- What is Fintech?

- How Fintech is Transforming the Financial Services Industry

- Types of Fintech Careers

- Skills Required for a Career in Fintech

- Educational Background and Certifications Required for Careers in Fintech

- Career Paths and Growth Opportunities in the Fintech Industry

- The Challenges and Rewards of Fintech Careers

- Tips for Breaking into the Fintech Industry

- Develop a strong foundation in both finance and technology

- Stay updated with industry trends

- Build a relevant skill set

- Gain practical experience

- Network actively

- Consider a traditional finance or tech role

- Future Trends of the Fintech Industry

- Ready for a Career in Fintech?

What is Fintech?

Fintech, short for Financial Technology, refers to the innovative use of technology in designing and delivering financial services and products. It encompasses a wide range of applications, from mobile banking and investment apps to cryptocurrency and blockchain technology.

The Fintech industry emerged as a response to the growing demand for more efficient, accessible, and user-friendly financial services in the digital age. However, the concept of Fintech isn’t entirely new. This technology has been used in financial services for decades, but the term gained prominence in the 21st century. More specifically, the 2008 financial crisis highlighted the need for more transparent, efficient, and consumer-focused financial services, paving the way for innovative startups to challenge traditional financial institutions with technology-driven solutions.

How Fintech is Transforming the Financial Services Industry

Fintech has been and continues to revolutionize the financial services landscape in many ways. The most common ways that have made an impact in how we interact with and use various financial products and services include:

- Increased accessibility: Fintech has democratized access to financial services. Mobile banking apps, peer-to-peer lending platforms, and robo-advisors have enabled individuals to manage their finances, invest, and access loans without traditional barriers.

- Enhanced efficiency: Automation and artificial intelligence have streamlined many financial processes, reducing the time and cost associated with transactions, loan approvals, and investment management.

- Improved customer experience: Fintech companies prioritize user-friendly interfaces and personalized services, setting new standards for customer expectations in the financial sector.

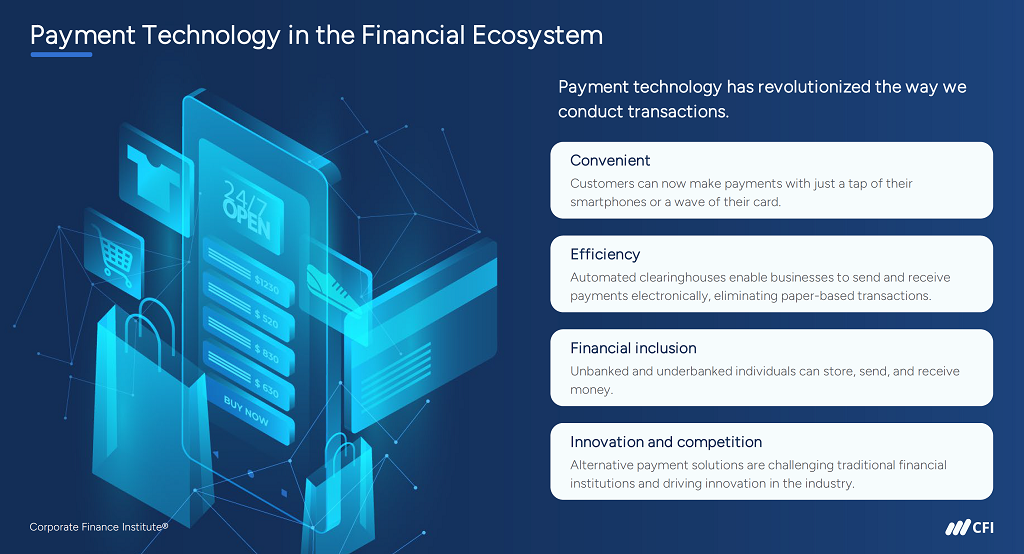

- Innovation in payments: The rise of digital wallets, contactless payments, and cryptocurrencies is changing how we think about and use money.

- Data-driven insights: Advanced analytics and big data technologies allow financial institutions to gain deeper insights into customer behavior, risk assessment, and market trends.

- Regulatory technology (RegTech): Fintech is also transforming how financial institutions manage compliance and regulatory requirements, making these processes more efficient and accurate.

These transformations have forced traditional financial institutions to adapt and innovate, leading to partnerships between banks and Fintech startups, as well as the development of in-house Fintech solutions by established players.

Types of Fintech Careers

The Fintech industry offers diverse career opportunities, blending finance, technology, and innovation. Some key roles in this sector include financial analysts, data analysts, data scientists, product managers, and business development managers.

Here’s an overview of what these types of careers in the industry look like, including their typical daily tasks:

Financial Analyst

Financial analysts in the Fintech industry are essential as they’re responsible for assessing financial data and market trends to guide business decisions. They analyze complex financial information, create financial models, and provide insights to help companies make informed strategic choices.

A typical day for a Fintech financial analyst usually involves:

- Analyzing financial statements and market data

- Creating and maintaining financial models

- Preparing reports on financial performance and projections

- Collaborating with other teams to provide financial insights for product development or business strategies

- Monitoring industry trends and competitor activities

- Evaluating potential investments or partnerships

Data Analyst

Fintech data analysts collect, process, and perform statistical analyses on large datasets. This role is critical in the financial services industry as these professionals extract meaningful insights from financial data to support decision-making processes.

A day in the life of a Fintech data analyst typically includes:

- Collecting and cleaning data from various sources

- Developing and maintaining databases

- Conducting statistical analyses to identify trends and patterns

- Creating visualizations and dashboards to present findings

- Collaborating with other teams to understand data needs and provide insights

- Continuously improving data collection and analysis processes

Data Scientist

Data scientists in Fintech leverage advanced statistical and machine learning techniques to extract deeper insights from complex financial data. They develop predictive models and algorithms that power many Fintech innovations.

A regular day for Fintech data scientists often involves:

- Developing and implementing machine learning models

- Conducting advanced statistical analyses on large datasets

- Creating algorithms for fraud detection, credit scoring, or trading

- Collaborating with engineers to implement models into production systems

- Researching and staying updated on the latest advancements in data science and machine learning

- Presenting findings and recommendations to stakeholders

Product Manager

Product managers in Fintech oversee the development and lifecycle of financial technology products. They work at the intersection of technology, user experience, and business strategy to create innovative financial solutions.

A day in the life of a Fintech product manager could include:

- Defining product vision and strategy

- Collaborating with engineering, design, and marketing teams

- Conducting market research and analyzing user feedback

- Prioritizing features and creating product roadmaps

- Overseeing the product development process

- Analyzing product performance metrics and making data-driven decisions

Business Development Manager

Business development managers in Fintech focus on growing the company through strategic partnerships, new market opportunities, and revenue-generating initiatives. They play a crucial role in expanding the reach and impact of Fintech solutions.

The daily tasks of a Fintech sales or business development manager typically include:

- Identifying and pursuing new partnership opportunities

- Negotiating and structuring deals

- Developing and presenting business proposals

- Analyzing market trends and competitor activities

- Collaborating with internal teams to align business development efforts with product capabilities

- Building and maintaining relationships with key stakeholders and industry players

Skills Required for a Career in Fintech

Success in Fintech jobs requires a unique blend of financial knowledge, technical skills, and soft skills. Here are some key skills needed for a fintech career.

- Financial acumen: A strong understanding of financial concepts, markets, and regulations is crucial. This includes knowledge of banking systems, investment strategies, and risk management.

- Technical proficiency: Familiarity with programming languages (such as Python, R, or Java), data analysis tools, and database management systems is often required. Knowledge of blockchain, AI, and machine learning can be advantageous.

- Data analysis: In fintech, the ability to collect, process, and interpret large datasets is essential. This includes skills in statistical analysis, data visualization, and predictive modeling.

- Problem-solving: Fintech professionals must often tackle complex challenges and develop innovative solutions. Strong analytical and critical thinking skills are vital.

- Adaptability: The Fintech industry evolves rapidly, so learning quickly and adapting to new technologies and methodologies is crucial.

- Communication: It is important to be able to explain complex financial and technical concepts to both technical and non-technical audiences. This includes strong written and verbal communication skills.

- Project management: Many Fintech roles involve managing complex projects from conception to implementation. Organizational skills and the ability to meet deadlines are essential.

- Cybersecurity awareness: Given the sensitive nature of financial data, understanding cybersecurity principles and best practices is increasingly vital in Fintech.

- Regulatory knowledge: Familiarity with financial regulations and compliance requirements is crucial, as Fintech operates in a highly regulated environment.

- Business acumen: Understanding business models, market dynamics, and strategic thinking is valuable for many Fintech roles, particularly in product management and business development.

Educational Background and Certifications Required for Careers in Fintech

The educational requirements for a career in Fintech can vary depending on the specific role and company. However, these are some of the common educational must-haves and good-to-haves for a solid career in the industry:

- Must-have: Bachelor’s degree in Finance, Economics, Computer Science, Mathematics, or related fields

- Good-to-have: Master’s degree in Financial Engineering, Data Science, or Business Administration (MBA) with a focus on Finance or Technology

- Good-to-have: Ph.D. in relevant fields for advanced research positions

In addition to formal education, several certifications can enhance your knowledge and credentials in the Fintech industry:

- Chartered Financial Analyst (CFA): This globally recognized certification demonstrates expertise in investment analysis and portfolio management. It’s particularly valuable for financial analyst roles in Fintech.

- Fintech Industry Professional (FTIP): CFI’s FTIP certification is designed for data scientists, strategists, product managers, analysts, and other Fintech specialists who require credentials in financial technology, cryptocurrency, and other technologies.

- Financial Risk Manager (FRM): Offered by the Global Association of Risk Professionals, this certification is ideal for those focusing on risk management in Fintech. It covers topics like market risk, credit risk, and operational risk.

- Certified Information Systems Security Professional (CISSP): This certification is valuable for Fintech professionals working on various aspects of cybersecurity projects. It covers critical areas of information security and is highly regarded in the industry.

- Certified Financial Technologist (CFT): Offered by the Institute of Banking and Finance Singapore, this certification is specifically designed for Fintech professionals. It covers areas like Fintech innovation, blockchain, and digital transformation in finance.

- AWS Certified Solutions Architect or Google Cloud Professional Cloud Architect: As many Fintech solutions are cloud-based, certifications in major cloud platforms can be beneficial. These demonstrate proficiency in designing and implementing cloud solutions.

- Professional Scrum Master (PSM) or Project Management Professional (PMP): These certifications demonstrate expertise in agile methodologies and project management principles for product managers or those involved in project management.

Career Paths and Growth Opportunities in the Fintech Industry

When working in Fintech, you’ll find that the career paths are diverse and dynamic, with ample opportunities for growth and advancement. Here’s an overview of potential career trajectories for the roles mentioned earlier:

Financial Analyst

- Entry-level: Junior Financial Analyst

- Mid-level: Senior Financial Analyst, Financial Manager

- Advanced: Chief Financial Officer (CFO), Finance Director

- Exit opportunities: Investment Banking, Private Equity, Venture Capital

Data Analyst

- Entry-level: Junior Data Analyst

- Mid-level: Senior Data Analyst, Data Analytics Manager

- Advanced: Head of Analytics, Chief Data Officer

- Exit opportunities: Data Science, Business Intelligence, Management Consulting

Data Scientist

- Entry-level: Junior Data Scientist

- Mid-level: Senior Data Scientist, Lead Data Scientist

- Advanced: Chief Data Scientist, AI Research Scientist

- Exit opportunities: AI/ML Engineering, Quantitative Research, Academia

Product Manager

- Entry-level: Associate Product Manager

- Mid-level: Senior Product Manager, Product Lead

- Advanced: Director of Product, Chief Product Officer

- Exit opportunities: Technology Consulting, Entrepreneurship, Venture Capital

Business Development Manager

- Entry-level: Business Development Associate

- Mid-level: Senior Business Development Manager, Head of Partnerships

- Advanced: VP of Business Development, Chief Business Officer

- Exit opportunities: Strategy Consulting, Corporate Development, Entrepreneurship

In addition to vertical growth within these career paths, there are also opportunities for horizontal moves between different areas of the industry. For example, a data analyst might transition into a product management role, leveraging their data skills to drive product decisions.

The rapidly evolving nature of the Fintech space also means that new roles and specializations are constantly cropping up. Professionals who stay updated with the latest trends and technologies can find opportunities in emerging areas such as blockchain development, AI ethics, or sustainable finance.

The Challenges and Rewards of Fintech Careers

The Fintech industry not only offers plenty of career opportunities, but it also offers the following benefits:

- Innovation at the forefront: Fintech is at the cutting edge of both finance and technology, offering the opportunity to work on innovative solutions that are reshaping the financial landscape.

- High growth potential: The Fintech sector continues to grow rapidly, offering numerous opportunities for career advancement and the potential to make a significant impact.

- Competitive compensation: Fintech roles often come with attractive salaries and benefits packages due to the high demand for skilled professionals.

- Diverse and dynamic work environment: Fintech companies often have a startup-like culture, promoting creativity, collaboration, and continuous learning.

- Global impact: Fintech solutions have the potential to improve financial inclusion and accessibility on a global scale, offering the opportunity to make a meaningful difference in people’s lives.

- Skill development: Working in Fintech allows professionals to develop a unique skill set that combines financial expertise with technological proficiency, making them valuable in various industries.

- Entrepreneurial opportunities: The Fintech sector is ripe for innovation, offering numerous opportunities for entrepreneurial-minded individuals to start their own impactful ventures.

While rewarding, careers in Fintech also come with their own set of challenges, including:

- Rapid technological changes: The industry’s fast-paced nature requires continuous learning and adaptation to new technologies and methodologies.

- Regulatory complexity: Navigating the complex and evolving regulatory landscape can be challenging, particularly for innovative Fintech solutions. Remaining compliant with regulatory laws and requirements globally is critical for companies within the industry, as being found non-compliant can cause significant setbacks as well as complete shutdowns.

- Cybersecurity threats: The financial sector is a prime target for cyberattacks, putting pressure on Fintech professionals to maintain top-notch security measures.

- Competitive job market: The high demand for Fintech talent means the job market can be highly competitive, particularly for senior roles.

- Work-life balance: The fast-paced nature of Fintech startups can sometimes lead to long working hours and high-stress environments.

- Bridging knowledge gaps: Fintech requires expertise in both finance and technology, which can be challenging for professionals from traditional finance or tech backgrounds.

- Uncertain business models: Some Fintech startups may struggle to achieve profitability or face challenges in scaling their business models.

Tips for Breaking into the Fintech Industry

If you’re interested in starting a career in Fintech, here are some actionable tips to help you on your way:

Develop a strong foundation in both finance and technology

Beginning with a formal education and including self-study, aim to build knowledge in areas like financial markets, data analysis, and programming. This dual expertise is highly valued in Fintech, and it will allow you to continue evolving your knowledge base as the industry evolves.

Stay updated with industry trends

Follow Fintech news, attend industry conferences, and participate in webinars to stay informed about the latest developments. This knowledge will be valuable during interviews and your work, especially during pivotal times when companies rely on innovation and new ideas to drive success.

Build a relevant skill set

Focus on developing skills in high demand in Fintech, such as data analysis, machine learning, blockchain, distributed ledger technology, or API development. Plenty of online courses exist for this purpose and are great resources for skill development.

Gain practical experience

Look for internships, part-time roles, or freelance projects you can apply for with Fintech companies. If these aren’t immediately available, consider working on personal projects or contributing to open-source Fintech projects to build your portfolio. The more real-world experience you have, the easier it will be to land the industry job you want.

Network actively

Make it a point to attend fintech meetups, join online communities, and connect with industry professionals. Networking can lead to mentorship opportunities, job leads, and valuable insights about the industry. It’s also another way to stay updated on the latest news and trends within the industry.

Consider a traditional finance or tech role

If you’re struggling to land a Fintech role directly, consider starting in a related field like traditional banking or software development. You can then leverage this experience to eventually transition into the career you want, and it’ll give you some hands-on experience and the time to work toward specific credentials that can bolster your resume.

Future Trends of the Fintech Industry

The Fintech industry continues to evolve rapidly, with several key trends shaping its future:

- AI and Machine Learning: AI and ML will play an increasingly important role in fraud detection, personalized financial advice, and algorithmic trading.

- Blockchain and decentralized finance (DeFi): The use of blockchain technology is expected to grow, particularly in areas like cross-border payments, smart contracts, and decentralized financial services.

- Open banking and APIs: The trend towards open banking, where financial data is shared securely between institutions via APIs, is likely to accelerate, leading to more integrated and personalized financial services.

- Sustainable finance: There’s growing interest in using Fintech to promote sustainable and ethical financial practices, including green investments and impact investing.

- Financial inclusion: Fintech will be crucial in expanding access to financial services for underserved populations globally.

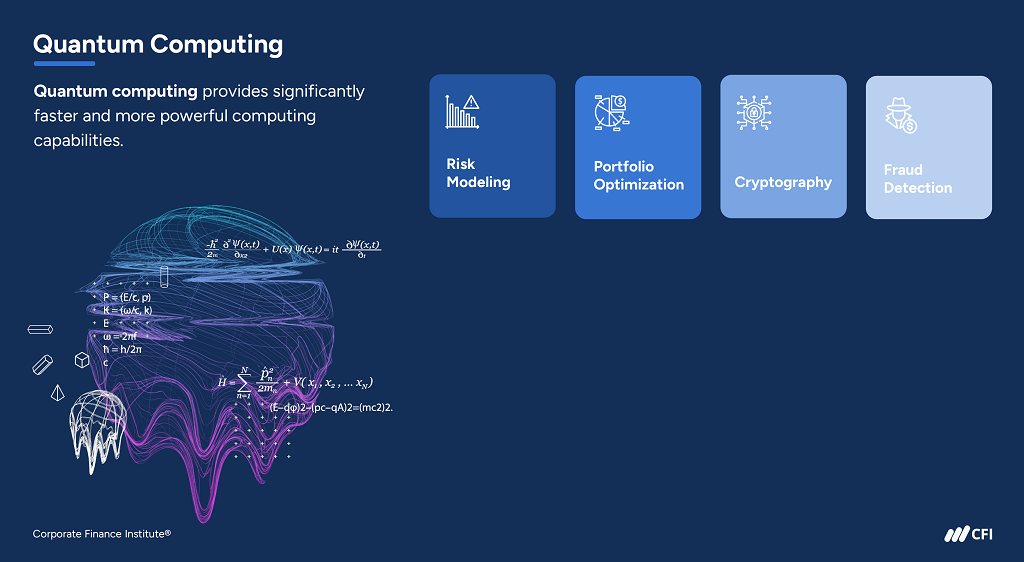

- Quantum computing: While still in its early stages, quantum computing has the potential to revolutionize areas like cryptography and complex financial modeling.

These trends suggest that the Fintech industry will continue to offer exciting opportunities for innovation and career growth in the coming years.

Ready for a Career in Fintech?

The Fintech industry represents a dynamic and rapidly evolving sector at the intersection of finance, business operations, and technology, offering diverse career opportunities for finance professionals with a range of skills. For those interested in pursuing a career in Fintech, developing a strong foundation in both finance and technology is crucial—as is staying updated with industry trends, building relevant skills, and actively networking.

Consider exploring CFI’s comprehensive course catalog and certification offerings to get started on your Fintech career. These programs can help you develop the skills and knowledge needed to succeed in this industry.

Additional Resources

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in