Learn Financial Modeling with CFI

Topic Overview

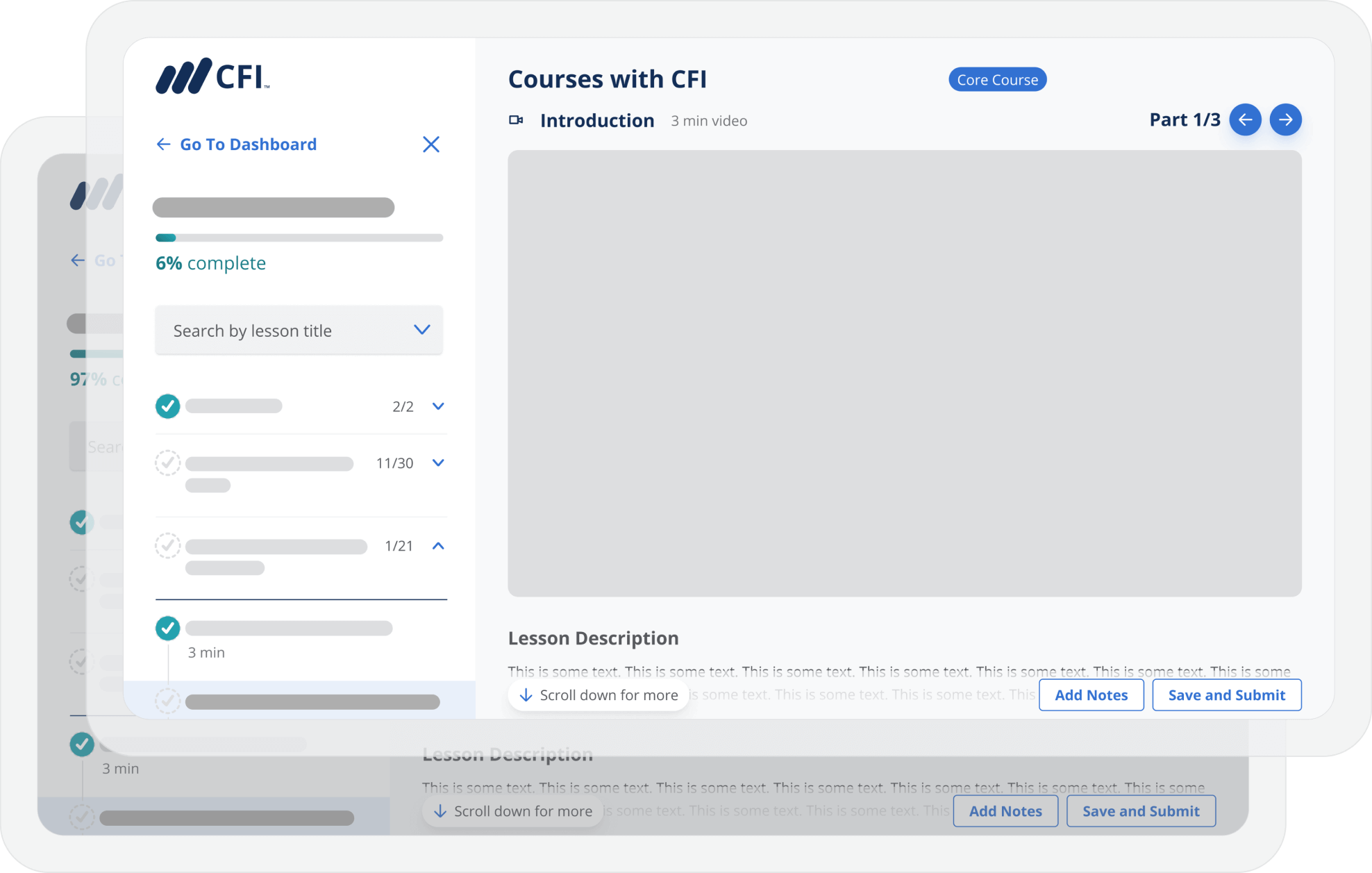

30 courses

Consisting of over 1900+ lessons

140+ interactive exercises

Learn by doing with guided simulations

Expert instructors

Learn from the very best

New courses monthly

On need-to-know subject matter

Blockchain cetificate

To verify your skills

500,000+ 5 star ratings

Best-in-class training, as rated by you

Find the right Financial Modeling course

Top Finance Modeling Courses

Browse all coursesWhy Learn Financial Modeling with CFI?

As one of the leading providers in online finance certification programs, CFI helps current and aspiring finance professionals reach their career goals. All of our financial modeling courses are designed by professional trainers with decades of experience training financial modeling at global financial institutions.

We offer comprehensive financial modeling education that combines theory with application to build real-world skills. All programs are online and self-paced, so you can learn in your free time and develop your skill set anytime, from anywhere.

Over 75% of CFI learners report improved productivity or competency within weeks.

With our financial modeling courses, you can learn how to:

Who should take these courses?

Investment professionals

Management consultants

Financial analysts

Registered Provider: National Association of State Boards of Accountancy

All courses are accredited by the Better Business Bureau (BBB), CPA Institutions in Canada, and the National Association of State Boards of Accountancy (NASBA) in the US. Most courses qualify for verified CPE credits for CPA charter holders.

Courses include video lessons, quizzes, and final assessments.