Overview

Securitized Products Course Overview

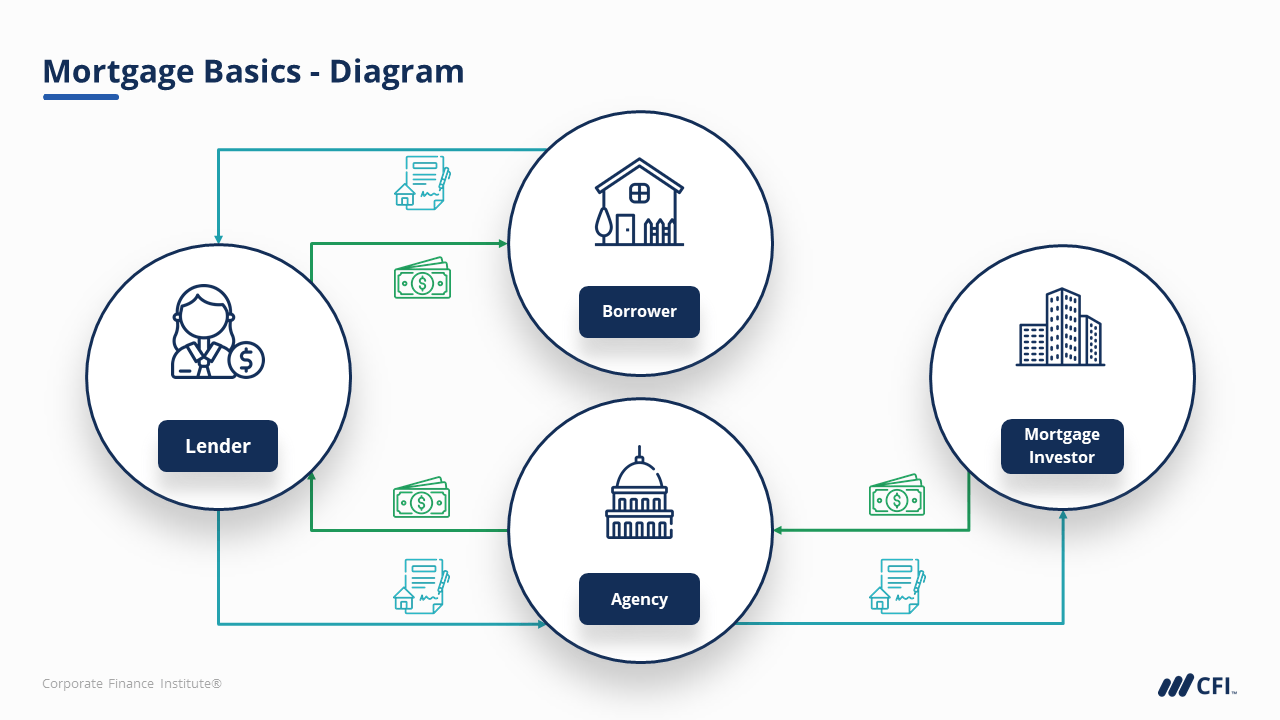

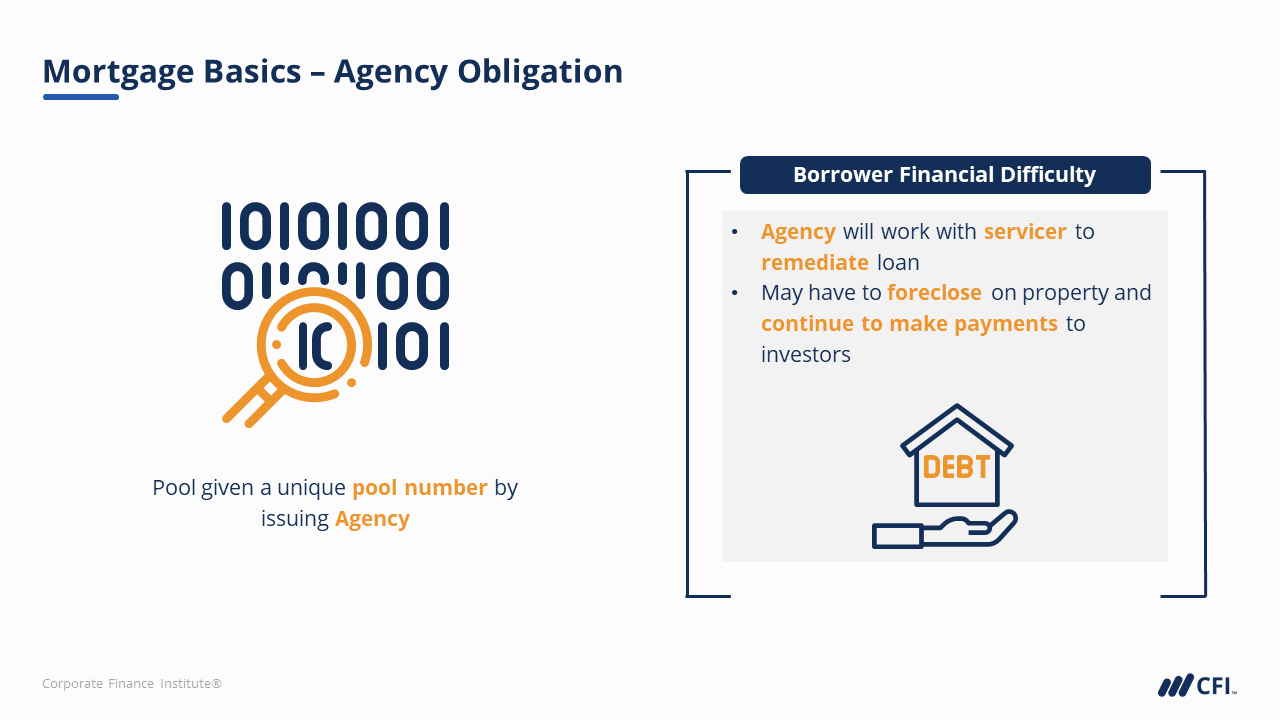

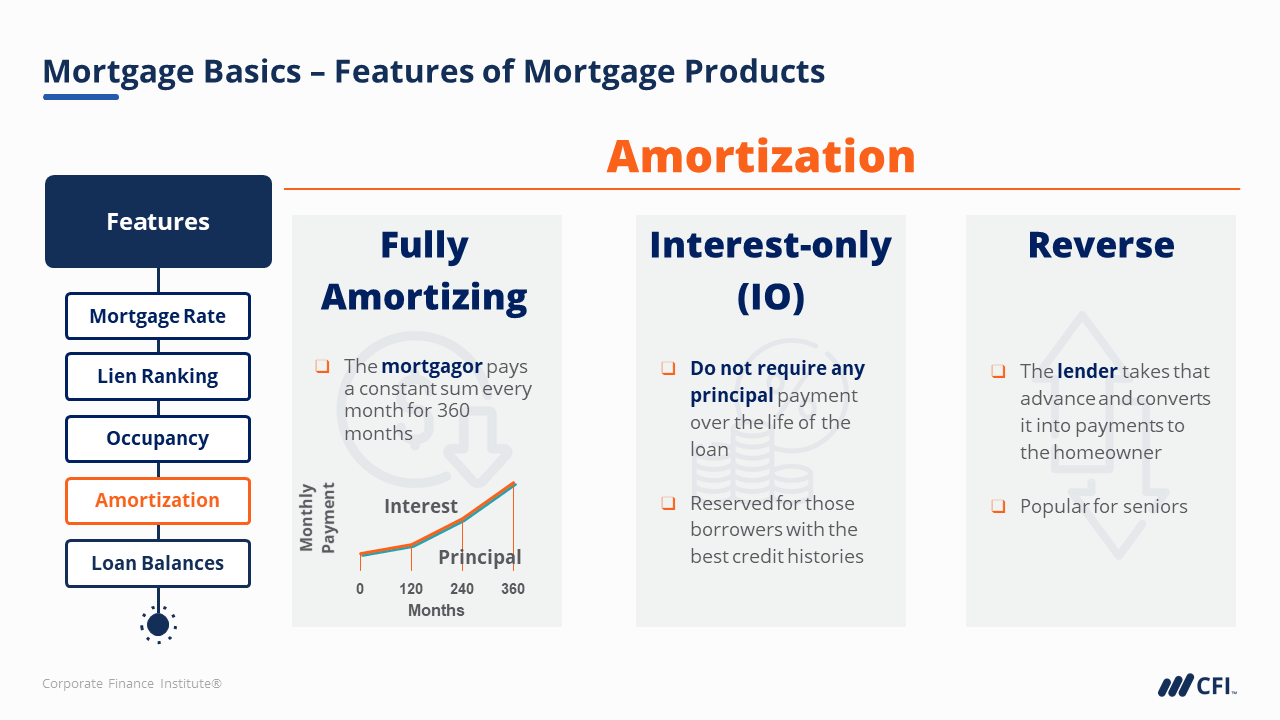

In Securitized Products, we will cover the basics of the securitization process, including its role in the world of finance, the structure of securitized products, and the risks associated with it. We will learn mortgage basics: borrower and loan classifications, features of mortgage products, and the way loans are being pooled into mortgage-backed securities (MBSs).

Securitized Products Learning Objectives

Upon completing this course, you will:- Acquire theoretical knowledge about the securitization process and products

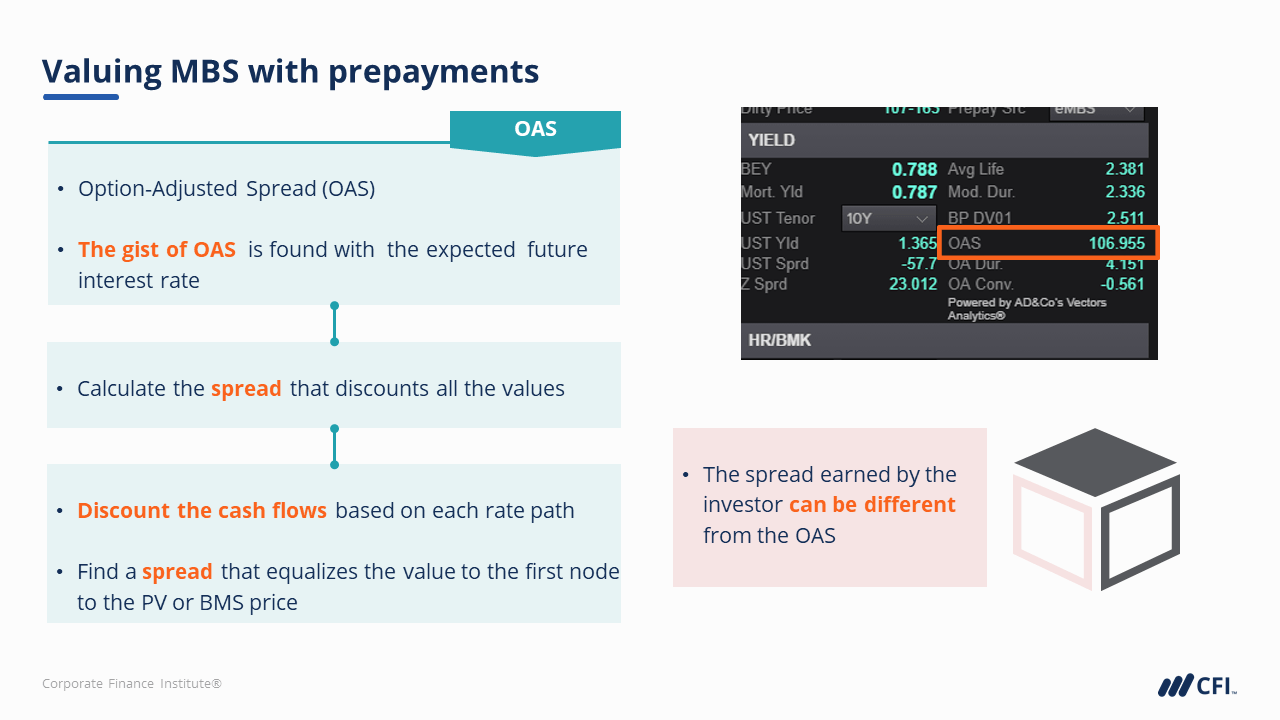

- Get practical experience calculating prepayment speeds and valuing MBS

- Comprehend the role of the US GSEs in the mortgage market

- Be well-versed in the basics of individual mortgage loans and their classification

- Learn how market participants get relative value, how they trade, and how they hedge MBS securities

Who should take this course?

This course is perfect for somebody interested in learning about one of the most critical financial practices that allow achieving liquidity in the market and for somebody who considers securitization finance or any capital markets-related position the desired career path. As this course covers topics from beginner to advanced level, current students and anyone in the early stage of their career and industry professionals seeking to transition to a new industry will gain valuable knowledge from this course.

Prerequisite Courses

Recommended courses to complete before taking this course.

Securitized Products

Level 4

1h 45min

100% online and self-paced

Field of Study: Finance

Start LearningWhat you'll learn

Mortgage Basics

Midway Check-In

Course Summary

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Commercial Banking & Credit Analyst (CBCA®) Certification

- Skills Learned Financial Analysis, Credit Structuring, Risk Management

- Career Prep Commercial Banking, Credit Analyst, Private Lending

Capital Markets & Securities Analyst (CMSA®) Certification

- Skills Learned Trading strategies used in the finance and capital markets

- Career Prep Work in capital markets, whether on the buy-side or the sell-side