0 search results for ‘’

People also search for:

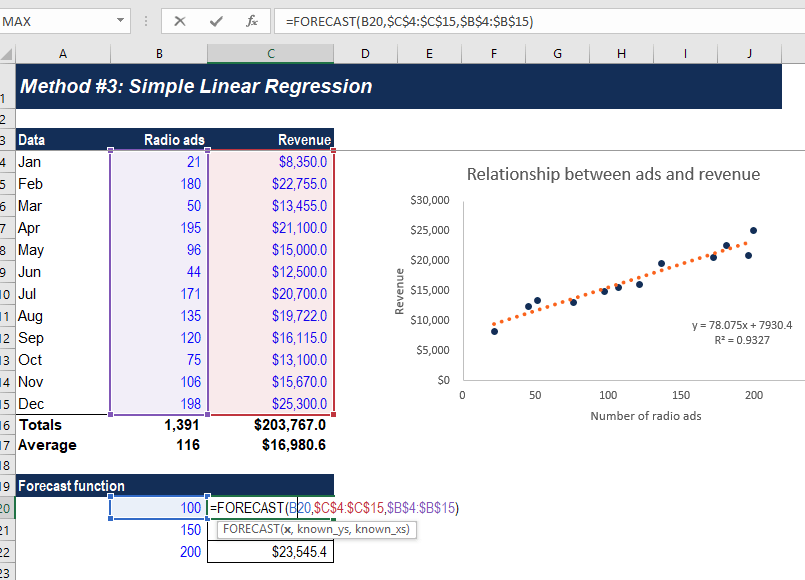

excel

power bi

esg

accounting

balance sheet

fmva

real estate

Explore Our Certifications

Resources

Popular Courses

Recent Searches