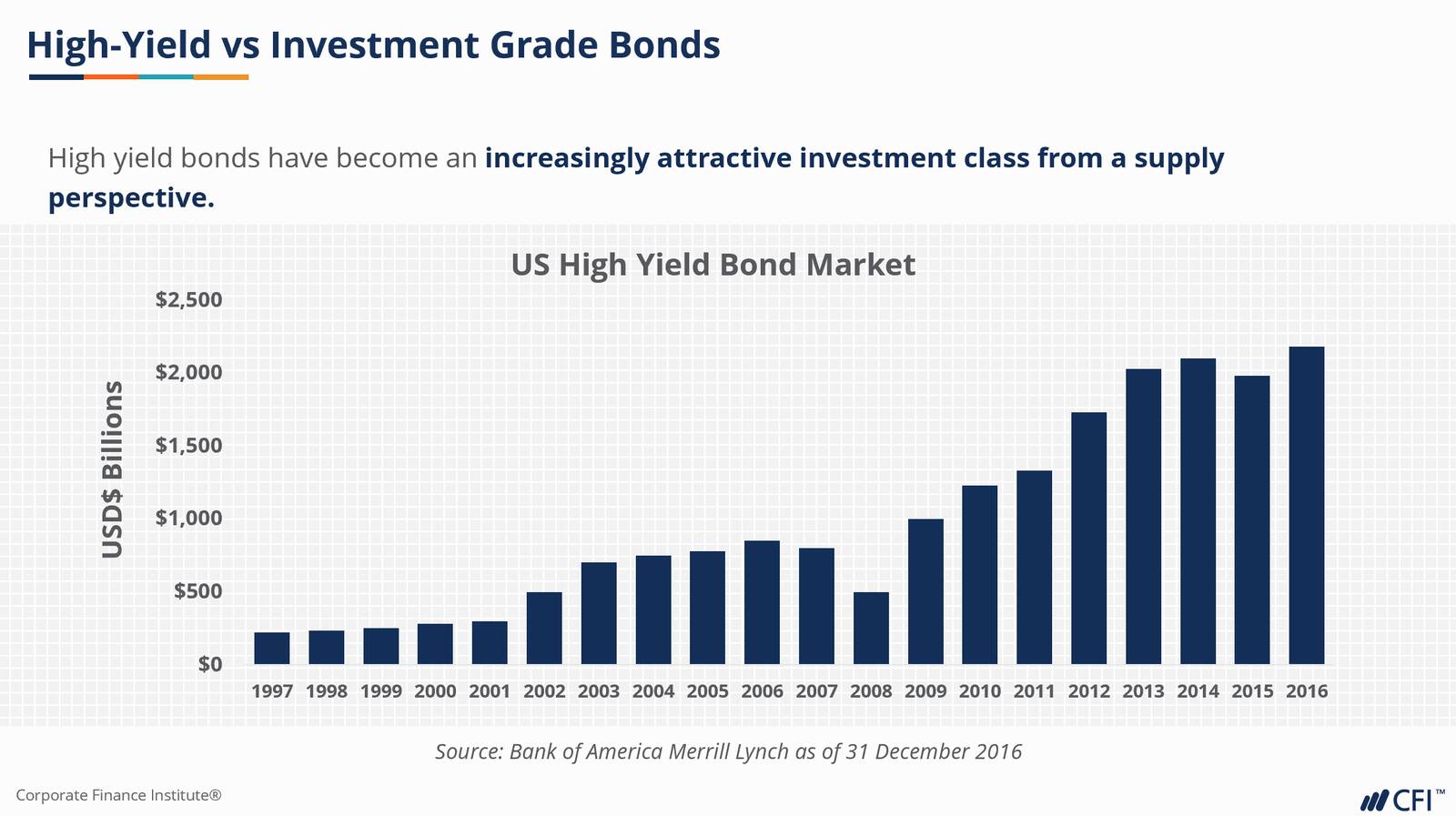

- Comprehend the market dynamics of each of these asset types

- Identify the issuers of these debt instruments and why

- Analyze the buyers and key risks of each asset

- Learn how to identify and analyze high-yield investments on leading market data platforms

Who should take this course?

This High-Yield Bonds, Subordinated Debt, and Loans course is perfect for anyone who wants to build up their understanding of capital markets and specialize in fixed-income instruments. This course is designed to equip anyone who desires to begin a career in fixed-income, sales, trading, or other areas of finance with advanced knowledge of high-yield fixed-income instruments.Prerequisite Courses

Recommended courses to complete before taking this course.

High-Yield Bonds, Subordinated Debt, and Loans

Level 3

2h 11min

100% online and self-paced

Field of Study: Finance

Start LearningWhat you'll learn

High-Yield Bonds

Subordinated Debt

Leveraged Loans

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Capital Markets & Securities Analyst (CMSA®) Certification

- Skills Learned Trading strategies used in the finance and capital markets

- Career Prep Work in capital markets, whether on the buy-side or the sell-side