Overview

Short Duration Products Course Overview

In this Short Duration Products course, we will explore the many different mechanics, uses, and groups involved in issuing and investing in short-duration products. Short duration products are widely used for investing and financing purposes. This course will dive into money market instruments and short-dated derivatives. These products are some of the most liquid products on the market. By learning about short duration products, you will open your knowledge base for careers in treasury, market making, financing, risk management, and asset management.

Short Duration Products Learning Objectives

Upon completing this course, you will be able to:- Recognize the mechanics, uses, and groups involved in short duration products

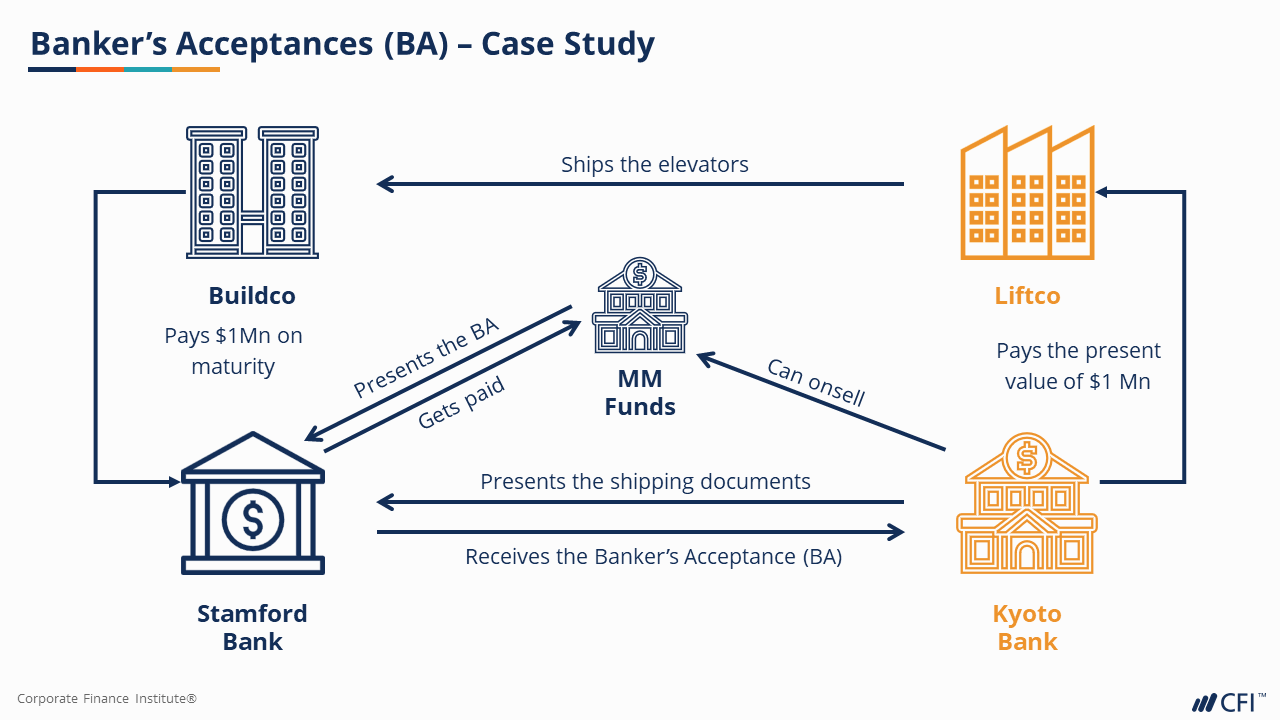

- Recall the features and characteristics of money market instruments

- Identify the issuers and uses of money market instruments

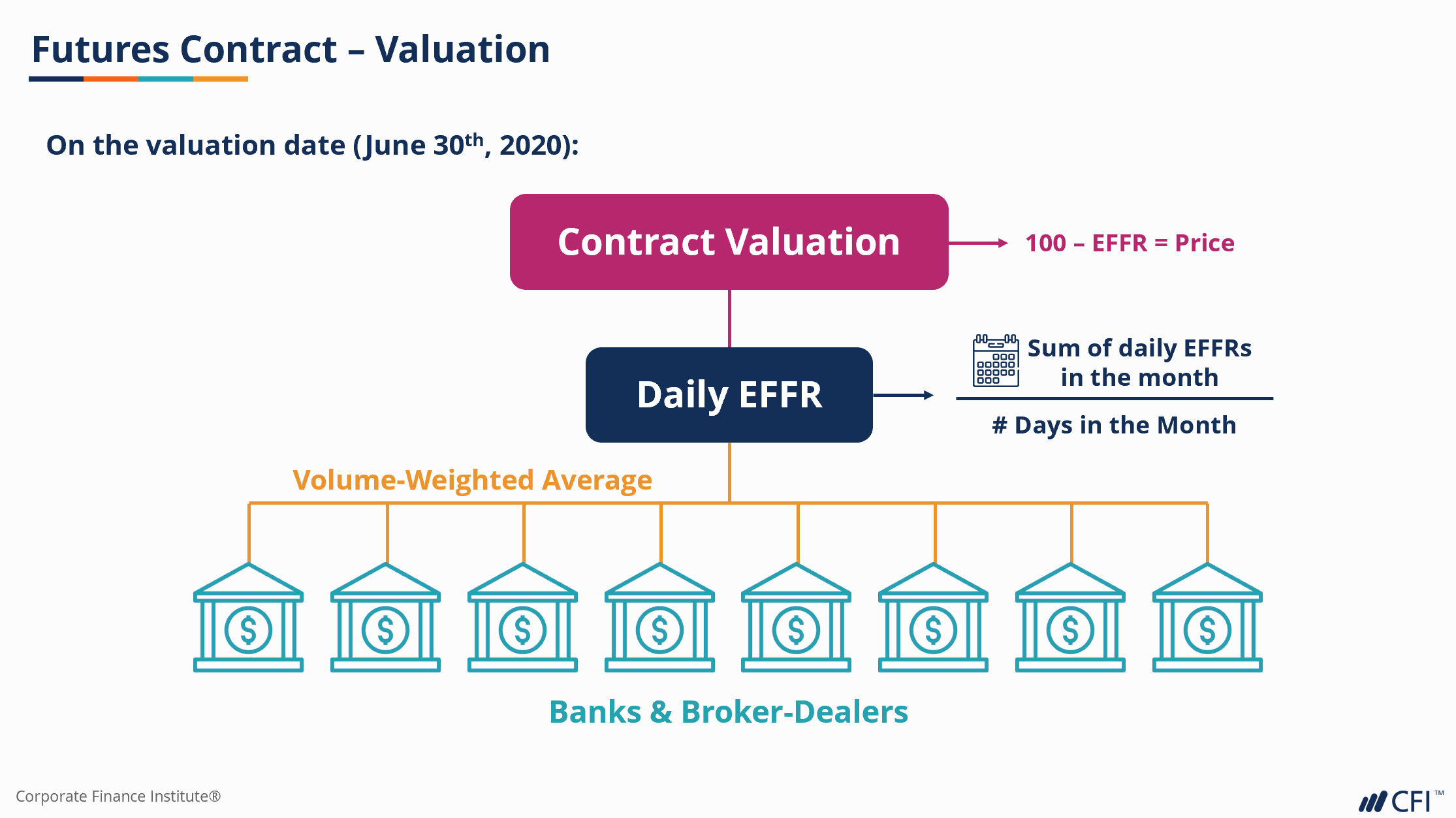

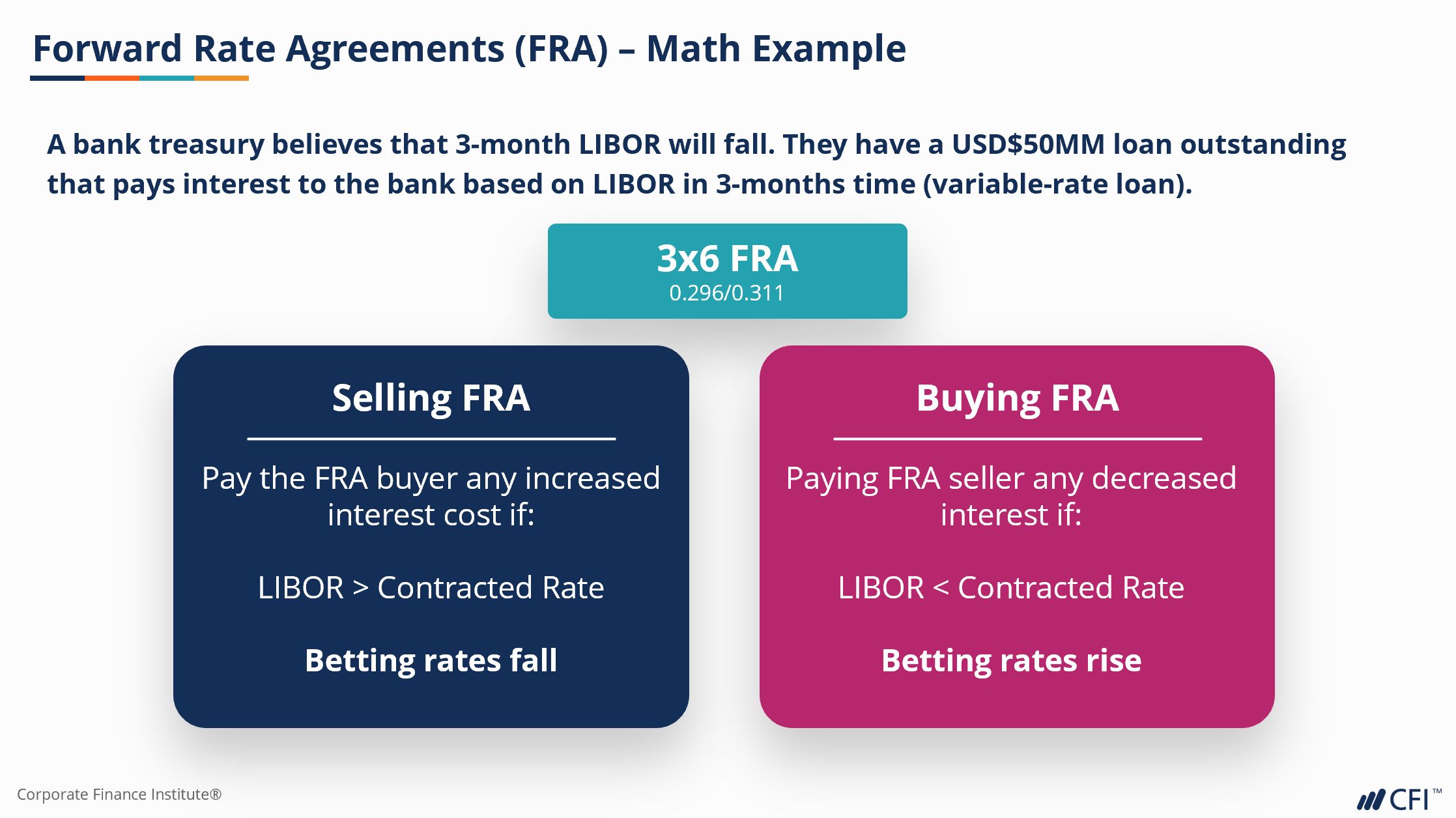

- Analyze different types of short-dated derivatives and their features

Who Should Take This Course?

This Short Duration Products course is perfect for anyone who would like to build up their understanding of capital markets. This course is designed to equip anyone who would like to begin their career in treasury, risk management, asset management, market-making sales & trading by equipping them with the fundamental knowledge of some of the most widely traded products in the world; short duration products.Prerequisite Courses

Recommended courses to complete before taking this course.

Short Duration Products

Level 3

2h 30min

100% online and self-paced

Field of Study: Finance

Start LearningWhat you'll learn

Introduction

Money Market Instruments

Short-Dated Derivatives

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Capital Markets & Securities Analyst (CMSA®) Certification

- Skills Learned Trading strategies used in the finance and capital markets

- Career Prep Work in capital markets, whether on the buy-side or the sell-side