Career Resources From CFI

Topic Overview

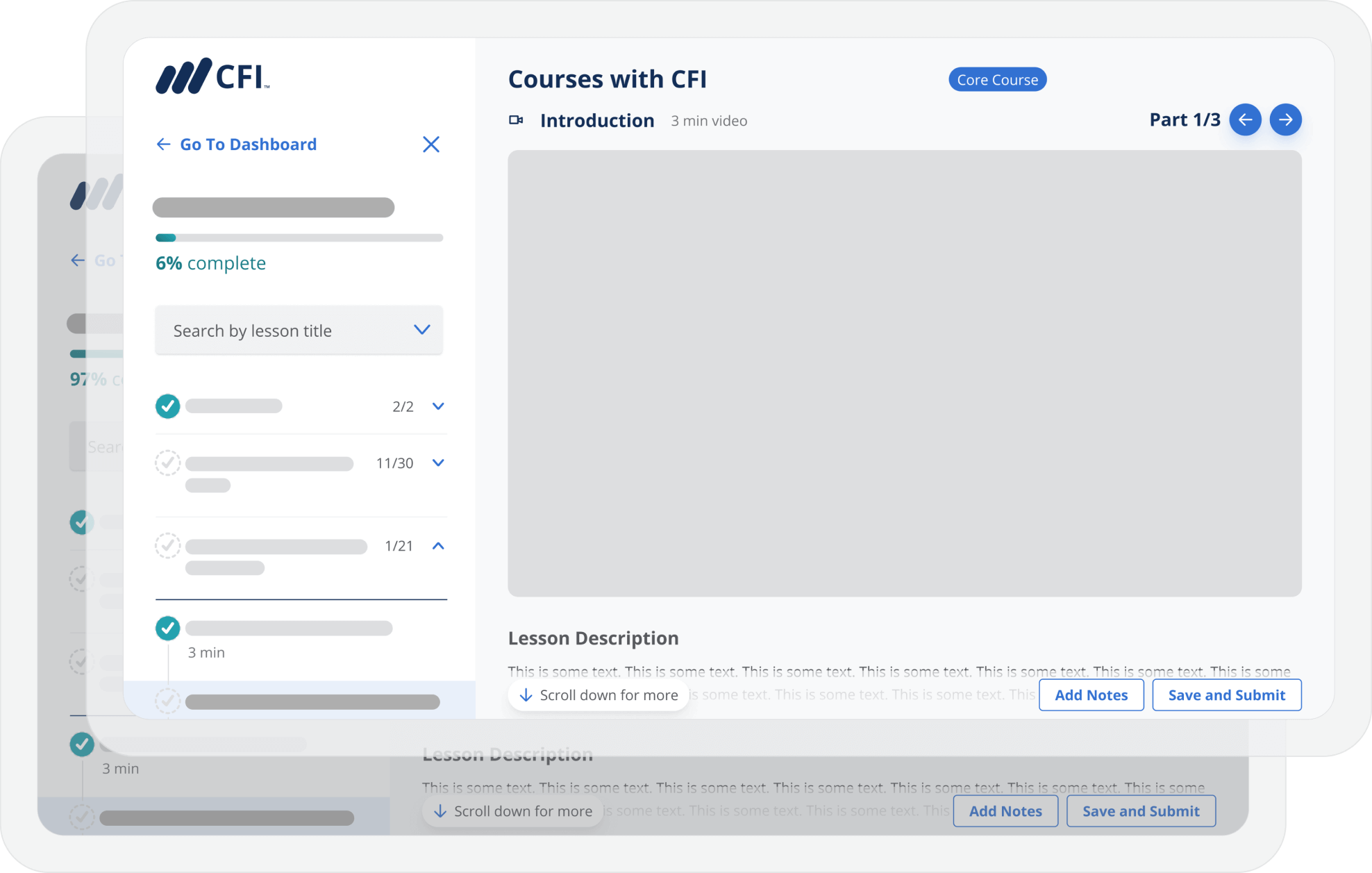

9 courses

Consisting of over 420+ lessons

40+ interactive exercises

Learn by doing with guided simulations

Expert Instructors

Learn from the very best

New courses monthly

On need-to-know subject matter

Blockchain certificates

To verify your financial skills

500,000+ 5 star ratings

Best-in-class training, as rated by you

Find the Right Career Course

Top Career Courses

Browse all coursesWhy Learn With CFI?

CFI is the leading learning and productivity resource for finance and banking professionals for a reason.

Focused on practical skill-building guided by experienced professionals, CFI courses are designed to help you learn by doing and gain real-world knowledge you can put to work right away. On-demand lessons mean you can go at your own pace and learn anytime, from anywhere, and range from beginner to advanced for professionals at any level.

And because CFI memberships offer unlimited access across programs and specializations, as well as free career resources, you can become an expert in any area of finance you choose.

Over 75% of CFI learners report improved productivity or competency within weeks.

With CFI Career Courses, You Can Discover:

Who Should Take CFI Career Courses?

Investment professionals

Management consultants

Financial analysts

Registered Provider: National Association of State Boards of Accountancy

All courses are accredited by the Better Business Bureau (BBB), CPA Institutions in Canada, and the National Association of State Boards of Accountancy (NASBA) in the US. Most courses qualify for verified CPE credits for CPA charter holders.

Courses include video lessons, quizzes, and final assessments.