0 search results for ‘’

People also search for:

excel

power bi

esg

accounting

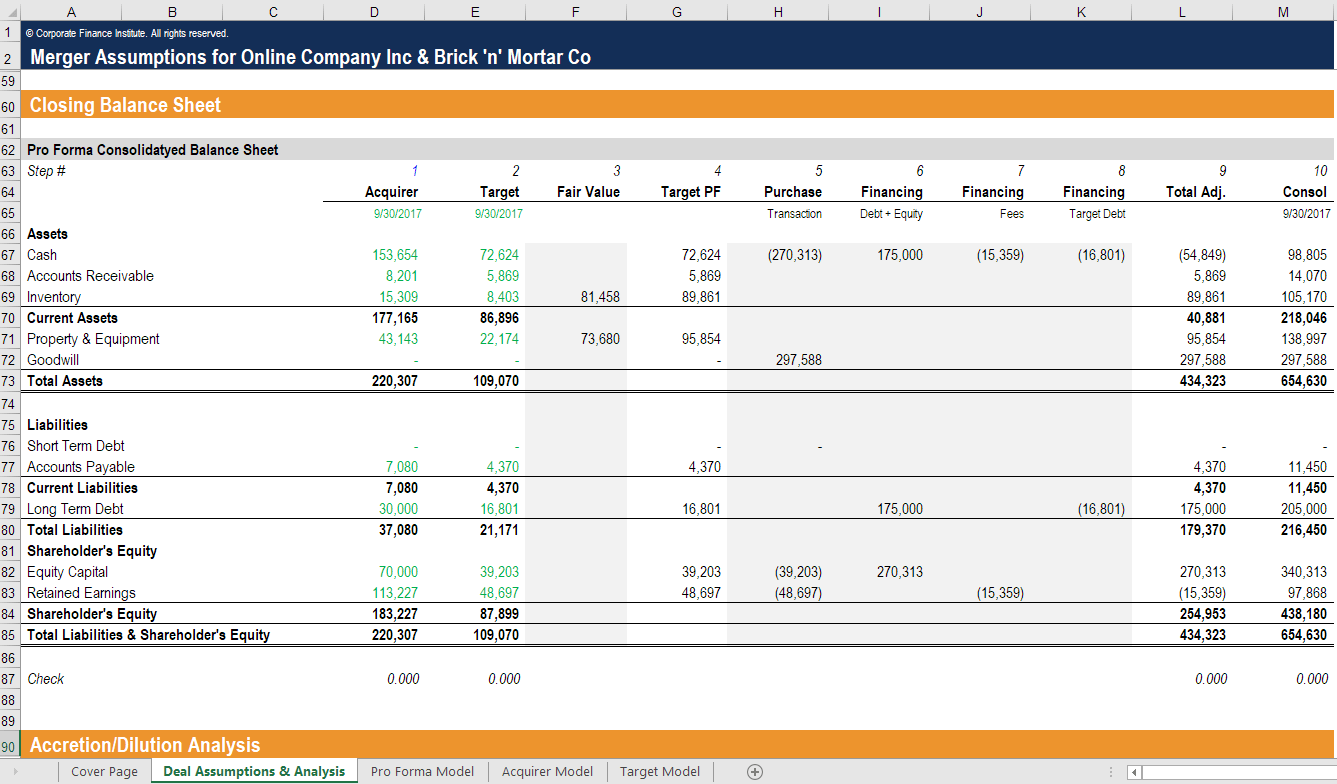

balance sheet

fmva

real estate

Explore Our Certifications

Resources

Popular Courses

Recent Searches