0 search results for ‘’

People also search for:

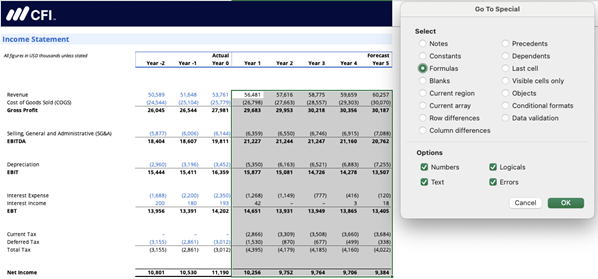

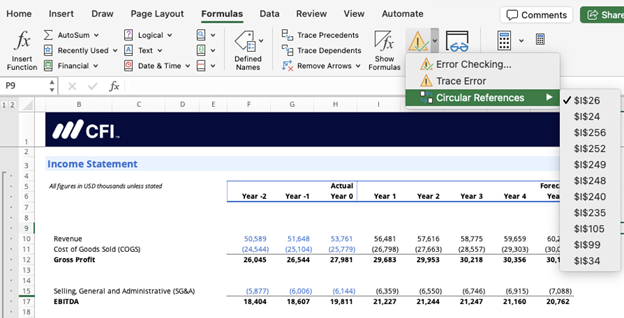

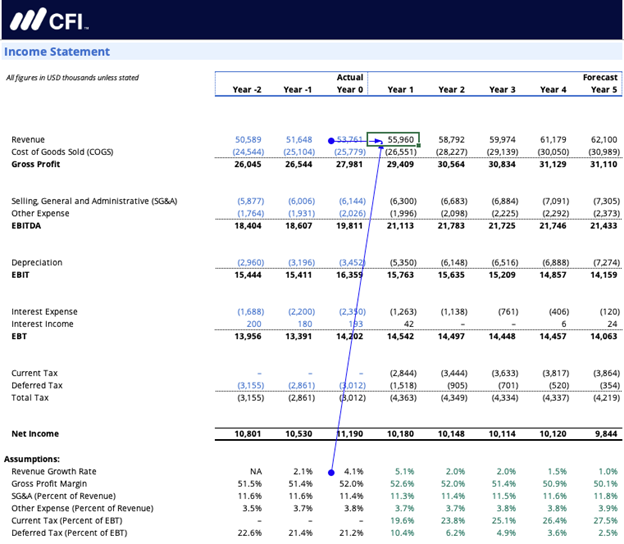

excel

power bi

esg

accounting

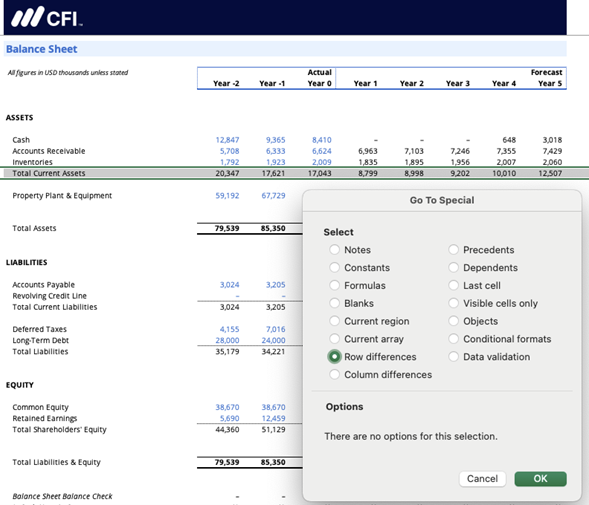

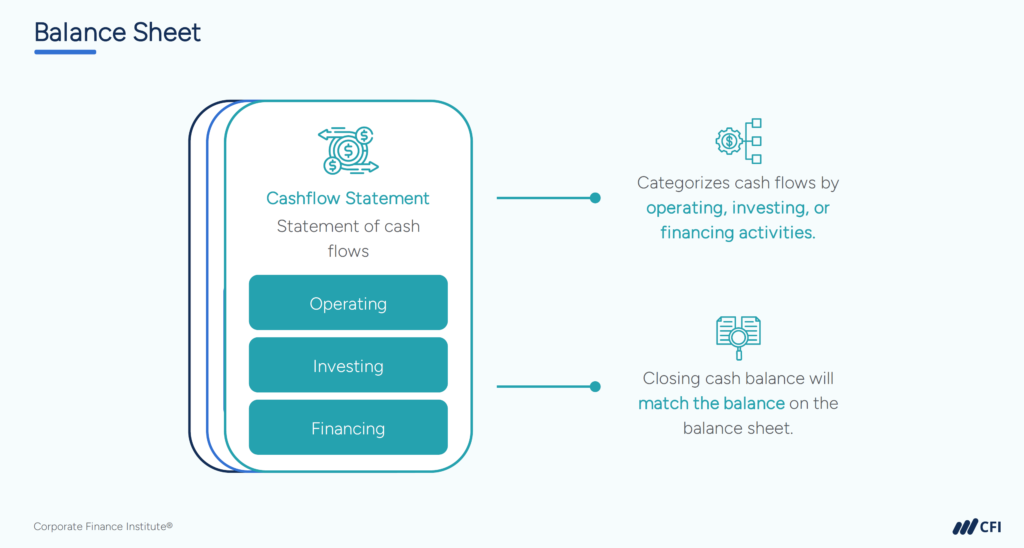

balance sheet

fmva

real estate

Explore Our Certifications

Resources

Popular Courses

Recent Searches

How to Fix It

How to Fix It Quick Tips

Quick Tips