Credit Analysis

The process of determining a debtor’s ability to repay loan obligations

Over 1.8 million professionals use CFI to learn accounting, financial analysis, modeling and more. Start with a free account to explore 20+ always-free courses and hundreds of finance templates and cheat sheets.

What is Credit Analysis?

Credit analysis is a process undertaken by lenders to understand the creditworthiness of a prospective borrower, meaning how capable (and how likely) they are of repaying principal and interest obligations.

The borrower, also known as the debtor, could be an individual or a business entity; the former is referred to as retail (or personal) lending, and the latter is what’s known as commercial lending.

Lenders, also known as creditors, employ a variety of qualitative and quantitative techniques (including risk models) when conducting credit analysis in order to quantify and effectively price risk.

Key Highlights

- Credit analysis is how lenders understand a borrower’s creditworthiness, whether they’re a business or an individual.

- Analysts use a variety of qualitative and quantitative techniques and frameworks to conduct credit analysis.

- A common framework to support credit analysis is the 5 Cs of Credit.

- Technology platforms called “Fintechs” are looking to disrupt traditional credit analysis techniques by developing AI and machine-learning programs to evaluate credit risk.

What is Credit?

Credit is “created” when one party receives resources from another party, but payment is not expected until some contracted date (or dates) in the future.

The resource may be cash, as is the case with a bank loan. Alternatively, the resource may be a physical product (like inventory); this is called trade credit.

In both cases, credit risk exists. This is defined as the risk that a creditor will advance resources to a debtor, but that payment (or repayment) will not be made. Credit analysis is conducted in order to understand the level of credit risk presented by a borrower, given the parameters of a specific credit request.

How is Credit Analysis Conducted?

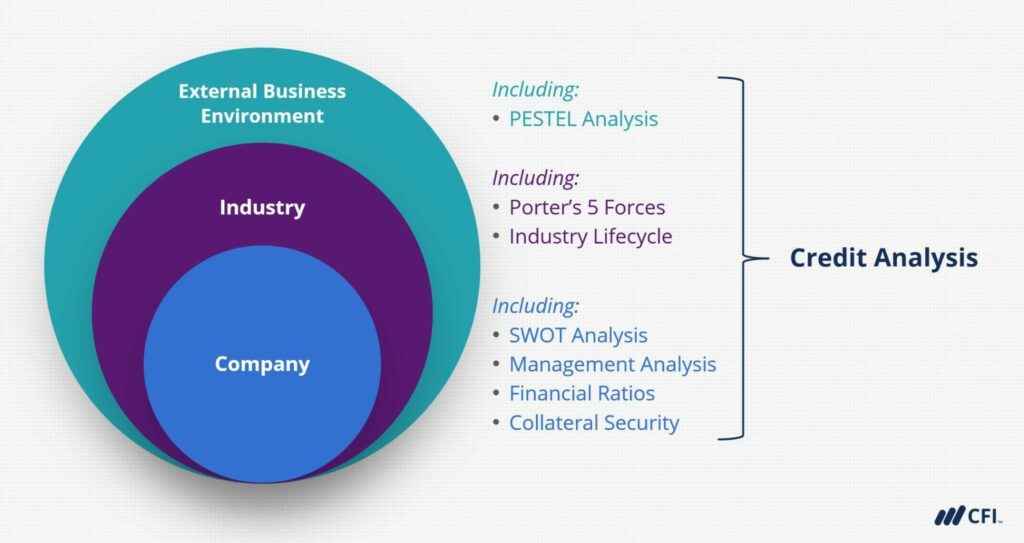

Credit professionals analyzing a prospective borrower will employ a variety of qualitative and quantitative techniques.

Qualitative techniques include trying to understand risks in the external environment, like where interest rates are heading and the state of the broader economy, among others. A framework like PESTEL is often employed.

For commercial lenders, specifically, they’ll also want to understand business characteristics – like the borrower’s competitive advantage(s) and industry trends (using frameworks like SWOT and Porter’s 5 Forces, respectively). Management experience is another very important consideration.

Quantitative elements of the analysis include assessing financial ratios using risk models, understanding financial projections, employing sensitivity analysis, and evaluating the strength of any physical collateral that could serve as security against the credit exposure.

Credit Analysis Framework – The 5 Cs

A popular credit analysis framework is the 5 Cs of Credit; the 5 Cs underpin the component parts of most risk rating and loan pricing models. The 5 Cs are:

- Character – This is about understanding who the borrower is, including what their credit history may tell us about their likelihood of making future loan payments.

- Capacity – This speaks to the borrower’s actual ability to make payments using internally-generated cash flow (by the company for a business borrower or by way of personal earnings for a retail borrower).

- Capital – This is an evaluation of the borrower’s overall financial health but also an assessment of alternative sources of liquidity should it be necessary.

- Collateral – This factors in the quality and the overall desirability of any physical assets that are available as security.

- Conditions – This is, in part, understanding the purpose of the loan proceeds but also “conditions” in the external environment that may impact the borrower’s financial health and cash position.

Commercial Credit Analysis

Personal lending (often referred to as “retail credit”) tends to be much more formulaic than its commercial counterpart.

With commercial credit analysis specifically – where the borrower is seeking a business loan – lenders must make sense of each individual business entity. And as we know, no two businesses are completely alike.

Underwriting commercial credit requires a larger number of quantitative and qualitative data points, which go into a risk model to calculate a corporate credit rating. This credit rating (or score) directly impacts pricing and other elements of loan structure.

There is considerable opportunity for finance enthusiasts that wish to make a career in commercial banking; 2022 commercial banking industry revenue in the United States was estimated at USD$963bn[1].

Careers in Credit Analysis

Strong credit analysis and lending management skills can open the door to a range of job opportunities in financial services, whether you’re seeking a career in personal or corporate finance. Some prospective employers include:

Financial Institutions

This includes traditional commercial banks of all sizes, as well as credit unions. There are countless relationship management, analyst, and risk management-type roles at financial institutions where someone with strong credit acumen can build a very rewarding career for themselves.

Private Lenders

Private, non-bank lenders come in many shapes and sizes, including residential and commercial real estate lending, equipment finance, and asset-based lending, among others. There are also many opportunities for people with lending experience to look at private loan and mortgage broker firms.

Corporations

Many businesses that sell B2B extend credit terms to their customers; this is what’s called trade credit. Many large corporations employ entire teams of credit analysts to assess the creditworthiness of prospective customers and to set reasonable limits on their accounts.

Rating Agencies

Rating agencies like Fitch and Moody’s employ teams of credit analysts to assess the credit risk of publicly traded companies. This fixed income credit analysis supports debt ratings that are used to price fixed income securities, which trade publicly (like corporate bonds).

Institutional Investors

These firms also hire credit analysts to manage risk in their investment portfolios, or even to manage the balance sheets of individual private companies that the firm has invested in and which employ debt in their capital structures.

Fintechs & Credit Analysis

Fintech is an abbreviation of two words – “financial technology.” For decades, technology applications have disrupted traditional products and services across a variety of sectors; financial services is no exception.

Many technology companies are developing AI (artificial intelligence) and machine learning-driven algorithms and programs to analyze and underwrite credit more quickly and efficiently than traditional financial services firms, which rely heavily on human intermediaries and considerable paperwork.

While much of the disruption and development has occurred in personal lending (where underwriting credit is more homogenous and generally involves fewer data points), some companies are also trying to innovate in the commercial credit space, particularly at the smaller end of the business landscape.

Related Resources

CFI offers the Commercial Banking & Credit Analyst™ certification program for those looking to take their careers to the next level. To keep learning and advancing your career, the following resources will be helpful:

- Loan Structure

- Collateral Quality

- Careers in Commercial Banking

- Debt Default

- See all commercial lending resources

Article Sources

Fundamentals of Credit

Learn what credit is, compare important loan characteristics, and cover the qualitative and quantitative techniques used in the analysis and underwriting process.

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in