- What is the Free Cash Flow (FCF) Formula?

- Types of Free Cash Flow

- How to Derive the Free Cash Flow Formula

- Download the Free Cash Flow (FCF) Template

- Importance of Free Cash Flow

- Levered and Unlevered Free Cash Flow

- FCF Formula in Financial Modeling, Analysis, and Valuation

- Limitations Associated with Free Cash Flow

Free Cash Flow (FCF) Formula

The Generic Free Cash Flow Formula

What is the Free Cash Flow (FCF) Formula?

The generic Free Cash Flow (FCF) Formula is equal to Cash from Operations minus Capital Expenditures. FCF represents the amount of cash generated by a business, after accounting for reinvestment in non-current capital assets by the company. This figure is also sometimes compared to Free Cash Flow to Equity or Free Cash Flow to the Firm (see a comparison of cash flow types).

Formula

Free Cash Flow = Cash from Operations – CapEx

Free cash flow is one measure of a company’s financial performance. It shows the cash that a company can produce after deducting the purchase of assets such as property, equipment, and other major investments from its operating cash flow. In other words, FCF measures a company’s ability to produce what investors care most about: cash that’s available to be distributed in a discretionary way.

Key Highlights

- Free cash flow (FCF) can be defined and calculated in many ways. However, in its most generic form, free cash flow is calculated as cash from operations minus capital expenditures.

- Free cash flow is one of the most important ways to measure a company’s financial performance. It demonstrates the cash flow a company can potentially distribute after making reinvestments in the business via CapEx and working capital.

- FCF is used for valuation and to determine whether a company can meet its debt obligations.

Types of Free Cash Flow

When someone refers to FCF, it is not always clear what they mean. There are several different metrics that people could be referring to.

The most common types include:

- Free Cash Flow to the Firm (FCFF), also referred to as “unlevered” free cash flows.

- Free Cash Flow to Equity (FCFE), also known as “levered” free cash flows.

- Generic Free Cash Flow (FCF), which is what this article focuses on.

To learn more about the various types, see our ultimate cash flow guide.

How to Derive the Free Cash Flow Formula

If you don’t have the cash flow statement handy to find Cash From Operations and Capital Expenditures, you can derive it from the Income statement and balance sheet. Below, we will walk through each of the steps required to derive the FCF Formula from the very beginning.

Step #1 – Cash From Operations and Net Income

Cash From Operations is net income plus any non-cash expenses, adjusted for changes in non-cash working capital (accounts receivable, inventory, accounts payable, etc).

Thus, the formula for Cash From Operations (CFO) is:

CFO = Net Income + Non-Cash expenses – Increase in Non-Cash Net Working Capital

To learn more, launch our financial modeling courses now!

Step #2 – Non-Cash Expenses

We can further break down non-cash expenses into simply the sum of all items listed on the income statement that do not affect cash.

The most common items that do not affect cash are depreciation and amortization, stock-based compensation, impairment charges, and gains/losses on investments.

Thus, the formula for non-cash adjustments is:

Adjustments = Depreciation + Amortization + Stock-Based Compensation + Impairment Charges +/- Losses/Gains on Investments

Step #3 – Changes in Non-Cash Net Working Capital

Calculating the changes in non-cash net working capital is typically the most complicated step in deriving the FCF Formula, especially if the company has a complex balance sheet.

The most common items that impact the formula (on a simple balance sheet) are accounts receivable, inventory, and accounts payable.

Thus, the formula for changes in non-cash working capital is:

Changes = (Year 2 AR – Year 1 AR) + (Year 2 Inventory – Year 1 Inventory) – (Year 2 AP – Year 1 AP)

Where:

- AR = accounts receivable

- AP = accounts payable

- Year 2 = current period

- Year 1 = prior period

Step #4 – Capital Expenditures

It is possible to derive capital expenditures (CapEx) for a company without the cash flow statement. To do this, we can use the following formula with line items from the balance sheet and income statement.

Thus, the formula for capital expenditures is:

CapEx = Year 2 PP&E – Year 1 PP&E + Depreciation

Step #5 – Combining the components of the FCF Formula

We can combine the above four steps into one long FCF formula.

The Full FCF Formula is equal to:

FCF = Net Income + [Depreciation + Amortization + Stock-Based Compensation + Impairment Charges +/- Losses/Gains on Investments] – [(Year 2 AR – Year 1 AR) + (Year 2 Inventory – Year 1 Inventory) – (Year 2 AP – Year 1 AP)] – [Year 2 PP&E – Year 1 PP&E + Depreciation]

or

FCF = Net Income + Non-Cash Expenses – Increase in Non-Cash Net Working Capital – Capital Expenditures

In practical terms, it would not make sense to calculate FCF all in one formula. Instead, it would usually be done as several separate calculations, as we showed in the first 4 steps of the derivation.

Thus, the simplified formula is:

FCF = Cash from Operations – CapEx

Download the Free Cash Flow (FCF) Template

Download CFI’s free Excel template now to advance your finance knowledge.

Importance of Free Cash Flow

Knowing a company’s free cash flow enables management to decide on future ventures that would improve shareholder value. Additionally, having positive free cash flow indicates that a company is capable of paying its debts. Conversely, negative free cash flow suggests a company may need to raise money. Companies can also use free cash flow to expand business operations or pursue other investments or acquisitions.

Compared to net income or other accrual accounting-based measures, free cash flow is more appropriate for showing a company’s potential to produce cash.

Meanwhile, investors will likely consider investing in companies that have healthy free cash flow profiles, which should ultimately lead to promising futures. Combined with undervalued share prices, equity investors can generally make good investments with companies that have high free cash flow. Investors greatly consider FCF compared to other measures, because it also serves as an important basis for stock pricing and the ability to service debt.

Levered and Unlevered Free Cash Flow

When corporate finance professionals refer to Free Cash Flow, they also may be referring to Unlevered Free Cash Flow, (Free Cash Flow to the Firm), or Levered Free Cash Flow (Free Cash Flow to Equity).

One of the main differences between generic Free Cash Flow and Unlevered Free Cash Flow is that generic FCF accounts for a company’s interest expense (since the calculation begins with net income), whereas the unlevered version does not deduct interest expense and makes an estimate of what taxes would be without the interest expense tax shield.

FCF Formula in Financial Modeling, Analysis, and Valuation

For professionals working in investment banking, equity research, corporate development, financial planning & analysis (FP&A), or other areas of corporate finance, it’s very important to have a solid understanding of how FCF is used in financial modeling.

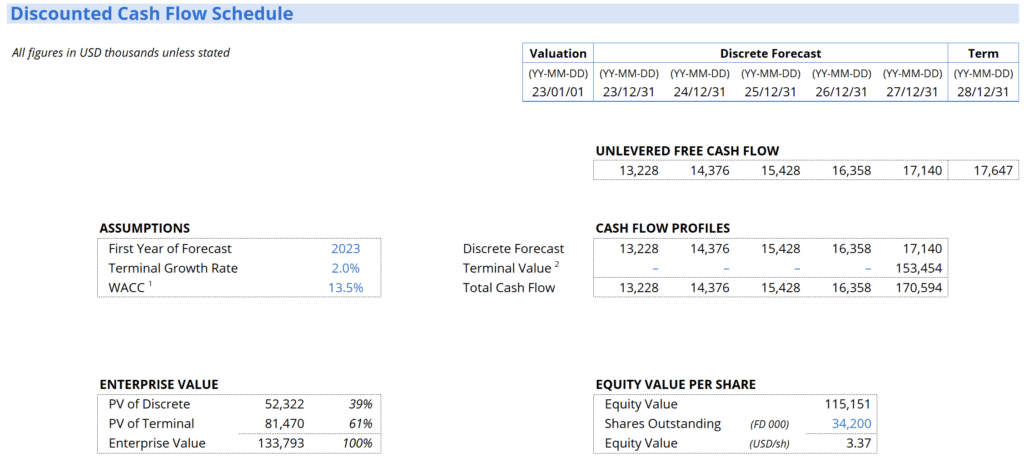

Discounted Cash Flow, or DCF models, are based on the premise that investors are entitled to a company’s free cash flows. DCF models value companies based on the timing and the amount of those cash flows.

When it comes to valuation and financial modeling, most analysts use unlevered FCF. They will typically create a separate schedule in the model where they break down the calculation into simple steps and combine all components together.

Below is an example of the unlevered FCF calculation from our DCF course.

Limitations Associated with Free Cash Flow

Net income relies on accrual accounting rules, which can be manipulated by companies. While it’s harder to manipulate cash flows, it’s not impossible.

For example, some companies may take longer to pay their debts in order to preserve cash. Alternatively, companies may shorten the time it takes to collect sales made on credit. Companies also have different guidelines on which investments are considered capital expenditures, potentially affecting the computation of FCF.

More Relevant Resources

We hope this has been a helpful guide to understanding the FCF formula, how to derive it, and how to calculate FCF yourself. To keep advancing your career, the additional resources below will be useful:

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in